Oil powered toward a seventh straight weekly gain as investors zeroed in on a fast-tightening global market and geopolitical tensions.

West Texas Intermediate (WTI) hit a fresh seven-year high near $92 a barrel, set for a jump of more than 4 per cent this week. Brent has surged 18 per cent since the year began and banks, including Goldman Sachs Group, Inc., forecast it’ll reach $100.

Gains this week have been driven by a combination of factors. Investors have expressed doubt the Organization of Petroleum Exporting Countries (Opec) and its allies can deliver in full on plans to boost output. At the same time, traders are tracking the situation in Ukraine amid concerns Russia plans to invade, which Moscow has denied. In Texas, a wave of freezing weather has hit some supply.

Oil has soared over the past year, joining a broad rally in commodities, as demand recovered from the painful impact of the pandemic. The upsurge has cut stockpiles, and prompted traders to pay steep premiums to secure near-term supplies. The jump will fan inflationary pressures, squeezing consumers and alarming politicians concerned about the fast-rising living costs.

“Oil prices remain constructive on solid fundamentals,” said John Driscoll, director of Singapore-based JTD Energy Services Pte. “Opec continues to fall short of its target, although it is promising to do better.”

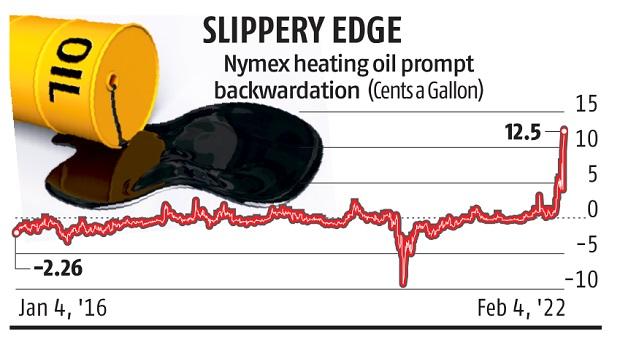

Oil markets are severely backwardated, a bullish pattern marked by premiums for near-term supplies.

Brent’s prompt spread - the differential between its nearest two contracts - was $1.45 a barrel on Friday, up from 41 cents at the start of the year. The six-month spread has widened to more than $6.

“Supply is tightening as inventories continue to draw,” said Driscoll, adding, “The six-month backwardation is over $6, or $1-per-barrel per month, and oil demand is picking up.”

Still, as prices forge higher there have been a couple of warnings. Citigroup Inc. set a bearish position for December Brent futures, saying it’s comfortable with taking a contrarian view as the market will swing to a surplus.

ConocoPhillips also flagged that traders should be concerned about strong oil-production growth in the US this year and in 2023. “If you’re not worried about it, you should be,” Chief Executive Officer Ryan Lance said.

Among industry data due later on Friday is the Baker Hughes rig count for the US, an indication of shale-production activity. This week’s print may top 500. That’s a rebound from the pandemic-era low of 172 in August 2020.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU