Alibaba: A Value Trap

Summary

- Alibaba's shares seem discounted and attractive after their recent selloff.

- But investors shouldn't get tempted just yet.

- The company is still faced with a few serious risk factors that are eroding its growth prospects.

David Becker/Getty Images News

Alibaba’s (NYSE:BABA) shares are down 60% over the last year and investors are wondering if this is a good time to buy. The rationale is that the stock is trading at a steep discount and that the company’s exceptional growth momentum is likely to drive the security to new highs going forward. In this article, I’ll discuss Alibaba’s strengths and eventually attempt to explain why its shares may continue to fall further in the weeks to come.

The Glorious Times of the Past

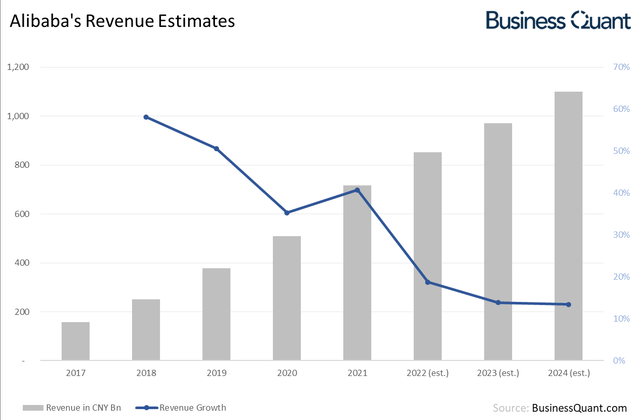

Let me start by saying that Alibaba’s growth trajectory has been nothing short of spectacular. The company posted sequential revenue growth in 15 of its 23 last quarters and it posted record revenue once again last quarter. Companies usually find it difficult to grow continuously, once their revenue base becomes sizable, but Alibaba is clearly growing with ease.

What’s even more interesting is the fact that Alibaba’s revenue growth hasn’t been reliant on one or two streams of income. On the contrary, the e-commerce giant has 9 different revenue streams and almost all of them have contributed to the company’s rapid growth. To put things in perspective, 7 of its 9 revenue streams reported sequential revenue growth in Q3 2022.

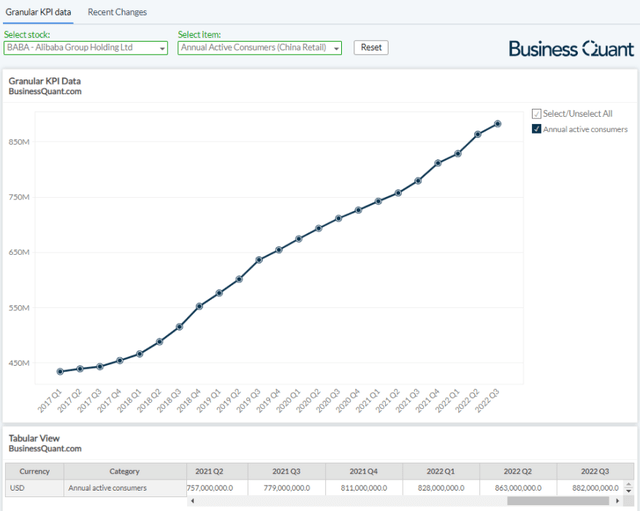

Another point to consider here is that Alibaba’s annual active consumer base within China has continually expanded over the past 5 years. This is indicative of a formidable competitive positioning and suggests that Alibaba isn’t done growing yet in spite of its sizable business. As more and more consumers continue to join its ecosystem of platforms and services, it should, in theory at least, boost the company’s revenue further in the coming quarters.

Overall, I believe Alibaba’s management has done a terrific job at growing their business rapidly, whilst also diversifying it over the last many years. This is a commendable feat and an enviable position to be in. So, it’s understandable why a broad swath of investors wants to invest in the company’s growth story and take advantage of its distressed stock price. But as we’ll see in the next section of this article, Alibaba is muddied with red flags and risk averse investors may want to avoid it for the time being at least.

Incoming Slowdown

There’s no denying that Alibaba has had a stellar growth trajectory in the past. But the problem arises when we try to assess its future prospects. There are broadly three things that are hampering its growth outlook. For starters, Chinese regulators had imposed a record $2.8 billion anti-trust fine on the company last year. The company was apparently strong-arming its merchants and restricting them from listing products on rival e-commerce platforms.

Alibaba’s management paid up the fine and vowed to drop their monopolistic practices. This sounds good on paper, but in practice, it means that Alibaba’s merchants are now free to list their products on rival e-commerce platforms. Now that the e-commerce giant has to play on a levelled playing field, it could lose market share, it may have to significantly increase its marketing spend to remain competitive and its growth momentum could also slow down.

Secondly, Alibaba and the technology sector in general, were subject to several regulatory crackdowns in China (like here). Such crackdowns adversely impacted Alibaba’s growth prospects and presented new operational headwinds for it. The bigger problem here is that we don’t know as to when will these regulatory crackdowns stop. An asset management firm speculated that these crackdowns could continue for decades to come.

Whether or not these crackdowns will last for decades, is a topic for another debate. But the point I’m trying to make here is that there’s a lot of uncertainty around Alibaba’s growth prospects and we just don’t know when will the regulators stop tinkering with it. The uncertainty hampers investors’ sentiment, scares investors away and it eventually subdues the stock price.

Third, China has a Zero COVID strategy in place and it’s been locking down major cities to curb the spread of the COVID-19 virus. This has resulted in major production facilities being shut, re-introduced supply-chain issues internationally and dampened the country’s economic growth prospects. In fact, Nomura just slashed China’s annual GDP-growth forecast by 400 basis points.

What this means for investors is that the Chinese populous will be strapped for disposable income amidst an inflationary environment, which is likely to limit the growth of Alibaba’s gross merchandise value and eventually its revenue. These factors, collectively, are resulting in lackluster growth prospects for the e-commerce giant.

Alibaba’s revenue grew by as much as 40% last year but analysts are expected it to grow just 14% next year. That’s a significant growth deceleration in just a span of two years and should encourage its growth-seeking investors to rethink their investment rationale.

Delisting Threat Looms

Another factor to consider here is that US listings of Chinese companies are still faced with the threat of delisting. The SEC requires all foreign companies that are listed on US bourses, to open their books for audit inspections or risk getting delisting within 3 years. The regulator has also passed a framework to carry out these delistings.

To address this risk, Chinese regulators confirmed earlier this month that it would change its auditing rules for overseas listings, and comply with the SEC’s requirements along the way. US-listed Chinese stocks such as Alibaba rallied by as much as 50% in the following days on this positive news. But it seems like the Street celebrated too soon.

The SEC hasn’t confirmed about making any material progress with the Chinese regulators, to prevent such delistings. In fact, the US regulator has issued a fifth provisional list of Chinese companies that face a possible delisting in the US. This essentially meant that the rally in Chinese stocks was much ado about nothing.

Fast forward by 3 weeks and most of these gains have already been erased -- Alibaba’s shares have dropped almost 30% from its April highs. It seems like the Street isn’t counting on Chinese regulators to actually comply with the SEC’s requirements and/or believes that the US regulators would find something new to punish Chinese stocks.

Final Thoughts

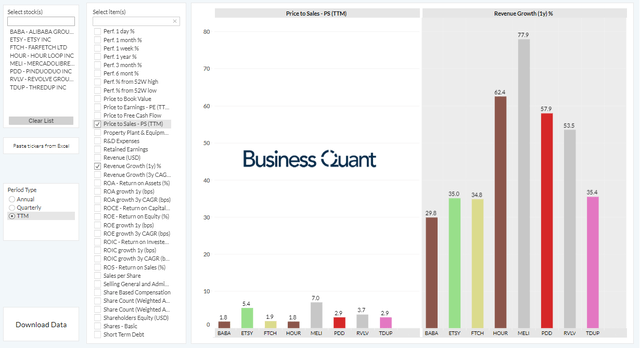

A commonly used argument by Alibaba’s contrarian bulls, is that its shares are seemingly cheap at its current levels. The stock is trading at just 1.8-times its trailing twelve-month sales so the reasoning behind such a claim is understandable. But a new picture emerges once we also factor in the prevalent growth rates within the internet retail industry.

Surely, Alibaba’s shares trade at a relatively lower P/S multiple but its revenue growth rate is also lower than some of its other prominent peers. This makes its shares more or less fairly valued and justifiably cheaper than many of its other peers. So, in light of the risk-factors surrounding Alibaba, I believe that risk-averse investors should avoid investing in the name for the time being at least. The stock seems well poised to fall further. Good Luck!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.