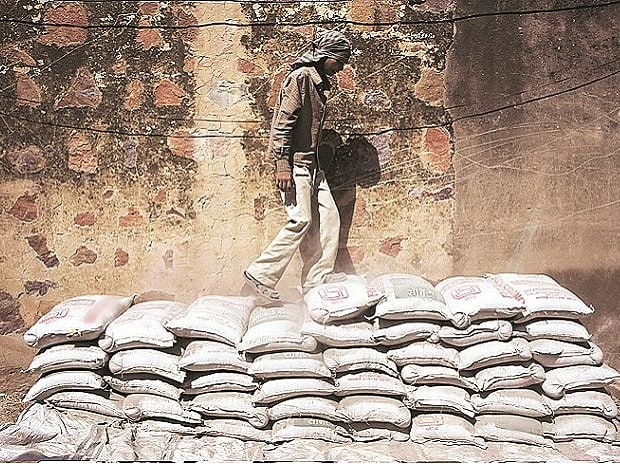

Chennai-based cement major India Cements saw a 76 per cent dip in consolidated net profit during the third quarter of the financial year 2021-22 to Rs 16 crore, as compared to Rs 68 crore during the same period last fiscal due to the impact of Covid and the heavy rains in South India on the sector.

The company's revenue from operations too saw a marginal dip of 2 per cent during the quarter to Rs 1,160 crore, as compared to Rs 1,185 crore during the Q3 of 2020-21. "There were challenges like Omicorn and also flood in South India. We were also under pressure owing to higher coal prices during the quarter," said N Srinivasan, vice-chairman and managing director of the cement major.

During the quarter under review, the company's volume dipped to 21.08 lakh tons for the quarter as compared to 23.77 lakh tons in the previous year ( a drop of 11 per cent). For the nine months ended December 2021, the overall volume was at 64.13 lakh tons up by 8 per cent as compared to 59.12 lakh tons. The capacity utilization of the company was around 54 per cent as compared to 61 per cent during the same quarter of the previous year.

While the net plant realization for the quarter was marginally higher by 5 per cent, the variable cost of operation had gone up by nearly 25 per cent as compared to the same quarter of the previous year due to a substantial increase in the price of fuel. The increase in variable cost alone meant a contribution loss of more than Rs 115 crore for the quarter. The company said that it is likely to further pass on the coal price increase to customers, but is better placed in terms of the available low-price coal.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU