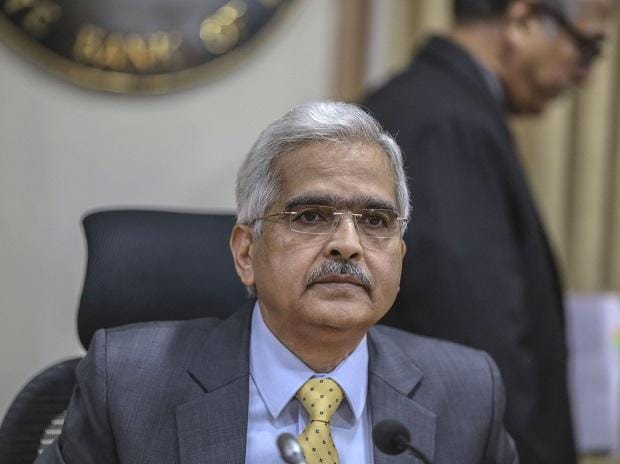

Reiterating his long-standing position on private cryptocurrencies, the Reserve Bank of India (RBI) governor Shaktikanta Das on Thursday said that private cryptocurrencies pose a big threat to India’s macroeconomic and financial stability and they can undermine the central bank’s ability to deal with financial stability issues.

He also cautioned people who are investing in cryptocurrencies that they are doing so at their own risk and there is no underlying value in such assets.

At the post policy meeting with media persons, Governor Das said, the investors who invest in cryptocurrencies should keep in mind that they are doing so at their own risk. They should also keep in mind that cryptocurrencies do not have any underlying, not even a tulip.

Private cryptocurrencies are a big threat to our macroeconomic and financial stability. Cryptos which have currency-like character will undermine RBI’s ability to deal with financial stability issues, he said.

This comes after the government’s move to tax gains made on crypto transactions by investors at 30 per cent. Many in the industry viewed this as a sign of the government softening its stance on such assets and not banning it outrightly, although a 30 per cent tax on income was a bit on the higher side, many had opined. However, they were happy with the fact that atleast the government is warming to the idea of this asset class.

In this year’s union budget, finance minister Nirmala Sitharaman had said, the magnitude and frequency of transactions in virtual assets have made it imperative to provide for a specific tax regime. Accordingly, she said, any income from transfer of any virtual digital asset shall be taxed at the rate of 30 per cent. Also, the government has also proposed to provide for Tax Deduction at Source (TDS) for payment made in relation to transfer of virtual digital assets at the rate of 1 per cent, in order to capture the transaction details.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU