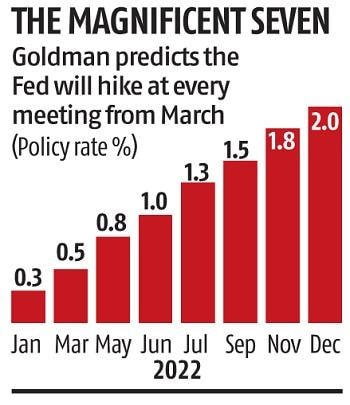

Goldman Sachs Group Inc. sees the Federal Reserve raising interest rates seven times this year to contain hotter-than-expected US inflation, rather than the five it had expected earlier.

The bank sees a 25 basis-point hike in each of the remaining meetings this year, economists led by Jan Hatzius wrote in a report to clients. The altered prediction follows US consumer prices posting the biggest jump since 1982 in January.

That view is also gaining currency among investors, who are pricing in a similar quantum and pace of hikes. Swaps linked to Fed meeting dates indicate investors expect the Fed’s main rate to be 1.85% after the December meeting from near zero now.

While there’s a case to be made for a 50 basis-point hike in March given the combination of very high inflation, hot wage growth and high short-term inflation expectations, the indications from policy makers so far are pointing to more incremental moves, according to the Goldman analysts.

“Most Fed officials who have commented have opposed a 50 basis points hike in March,” they wrote in a note. “We therefore think that the more likely path is a longer series of 25 basis points hikes instead.”

While many Fed officials are not in favor of bigger jumps, St. Louis Fed President James Bullard said he supports raising interest rates by a full percentage point by the start of July -- including the first half-point hike since 2000 -- in response to the hottest inflation in four decades.

The shift by Goldman mirrors remarks by former US Treasury Secretary Lawrence Summers, who last week told Bloomberg Television that investors should brace for the Fed to potentially raise interest rates at all seven remaining policy meetings this year and even for it to hike by more than a quarter point in one go.

Global banks have been ramping up their expectations for an aggressive Fed hiking cycle.

Deutsche Bank AG economists said the inflation data means a 50 basis-point hike in March is now their base case.

“More limited evidence of waning inflation pressures in the back half of the year suggest that the Fed will continue their more aggressive response for longer,” economists at the German bank said in a note. They tip further moves of 25 basis points at every meeting this year except for November, bringing the total increase in the Fed funds rate in 2022 to 175 basis points.

Lagarde warns ECB acting too fast could choke recovery

European Central Bank President Christine Lagarde warned that the Governing Council would harm the economy’s rebound from the pandemic if it were to rush to tighten monetary policy. Raising interest rates “would not solve any of the current problems,” she told Redaktionsnetzwerk Deutschland in an interview released on Friday. “On the contrary: if we acted too hastily now, the recovery of our economies could be considerably weaker and jobs would be jeopardized.” Bloomberg

Half-point BOE rate increase looks a done deal for traders

Traders priced in an unconventional half-point interest-rate hike from the Bank of England, betting that policy makers will front-load tightening to stem accelerating inflation.

Money markets are wagering on 75 basis points of rate increases by May, according to sterling overnight index swaps. That would require one 50-basis-point hike – unheard of since the BOE became independent in 1997 – and another 25-basis-point rise, spread out over the BOE’s March and May decisions. Bloomberg

Australia's central bank could hike later in ‘22, sees risk now

Australia's top central banker on Friday said it was plausible interest rates could rise later this year, but there were risks in moving too early and the bank wanted to see a couple more quarterly inflation reports before deciding. Reserve Bank of Australia (RBA) Governor Philip Lowe said it was not yet certain that the recent pick up in inflation would last and the RBA Board was prepared to be patient to make sure. "I think these uncertainties are not going to be resolved quickly. Another couple of CPI's would be good to see," said Lowe. Reuters

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU