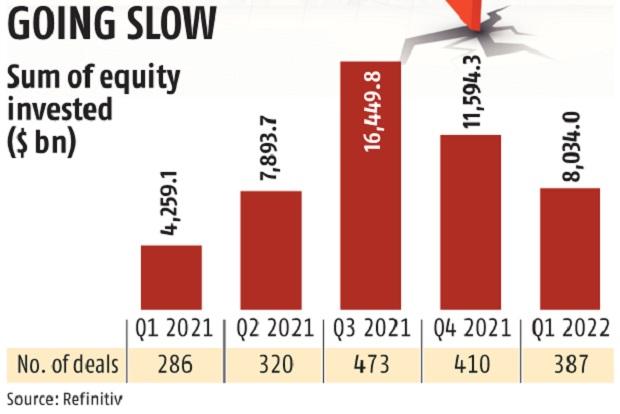

Private equity (PE) investments plunged 30.7 per cent quarter-on-quarter (QoQ) to $8.03 billion during the March quarter of calendar year 2022 (Q1CY22) from $11.59 billion in Q4CY21, according to Refinitiv. However, they were up 88.6 per cent year-on-year, compared with $4.2 billion in Q1CY21.

The total number of deals, too, declined to 387 in Q1CY21 from 410 in the previous quarter. However, on a year-on-year basis the total number of deals increased 35 per cent from 286 seen in Q1CY21.

Among sectors, internet specific and computer software garnered most of the investments in Q1CY22, with a total investment of $3.5 billion, compared with $1.5 billion in Q1CY21. Sectors such as financial services ($205.8 million), medical/health ($42.3 million), and biotechnology ($6 million) witnessed a decline in Q1, compared with the year-ago quarter.

The top deals during the quarter were led by the $800-million investment in Bjyu’s, followed by $700-milllion investment in Swiggy. The $494.72 million investment in Tata Motors Electric Mobility, $300 million funding raised by NTex Transportation Services (ElasticRun), and $300 million raised by Xpressbees featured in the top-five deals list during the quarter.

Funds located in India saw a 3.6 times jump quarter-on-quarter in the amount raised at $4.45 billion in Q1CY22. However, the number of companies invested in dropped by 60.6 per cent to 28.

“The momentum was driven by several significant factors including a historically low interest rate environment, digital acceleration and transformation, and increasing depth in the start-up ecosystem. There is also substantial capital waiting to be deployed as India-based PE funds raised $4.4 billion so far this year, more than double the amount raised in the first quarter of last year, pushing fundraising activity to more than $21 billion from 2019 to first quarter of this year,” said Elaine Tan, senior analyst at Refinitiv.

A boom in the initial public offering (IPO) market in 2021 also bolstered the PE industry.

“Last year, the buoyant secondary market and record primary listings in India drove confidence in the IPO markets, providing a conducive environment for companies to go public and provide a positive element for start-ups and investors to consider IPO as a viable exit strategy,” added Tan.

However, volatility in the secondary markets in the aftermath of the Russian invasion of Ukraine, and the US Federal Reserve’s decision to aggressively tighten monetary policy has put the brakes on the IPO market.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU