Business News›Tech›Newsletters›Tech Top 5›Nykaa’s Q3 results; Meta concerned about India’s data bill

Daily Top 5 Daily Top 5 |

Nykaa’s Q3 results; Meta concerned about India’s data bill

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

The parent company of beauty retailer Nykaa, which had a blockbuster IPO in 2021, has reported a 58% year-on-year fall in its consolidated net profit to Rs 29.01 crore for the October-December quarter. The company dominates India’s online beauty market but is set to face serious competition from Reliance and Tata.

Also in this letter:

■ Meta concerned about India’s upcoming data law

■ Xpressbees turns unicorn after raising $300 million

■ Crypto Esops will be taxed as gifts

Online fashion and beauty retailer Nykaa has reported a consolidated net profit of Rs 29.01 crore for the third quarter (Oct-Dec).

By the numbers: This was 57.87% down from the Rs 68.88 crore it reported in the same period in FY21, but up 2,376% from Rs 1.2 crore in the previous quarter.

Founder speak: “We continue to be on a steady growth trajectory across both beauty and fashion businesses. Growth in the beauty business accelerated in a relatively normalised Covid environment, with a strong revival in the cosmetics category,” said Falguni Nayar, MD and CEO of Nykaa’s parent company.

She added that Nykaa’s network of physical stores also saw one of its strongest quarters ever as the company continued opening new stores in line with its omnichannel vision. Marketing continues to be an area of investment for Nykaa, she added.

Stock plunges before results: Before the results were announced, Nykaa’s stock fell 0.7% to close at Rs 1,0848.90 on the NSE. On Tuesday, it had shed 2.18% on the NSE as investors sold their shares in droves. The stock is down more around 40% from its all-time high.

Competition incoming: We reported in January that Nykaa is set to face serious competition, with Reliance Industries preparing to launch its own omnichannel beauty platform.

The Mumbai-based conglomerate’s two recent acquisitions – retail tech startup Fynd and e-pharmacy Netmeds – are working in tandem to make it operational, two people aware of the matter told us.

The Tata group is also looking to launch an online venture focussed on the beauty space, we reported in September.

Facebook parent Meta Platforms said it was concerned about India's upcoming data protection bill, which seeks local storage and processing of data, according to a company filing with the US Securities and Exchange Commission (SEC).

It added that new laws or rules that restrict its ability to collect and use information about minors may also put limitations on its advertising services or its ability to offer products and services to minors in some jurisdictions.

In their words: "Some countries, such as India, are considering or have passed legislation implementing data protection requirements or requiring local storage and processing of data or similar requirements that could increase the cost and complexity of delivering our services," the company said.

India’s stand: A Joint Committee of Parliament studying the Personal Data Protection Bill, 2019 submitted its report in December. The report and the draft legislation recommended that sensitive personal data of Indians be stored only in India.

Indian officials have claimed that the storage of sensitive personal data within India would support the growth of data centres and an innovative, data-driven economy.

They have also argued that the EU’s data protection law, the General Data Protection Regulation (GDPR), has similar conditions, allowing data of Europeans to be transferred only to countries that comply with its ‘data adequacy’ rules.

Also Read: Decoding Data Protection Bill

Lawsuits galore: Meta also said that it has been managing investigations and lawsuits in India, Europe and other regions.

It specifically mentioned the lawsuit pending before the Supreme Court of India and government inquiries and lawsuits regarding the 2021 update to WhatsApp's terms of service and privacy policy.

Whatsapp has also challenged the Indian government's IT rules, which mandate traceability of messages and would require the instant messaging app to break its end-to-end encryption.

Europe-wide problem: The company said that the issue is not restricted to India, adding that it may even have to withdraw Facebook and Instagram from the EU because of restrictions imposed by its data privacy law.

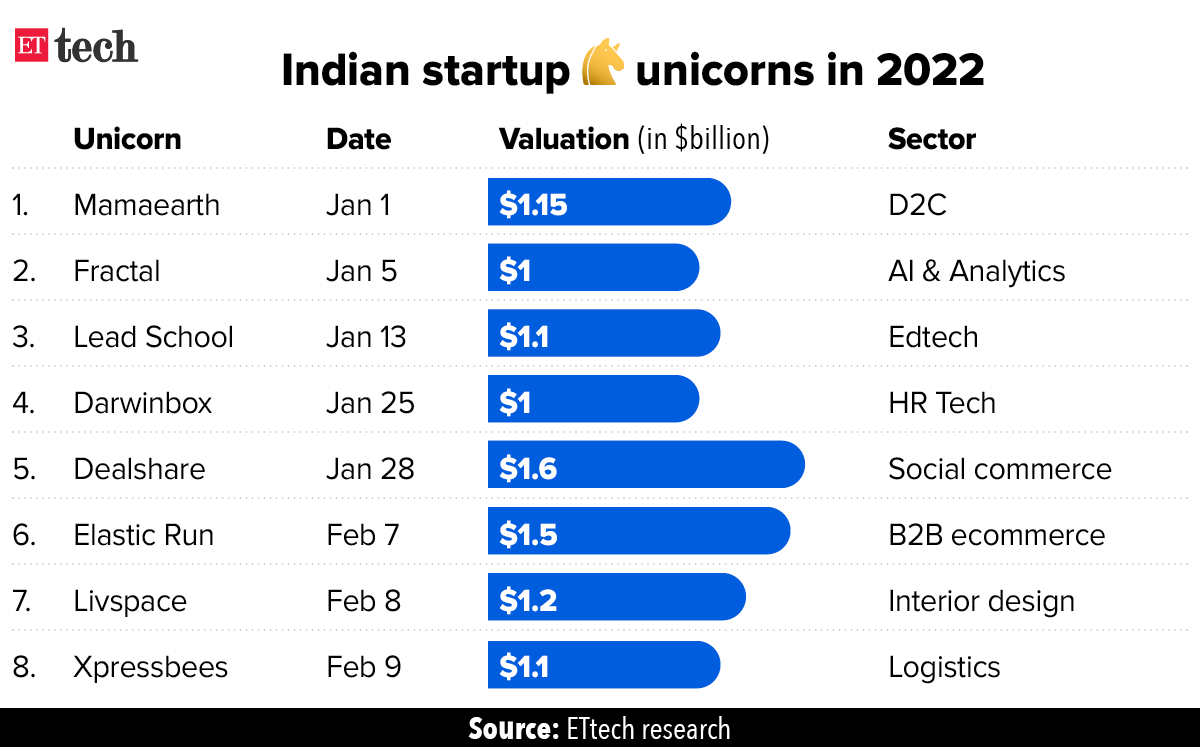

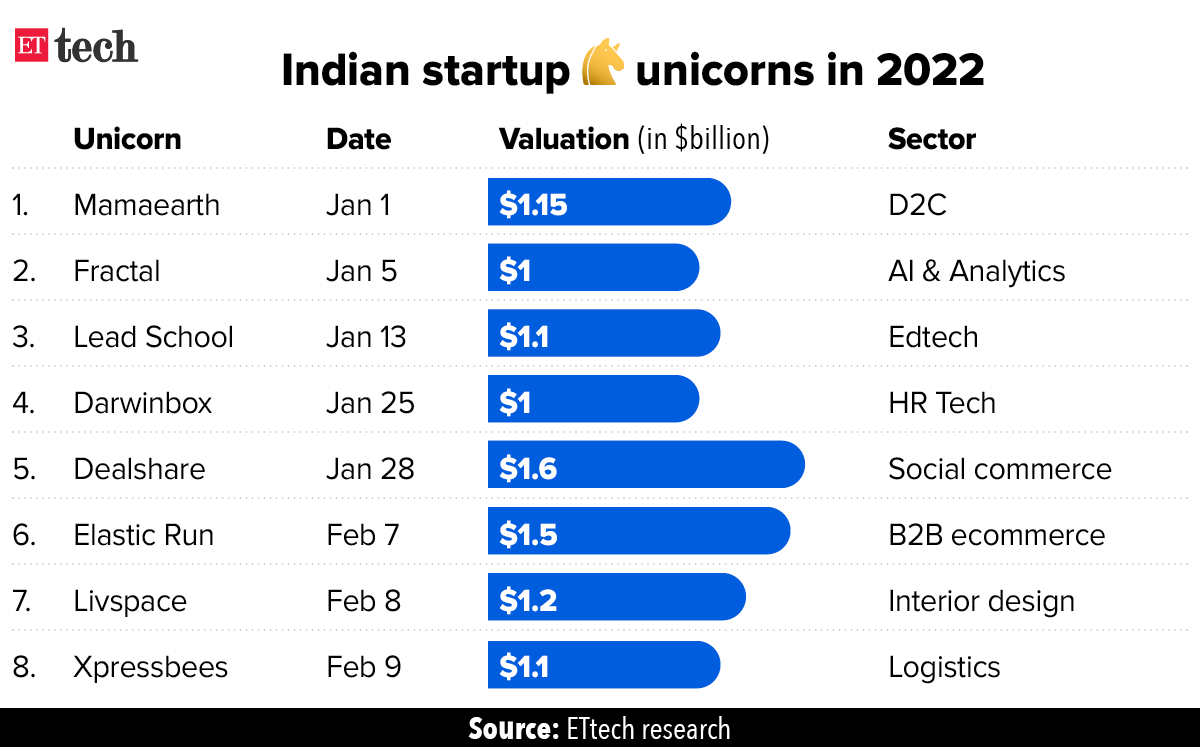

New-age logistics services provider Xpressbees said it has raised $300 million in a new funding round led by private equity funds Blackstone Growth, TPG Growth and ChrysCapital. The round values the Pune-based company at $1.1 billion, making it the latest member of India’s startup unicorn club.

ET was the first to report the proposed deal on January 17.

Other investors: Existing investors Investcorp and Norwest Venture Partners also participated in the round. Operated by BusyBees Logistics Solutions, the company’s major investors include Elevation Capital (formerly SAIF Partners), NEA, Vertex Ventures and Valiant Capital.

Quote: “A large part of the new financing round is secondary where some of our existing investors have partially cashed out,” Amitava Saha, CEO, Xpressbees said. “We will use the capital for financing technological advancement, increasing automation and to grow geographical presence. We will also look at inorganic growth opportunities,” he added.

Other done deals

■ Sistema.bio has raised $15.6 million (about Rs 115 crore) through a Series-B investment round that included a mix of equity, debt and non-dilutive capital. The round was led by an equity investment from KawiSafi Ventures and matched by AXA IM Alts, a global leader in alternative investments, through the AXA IM Impact Investing strategy.

■ Wealth management platform Wealthy said it has raised $7.5 million in a funding round led by Alpha Wave Incubation (AWI). Savrola group came in as a new investor while existing backers Venture Highway, Good Capital and Emphasis Ventures also participated in the round. Wealthy will use the funds to penetrate deeper into the Indian market and expand globally, including in the Middle East.

■ Automotive cybersecurity startup SecureThings.ai said that it has raised $3.5 million in a funding round led by tech-focused VC fund Inflexor Ventures. The funding round also saw participation from 9Unicorns, RPG Ventures, SAB Holdings, and various ultra-high networth individuals.

Employees who received cryptocurrencies or other digital assets such as NFTs from crypto exchanges as part of their compensation package will face 30% tax on these as they will be defined as a "gift" under the new tax law and not salary or employee stock options (Esops), say experts.

Tell me more: Many exchanges have rolled out their own tokens and offered these as part of their employees' annual income along the lines of Esops. In some cases, it was also linked to employee performance and employees achieving certain targets.

Tax experts say even if the employee hasn't sold such coins, she will be required to cough up tax during the assessment year.

Quote: "Unlike the Esops tax regime where employees can first vest and then pay taxes on exercise, this beneficial regime is not available for cryptos received by employees. This will also mean that the employee will be required to pay 30% tax on the fair value of crypto assets she received from her employer even if she hasn't sold them," said Amit Maheshwari, tax partner at tax consultancy firm AKM Global.

Concerns over NFTs: The non-fungible tokens (NFT) community has said that the government was being unfair to the emerging digital asset class by lumping it in with cryptocurrencies in the new tax rules.

Industry participants said NFTs were different in nature and use from cryptocurrencies and thus needed separate tax rules.

Crypto industry seeks talks with govt: The Blockchain and Crypto Assets Council (BACC) has said that much needs to be done to allay the scepticism that’s engulfed the sector after the new crypto tax regime was announced in the budget.

Amit Jain

Amit Jain

Sequoia Capital India’s Amit Jain is stepping down from his position as managing director to pursue entrepreneurship, the blue-chip venture capital firm confirmed in a series of tweets on the microblogging site Twitter on Wednesday.

“Amit joined us from Uber in 2019 and brought a world-class operator's perspective to our investing teams. He has been an amazing contributor to so many startups, having led or co-led growth rounds and served on the board of scaled companies,” said Sequoia India as a part of a statement on Twitter.

Tell me more: Jain, who joined Sequoia Capital India from global cab-hailing giant Uber in 2019, has been part of the venture firm’s growth-stage investment practice, and was based out of Singapore. Jain will continue with Sequoia India, as an entrepreneur-in-residence as he charts plans for his new venture.

Prior to joining Sequoia, Jain served as the head of Asia Pacific at Uber. He was also the president at Rent.com, a housing classified site based in Los Angeles and also worked at TPG Capital as well as McKinsey & Company.

Also Read: Sequoia elevates five execs to managing director position

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

Also in this letter:

■ Meta concerned about India’s upcoming data law

■ Xpressbees turns unicorn after raising $300 million

■ Crypto Esops will be taxed as gifts

Nykaa Q3 results: profit plunges 58% to Rs 29.01 crore; revenue up 36%

Online fashion and beauty retailer Nykaa has reported a consolidated net profit of Rs 29.01 crore for the third quarter (Oct-Dec).

By the numbers: This was 57.87% down from the Rs 68.88 crore it reported in the same period in FY21, but up 2,376% from Rs 1.2 crore in the previous quarter.

- Revenue from operations came in at Rs 1,098.36 crore, up 36% from Rs 808 crore in Q3 of FY21.

- Consolidated gross merchandise value (GMV) grew to Rs 235 crore, up 26% from the previous quarter and 49% year-on-year.

- In beauty and personal care, Nykaa’s GMV rose 32% year-on-year to Rs 1,533 crore.

- In fashion, its GMV was up 137% year-on-year to Rs 510 crore.

- The company said its Ebitda stood at Rs 69 crore at a margin of 6.3%, vs 3.3% in Q2.

Founder speak: “We continue to be on a steady growth trajectory across both beauty and fashion businesses. Growth in the beauty business accelerated in a relatively normalised Covid environment, with a strong revival in the cosmetics category,” said Falguni Nayar, MD and CEO of Nykaa’s parent company.

She added that Nykaa’s network of physical stores also saw one of its strongest quarters ever as the company continued opening new stores in line with its omnichannel vision. Marketing continues to be an area of investment for Nykaa, she added.

Stock plunges before results: Before the results were announced, Nykaa’s stock fell 0.7% to close at Rs 1,0848.90 on the NSE. On Tuesday, it had shed 2.18% on the NSE as investors sold their shares in droves. The stock is down more around 40% from its all-time high.

Competition incoming: We reported in January that Nykaa is set to face serious competition, with Reliance Industries preparing to launch its own omnichannel beauty platform.

The Mumbai-based conglomerate’s two recent acquisitions – retail tech startup Fynd and e-pharmacy Netmeds – are working in tandem to make it operational, two people aware of the matter told us.

The Tata group is also looking to launch an online venture focussed on the beauty space, we reported in September.

Concerned about India’s upcoming privacy law, Meta tells SEC

Facebook parent Meta Platforms said it was concerned about India's upcoming data protection bill, which seeks local storage and processing of data, according to a company filing with the US Securities and Exchange Commission (SEC).

It added that new laws or rules that restrict its ability to collect and use information about minors may also put limitations on its advertising services or its ability to offer products and services to minors in some jurisdictions.

In their words: "Some countries, such as India, are considering or have passed legislation implementing data protection requirements or requiring local storage and processing of data or similar requirements that could increase the cost and complexity of delivering our services," the company said.

India’s stand: A Joint Committee of Parliament studying the Personal Data Protection Bill, 2019 submitted its report in December. The report and the draft legislation recommended that sensitive personal data of Indians be stored only in India.

Indian officials have claimed that the storage of sensitive personal data within India would support the growth of data centres and an innovative, data-driven economy.

They have also argued that the EU’s data protection law, the General Data Protection Regulation (GDPR), has similar conditions, allowing data of Europeans to be transferred only to countries that comply with its ‘data adequacy’ rules.

Also Read: Decoding Data Protection Bill

Lawsuits galore: Meta also said that it has been managing investigations and lawsuits in India, Europe and other regions.

It specifically mentioned the lawsuit pending before the Supreme Court of India and government inquiries and lawsuits regarding the 2021 update to WhatsApp's terms of service and privacy policy.

Whatsapp has also challenged the Indian government's IT rules, which mandate traceability of messages and would require the instant messaging app to break its end-to-end encryption.

Europe-wide problem: The company said that the issue is not restricted to India, adding that it may even have to withdraw Facebook and Instagram from the EU because of restrictions imposed by its data privacy law.

Xpressbees turns unicorn after raising $300 million

New-age logistics services provider Xpressbees said it has raised $300 million in a new funding round led by private equity funds Blackstone Growth, TPG Growth and ChrysCapital. The round values the Pune-based company at $1.1 billion, making it the latest member of India’s startup unicorn club.

ET was the first to report the proposed deal on January 17.

Other investors: Existing investors Investcorp and Norwest Venture Partners also participated in the round. Operated by BusyBees Logistics Solutions, the company’s major investors include Elevation Capital (formerly SAIF Partners), NEA, Vertex Ventures and Valiant Capital.

Quote: “A large part of the new financing round is secondary where some of our existing investors have partially cashed out,” Amitava Saha, CEO, Xpressbees said. “We will use the capital for financing technological advancement, increasing automation and to grow geographical presence. We will also look at inorganic growth opportunities,” he added.

Other done deals

■ Sistema.bio has raised $15.6 million (about Rs 115 crore) through a Series-B investment round that included a mix of equity, debt and non-dilutive capital. The round was led by an equity investment from KawiSafi Ventures and matched by AXA IM Alts, a global leader in alternative investments, through the AXA IM Impact Investing strategy.

■ Wealth management platform Wealthy said it has raised $7.5 million in a funding round led by Alpha Wave Incubation (AWI). Savrola group came in as a new investor while existing backers Venture Highway, Good Capital and Emphasis Ventures also participated in the round. Wealthy will use the funds to penetrate deeper into the Indian market and expand globally, including in the Middle East.

■ Automotive cybersecurity startup SecureThings.ai said that it has raised $3.5 million in a funding round led by tech-focused VC fund Inflexor Ventures. The funding round also saw participation from 9Unicorns, RPG Ventures, SAB Holdings, and various ultra-high networth individuals.

Tweet of the day

Cryptocurrencies as Esops will be taxed as 'gifts' under new tax law

Employees who received cryptocurrencies or other digital assets such as NFTs from crypto exchanges as part of their compensation package will face 30% tax on these as they will be defined as a "gift" under the new tax law and not salary or employee stock options (Esops), say experts.

Tell me more: Many exchanges have rolled out their own tokens and offered these as part of their employees' annual income along the lines of Esops. In some cases, it was also linked to employee performance and employees achieving certain targets.

Tax experts say even if the employee hasn't sold such coins, she will be required to cough up tax during the assessment year.

Quote: "Unlike the Esops tax regime where employees can first vest and then pay taxes on exercise, this beneficial regime is not available for cryptos received by employees. This will also mean that the employee will be required to pay 30% tax on the fair value of crypto assets she received from her employer even if she hasn't sold them," said Amit Maheshwari, tax partner at tax consultancy firm AKM Global.

Concerns over NFTs: The non-fungible tokens (NFT) community has said that the government was being unfair to the emerging digital asset class by lumping it in with cryptocurrencies in the new tax rules.

Industry participants said NFTs were different in nature and use from cryptocurrencies and thus needed separate tax rules.

Crypto industry seeks talks with govt: The Blockchain and Crypto Assets Council (BACC) has said that much needs to be done to allay the scepticism that’s engulfed the sector after the new crypto tax regime was announced in the budget.

Sequoia India MD Amit Jain steps down to launch his own venture

Sequoia Capital India’s Amit Jain is stepping down from his position as managing director to pursue entrepreneurship, the blue-chip venture capital firm confirmed in a series of tweets on the microblogging site Twitter on Wednesday.

“Amit joined us from Uber in 2019 and brought a world-class operator's perspective to our investing teams. He has been an amazing contributor to so many startups, having led or co-led growth rounds and served on the board of scaled companies,” said Sequoia India as a part of a statement on Twitter.

Tell me more: Jain, who joined Sequoia Capital India from global cab-hailing giant Uber in 2019, has been part of the venture firm’s growth-stage investment practice, and was based out of Singapore. Jain will continue with Sequoia India, as an entrepreneur-in-residence as he charts plans for his new venture.

Prior to joining Sequoia, Jain served as the head of Asia Pacific at Uber. He was also the president at Rent.com, a housing classified site based in Los Angeles and also worked at TPG Capital as well as McKinsey & Company.

Also Read: Sequoia elevates five execs to managing director position

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.