In a January report titled “Metros and pricing buoy India’s FMCG industry in Q3 2021”, consumer research firm NielsenIQ noted a “significant price-led growth”.

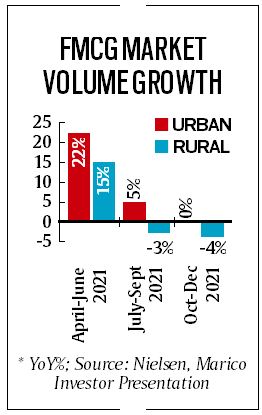

In a January report titled “Metros and pricing buoy India’s FMCG industry in Q3 2021”, consumer research firm NielsenIQ noted a “significant price-led growth”. THE DECEMBER quarter earnings of FMCG companies point to an unusual trend in rural markets: marginal or better-than-urban sales growth that is visible in value terms but amid falling demand that is evident in thinning volumes.

Hindustan Unilever chairman Sanjiv Mehta pointed out in the October-December earnings call for the country’s largest FMCG company that despite a negative volume growth, value growth was actually positive.

HUL was not the only consumer goods company witnessing this trend. The growth charted by FMCG companies in rural segments over the past two quarters has mainly been on account of price increase, and not increased demand, as several companies have admitted.

Rural markets have been growth drivers for FMCG companies for years given the low penetration of several consumption items, ranging from food and staples to healthcare and hygiene products. This has especially been the case after Covid, when strong agricultural growth and the relative insulation of the hinterland from pandemic restrictions, etc., have been drivers for FMCG demand.

In a January report titled “Metros and pricing buoy India’s FMCG industry in Q3 2021”, consumer research firm NielsenIQ noted a “significant price-led growth”.

“Overall, NielsenIQ recorded a significant price-led growth in the Indian FMCG industry, attributing it to price hikes on commodities, raw materials, and fuel and transportation costs. While price increases have resulted in a double nominal growth, there was a drop in volume growth for the industry,” it observed.

Specifically, in the rural segment, there was a 9.4 per cent value growth but a 2.9 per cent decline in consumption amidst rising prices of goods. “Consumers (in rural areas) lessened their consumption of cooking medium, packaged grocery, and hot beverages; while for non-food, they reduced their use of fabric care and personal care products,” the report said.

Manufacturers are of the view that the fall in rural demand is partly on account of migrant labourers returning to cities over the last two quarters, following the second Covid wave, resulting in subdued rural volumes.

However, despite the fall in rural demand, there is no relief in sight for FMCG companies in terms of inflationary pressure. “The kind of inflation that we are seeing, we don’t know when it will improve…let us wait and watch, we need to wait another month or so to get a better picture,” Goenka said.

For Dabur India, which reported its quarterly earnings last week, rural growth in value terms was around 7.5 per cent, while urban growth was around 2.6 per cent, the company’s CEO Mohit Malhotra said last Thursday in a post-earnings analyst call.

“Even in a challenging environment, rural demand for Dabur outpaced urban demand. For us, rural growth was around 7.5 per cent (in terms of value growth in Q3 FY 2021-22), while our urban growth was around 2.6 per cent…,” Malhotra said.

Fall in spending, price rise

Consumption of FMCG items in rural areas picked up after the first Covid wave but is now recording a slump. This is indicative of consumers spending less on these goods as a result of several factors, including rising prices.

Notably, Dabur undertook “calibrated price increases” of around 5 per cent in key products across categories, such as health supplements, ayurvedic over-the-counter items, hair oils and toothpaste.

“The inflation in this quarter was truly unprecedented at over 13 per cent and this impacted the gross margin of the consolidated business. There is continued inflation in hydrocarbon derivatives, paper-based packing material, raw honey, edible oils and some key spices that we use. Going forward, we will be taking calibrated price increases in addition to cost optimisation to mitigate this impact,” Malhotra said.

According to an investor presentation of biscuit and dairy products manufacturer Britannia Ltd, prices of commodities used by the company — flour, milk, sugar, rubber process oil — saw sequential inflation of around 4 per cent in the December-quarter, while the year-on-year inflation was around 20 per cent.

In addition, inflation in other commodities, such as industrial fuel, freight-diesel, laminates and corrugated boxes, added to the company’s margin pressure.

Another impact of the rising input costs, NielsenIQ said, was on comparatively smaller manufacturers, as a result of them being forced to increase prices of food products and cooking mediums (edible oil, etc).

“This has severely impacted small manufacturers, as 14 per cent have exited the business in Q3 2021 compared to Q3 2020. Out of the total value growth that the industry had in September 2021 (compared to a year ago), 76 per cent of this growth came from large manufacturers, while the small players had just 2 per cent with the rest coming from mid-size players,” it noted.

Kolkata-based Emami Ltd, which declared its earnings last Thursday, also noted a similar trend.

“For Emami, rural was slightly better than urban. Urban was flat, rural saw marginal growth. I cannot give a timeline as to when the markets would revive. Even the month of January was subdued as far as the rural demand is concerned,” Mohan Goenka, director, Emami Ltd, said during the analyst call.

- The Indian Express website has been rated GREEN for its credibility and trustworthiness by Newsguard, a global service that rates news sources for their journalistic standards.