The Union Cabinet on Wednesday approved an additional payment of about Rs 973 crore on account of pending claims for government’s compound interest waiver scheme that reimbursed ‘interest-on-interest’ charged on small ticket loans of up to Rs 2 crore.

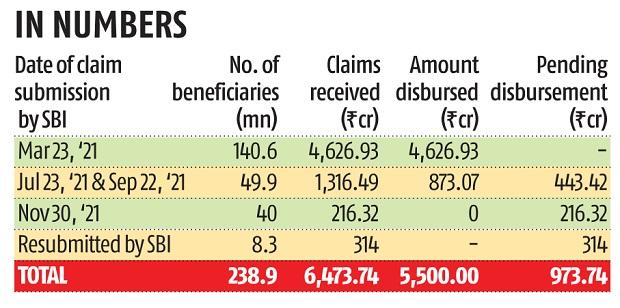

The Centre had received total claims of Rs 6,473 crore from 238 million borrowers under the “scheme for grant of ex-gratia payment of difference between compound interest and simple interest for six months to borrowers in specified loan accounts (between March 3, 2020 to August 31, 2020)”, against an estimated Rs 5,500 crore. The government had also made provision of Rs 5,500 in the Union Budget 2020-21 by extrapolating the share of State Bank of India (SBI) — the nodal agency for the scheme — and scheduled commercial banks for the same.

Under the scheme, micro, small & medium enterprises (MSME), housing, education, consumer durables, auto, and credit card dues of up to Rs 2 crore were eligible, irrespective of whether the borrower had availed a moratorium or not.

The Centre had transferred the entire budgeted Rs 5,500 crore to SBI for reimbursement to lending institutions. The SBI has received consolidated claims of about Rs 6,473.74 crore from lending institutions, and the Cabinet has now granted approval to disburse the remaining Rs 973.74 crore to the state-owned lender. The lender had to settle claims by November 2021.

Fund infusion

The cabinet committee on economic affairs (CCEA) has also approved an equity infusion of Rs 1,500 crore in Indian renewable energy development agency limited (IREDA).

The equity infusion will help the IREDA to lend an additional Rs 12,000 crore in the renewable energy sector, information and broadcasting minister, Anurag Thakur, said. This would help in funding an additional capacity of approximately 3,500-4,000 megawatts of renewable energy.

“This equity infusion will help in creating around 10,200 jobs per year and also reduce carbon-dioxide (CO2) equivalent emissions of approximately 7.49 million tonnes a year,” a government statement said.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU