The government has asked public and private sector banks to raise per transaction limit for UPI payments to Rs 2 lakh to ensure applications by retail investors for Life Insurance Corporation of India’s (LIC’s) initial public offering (IPO) through UPI are successfully processed.

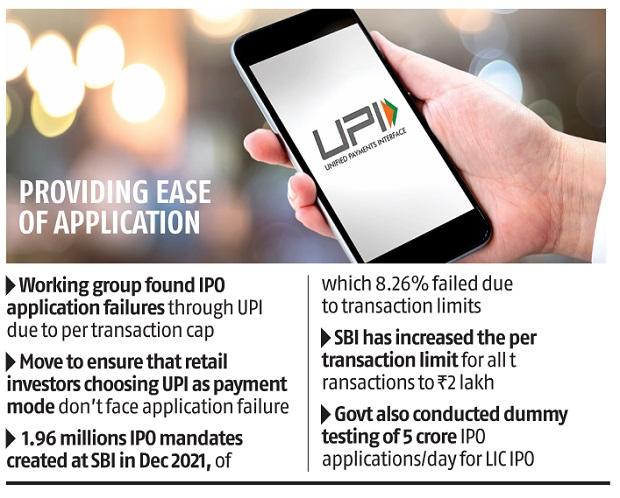

A working group — overseen by the Department of Investment and Public Asset Management (DIPAM) — created to check technological readiness of back-end systems for IPOs, had found that processing of many applications failed if UPI was selected as a mode of payment by retail investors due to per transaction caps imposed by banks, an official said.

Retail investors can invest up to Rs 2 lakh in an IPO.

The present limit for UPI, too, is Rs 2 lakh, but different banks have different per transaction limits. About Rs 1 lakh can be spent in a day through UPI, but exception is made for IPO and insurance payments, among others.

However, the working group’s analysis of past IPOs found application failures due to “business decline”. The issue was discussed with National Payments Corporation of India (NPCI), and found that such failures were occurring due to per transaction caps or limits imposed by individual banks, said the official.

Business decline are transactions declined due to reasons such as exceeding per transaction limit, exceeding permitted count of transactions per day and exceeding amount limit for the day. According to the available data, about 313,995 IPO mandates — the highest among all banks —were created at State Bank of India (SBI) in January 2022, of which 12.51 per cent were business declines. This compares with 1.96 million IPO mandates created at SBI in December 2021, of which 8.26 per cent were attributed to business declines.

This has led to the government asking banks to lift these individual transaction caps at least when the issue opens, so that retail investors applying for LIC IPO do not face such back-end failures. This has been done for IPO-related transactions, but some banks such as SBI have increased the per-transaction limit for all transactions as it’s difficult to monitor individual transactions due to scale of operations. Other banks are also in the process of removing the per-transaction limit, the official said.

Besides UPI, the working group has also checked the existing IPO framework by placing a high number of dummy bids. Testing has been done by placing 50 million dummy bids/day as against a maximum of about four million applications received for other IPOs in about a three-day window. These dummy bids were placed with stock exchanges, and were sent to sponsor banks to check for any failures.

The working group has also checked the capacity of banks, stock exchanges, depositories, registrars and share transfer agents on how shares are allocated.

“A review has been conducted to find any lapses,” the official quoted above said. Several rounds of testing have been done to ensure the system is capable of meeting IPO demand,” he added.

The working group is chaired by a deputy managing director of SBI, and has representation from Indian Banks’ Association. It also includes representation from Securities and Exchange Board of India (Sebi), share transfer agents, registrar and NPCI, among others.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU