It is the psychological trauma and the feeling of guilt and shame that affects victims the most, which often leads to not filing complaints.

It is the psychological trauma and the feeling of guilt and shame that affects victims the most, which often leads to not filing complaints. WHILE CYBERCRIME is largely measured in financial terms it is the psychological trauma that hurts victims the most when they are blamed by their family members or society in general for falling victim to the attack/scam.

From wiping out the medical expenses of an 84-year-old woman, money put aside for children’s education is lost in fraud, to a woman whose wedding had to be put off since the money put aside for that was transferred by cybercriminals.

Apart from this, there have been cases of matrimonial fraud victims, who have left these portals completely after being left scarred emotionally and monetarily by fraudsters with whom these women shared intimate details, especially on matrimonial sites.

Most of the time, the victims hesitate to approach the police or financial institutions to register their complaints. However, it is the psychological trauma and the feeling of guilt and shame that affects victims the most, which often leads to not filing complaints.

A 47-year-old woman, who recently fell prey to online fraud — SIM card swap — and lost Rs 18.51 lakh, broke down multiple times while speaking to The Indian Express. She wondered how she would pay for the medical expenses of her 84-year-old mother, as she lost her mother’s entire life savings in the incident.

In her case, someone used fake Know Your Customer (KYC) details and blocked her SIM card and got a new SIM. Later, the fraudsters withdrew money from her account as the One Time Password (OTP) went to the new number. Even as the Mumbai Crime Branch’s cyber police managed to trace one accused from the gang of cyber fraudsters from West Bengal, they were unable to recover her money.

She, along with her husband, runs an export business. She said, “This incident is killing me every day. I am having sleepless nights and have developed anxiety. I had taken money from my widowed mother. I am her only daughter. She needed the money for her old age. I was going to return the money to her. Now, what if something happens to her health? How will I arrange the money?” the woman said, requesting anonymity.

In another case, a 53-year-old retired Indian Navy personnel lost Rs 9.53 lakh to vishing (a cybercrime that uses the phone to steal personal confidential information from victims) last month. He told The Indian Express that the fraudsters not only took away his entire savings accumulated over a decade but also put him through a lot of mental harassment.

In January, he called up a customer service number of SBI found on the internet to change his bank password, which turned out to be fake. A fraudster, who answered the call, made him download a remote-access app, gained access to his phone and withdrew Rs 9.53 lakh from his account.

“I had saved the money over the last 15 years, and now my bank balance is zero. I had saved the money for the higher education of my son and my daughter, who is in school. The fraudster broke my fixed deposit and took a loan in my name. Now I must take a loan to pay the MBA fees for my son and will have to save up for my daughter’s education,” he told The Indian Express.

“Mental harassment is also a big issue. I have been to the local police station four to five times and visited the local crime branch three times. I went to the bank four times. I also wrote to the RBI but have got no response from them. I know I made a mistake, but how does SBI not take any action on the fake numbers uploaded in their name on the internet. They must do something about it. The fraudster had made the same logo as the SBI app. Further, the search engine needs to act against such fraudulent numbers,” he added.

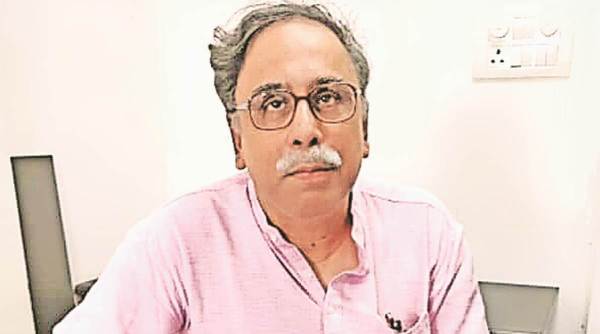

Shridhar Naik was cheated of Rs 4 lakh by a fraudster.

Shridhar Naik was cheated of Rs 4 lakh by a fraudster. Shridhar Naik, a 64-year-old south Mumbai resident, who is a professor, got an SMS from Airtel stating that his documents were incomplete. A fraudster then got Naik to download an app using which the accused got control of his mobile phone and transferred Rs 4 lakh from his account.

“I had dissolved my mutual fund for carrying out repairs at my residence. The fraudster, however, took away the money. Initially, the police even refused to register an FIR. Finally, they have registered a complaint at the Marine Drive police station but are not interested in investigating the matter. One officer tells me to go and meet the other officer,” Naik said.

Madhavi Pujari, 29, suffered from sleepless nights for a week after she lost Rs 90,000 from her account due to online fraud.

“I had set aside the money for my marriage. However, ever since I lost the money on an e-commerce site, I am still in a state of shock. Initially, I couldn’t sleep at night. For now, we have called off the wedding as we will need to set aside money for that,” Pujari told The Indian Express.

A 38-year-old woman, who currently stays in Andheri fell victim to a matrimonial fraud in 2018 to a fraudster pretending to be a UK-based doctor. “I would chat with this person Dr Kamran Bhatt every day for over a month. When he claimed to need money as his mother had an accident, I suspected something amiss. Later, I found no such Dr Kamran Bhatt.”

“When I confronted the person, he hung up and never answered the phone again. Later, when I searched online, I found out about matrimonial fraud. I was traumatised to find that the person was a fraud. After that, I have found it difficult to trust anyone online and have stopped going to matrimonial sites,” the woman told The Indian Express.

- The Indian Express website has been rated GREEN for its credibility and trustworthiness by Newsguard, a global service that rates news sources for their journalistic standards.