Alibaba: Warning, Too Much Pressure Ahead

Summary

- In March, the Chinese authorities introduced quarantine in Shanghai and Shenzhen. In April, the situation does not improve, which is guaranteed to lead to a further reduction in the economy.

- Given the clear signs of a slowdown in the Chinese economy in Q1, I do not see a chance that the upcoming quarterly report can surprise the market.

- If the price does not rise above the $86 level during the next two trading sessions, a further decline to the local low of $73 is very likely.

maybefalse/iStock Unreleased via Getty Images

Intro

In the complex, the fundamental situation, and the technical picture indicates the beginning of a period of increased pressure on Alibaba (NYSE:BABA) quotes.

Negative background from China

Growing concerns about China's business activity, as its zero-COVID policy potentially means new lockdowns and restrictions on domestic movement, led to a sharp weakening of the yuan last week:

In parallel, futures prices for copper and silver (key industrial metals) broke their uptrend. This is also a negative sign, indicating lower expectations for the economic recovery of the Chinese economy.

TradingView, Author TradingView, Author

The key reason for the cheapening of metals and the yuan was new highs in the daily incidence of COVID in Shanghai, despite the effect of strict restrictions. On Sunday, April 24, 19,455 cases of the disease were detected in the city. Quarantine in Shanghai is now in its fourth week, while the city's contribution to national GDP is at least 10%...

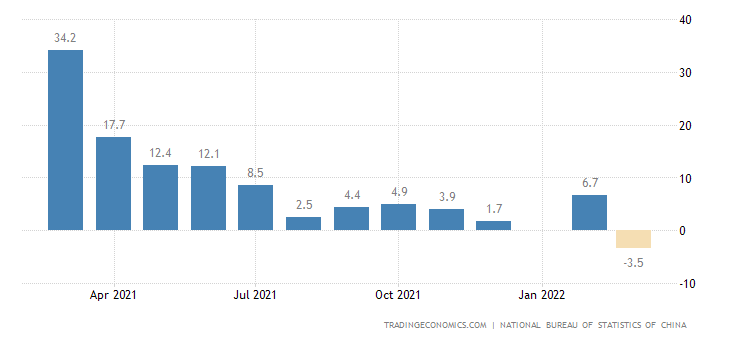

I want to remind you that recent statistics have already pointed to a slowdown in the Chinese economy. In March, China reported the biggest decline in consumer spending and the highest unemployment rate since the start of the pandemic. Retail sales fell in March for the first time since 2020:

tradingeconomics.com

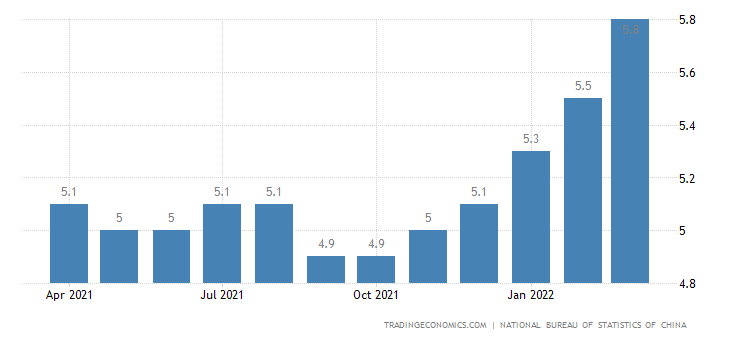

The observed unemployment rate rose to 5.8%, the highest since May 2020:

tradingeconomics.com

So, the Chinese economy is forced to slow down and this is generally a bad background for the Chinese market.

Weak expectations before the report

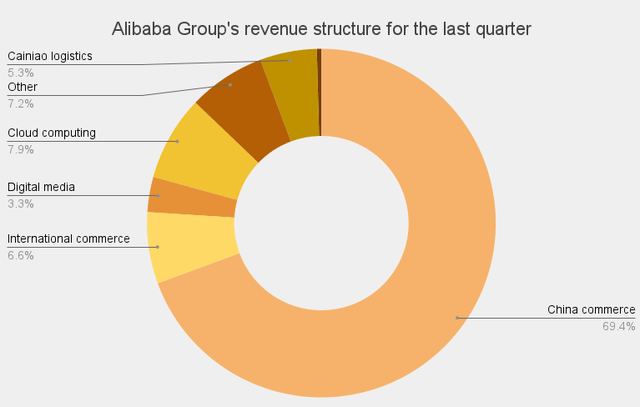

Alibaba receives over 90% of its revenue from the domestic market:

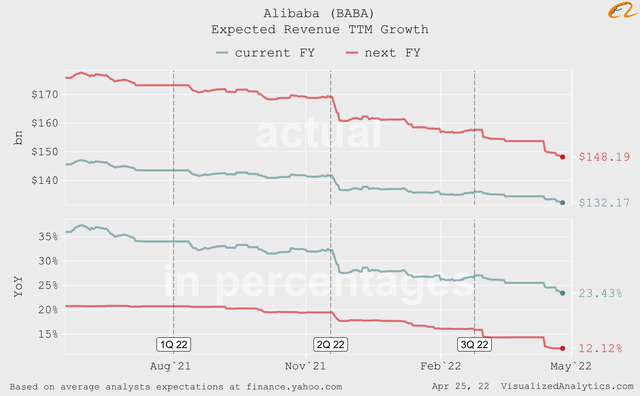

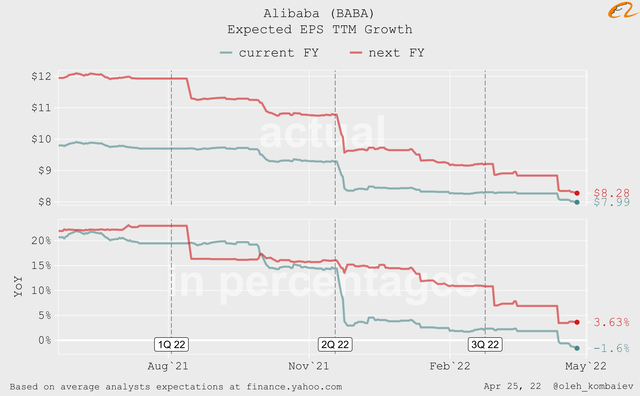

Given the clear signs of a slowdown in the Chinese economy in the first quarter, I simply do not see a chance that the numbers of the upcoming quarterly report can surprise the market. It is worth adding that the dynamics of average analyst expectations regarding the company's revenue and EPS confirm my fears:

visualizedanalytics.com visualizedanalytics.com

Dangerous technical picture

On March 14, there was a gap in Alibaba's daily quotes. This price action provided strong support at $86:

On April 25, the price of the company's shares fell below this level, which I personally consider critical. In my opinion, if the price does not rise above this level in the next two trading sessions, a further decline to the local low at $73 is very likely.

Bottom line

In general, the situation does not cause optimism for me personally. The weakening of the yuan and the slowdown in consumer demand in China is directly negative for the company. I repeat that the next two sessions will be critical. But in any case, I do not expect a significant increase in the company's price before the publication of quarterly reports.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.