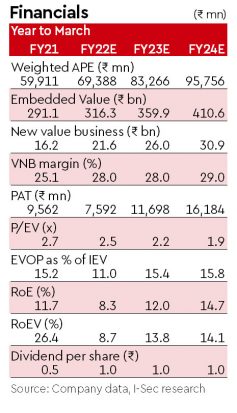

We remain enthused with IPRU Life’s product and channel diversification strides, which has made the business considerably more robust than before. This is illustrated by the fact that the Rs 21.6-bn FY22 VNB mix is split between 16% by ULIPs, 43% by protection and 41% by non-linked savings. While volume growth has been volatile, product/distribution levers are available for VNB (volume and margin) growth, which should ensure >15% RoEV. Current valuation at 2.2x/1.9x FY23E/FY24e P/EV is attractive. Maintain Buy.

APE growth of near-20% in FY23E is key milestone: Mgmt remains positive on achieving >Rs 26-bn VNB in FY23 based on available levers in distribution, products and margins. Retail protection can gradually improve (grew 50% y-o-y in Q4FY22) and there is scope for credit protection to continue expanding (+46% in FY22).

Channel diversification is now a structural business moat: Banca/ agency/direct/partnership/group channels registered growth of 10%/19%/ 23%/22%/49% y-o-y, respectively in FY22. Share of banca has reduced from 42.3% in FY21 to 39% in FY22 while that of group has increased from 12.3% in FY21 to 15% in FY22. Among initiatives, the company added 24,607 agents in FY22. There are a total of ~800 partnerships with 27 banks and 198,000 advisors as of Mar’22. Company has maintained its aim to register growth from agency by ring-fencing productive agents and increasing the contribution from all partnerships. The channel diversification can be best summarised from the fact that the share of parent bank in overall APE fell from 51% in FY19 to 25% in FY22.

Maintain Buy: We factor in VNB margins of 28%/29% with APE growth of 20%/15% for FY23e/FY24e respectively. This results in an embedded value (EV) of Rs 410 bn by FY24e adjusted for variances (we factor in rising interest rates impact). As we roll over our estimates to FY24, our target price works out to Rs 720 (unchanged) by assigning 20x multiple to FY24 VNB of Rs 31 bn (earlier 25x). At our TP, the stock will trade at 2.52x FY24e P/EV. At CMP, it is trading at 1.9x FY24e P/EV.