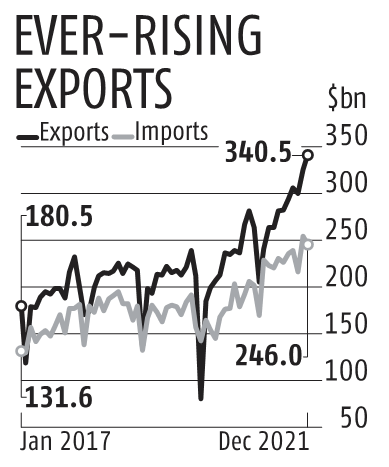

China posted a record trade surplus in December and in 2021, as exports outperformed expectations during a global pandemic, but some analysts pointed to a slowdown in international shipments in the coming months. The trade surplus hit $676.43 billion in 2021, the highest since records started in 1950, up from $523.99 billion in 2020, according to data from the statistics bureau. China also posted a record trade surplus for the month of December as exports remained robust while import growth slowed sharply, customs data showed on Friday. The trade surplus rose to $94.46 billion in December, the highest since records started in August 1994. That was up sharply from a $71.72 billion surplus in November and above a forecast for a $74.50 billion surplus in a Reuters poll. China’s hefty trade surplus with the United States, a key source of contention between the world's two biggest economies, hit $39.23 billion in December, widening from $36.95 billion the month before, but below this year's high of $42 billion in September.  China’s commerce ministry said on Thursday that it hopes the United States can create conditions to expand trade cooperation, after Chinese purchases of U. S. goods in the past two years fell well short of the targets in a Trump-era trade deal. China's exports outperformed expectations for much of 2021, but shipments have been slowing as an overseas surge in demand for goods eases and high costs pressure exporters. It was unclear how the Omicron coronavirus variant would affect that trend. Exports increased 20.9 per cent year-on-year last month, beating expectations for a 20 per cent rise, but down from a 22 per cent gain in November. The trade data provided some support to the yuan, which looked set for the biggest weekly gain in two months. “Exports remained strong last month but may soften in the coming months amid growing disruptions at ports,” said Julian Evans-Pritchard, senior China economist at Capital Economics, in a note. China reported a total of 143 local confirmed Covid-19 cases for January 13, its health authority said on Friday, including in the key northern port city of Tianjin. But Zhang Zhiwei, chief economist at Pinpoint Asset Management, said exports may already be benefiting from Omicron’s disruption to other countries’ supply chains. “We expect China's exports to remain strong in Q1 because of resilient global demand and worsening pandemic in many developing countries.

China’s commerce ministry said on Thursday that it hopes the United States can create conditions to expand trade cooperation, after Chinese purchases of U. S. goods in the past two years fell well short of the targets in a Trump-era trade deal. China's exports outperformed expectations for much of 2021, but shipments have been slowing as an overseas surge in demand for goods eases and high costs pressure exporters. It was unclear how the Omicron coronavirus variant would affect that trend. Exports increased 20.9 per cent year-on-year last month, beating expectations for a 20 per cent rise, but down from a 22 per cent gain in November. The trade data provided some support to the yuan, which looked set for the biggest weekly gain in two months. “Exports remained strong last month but may soften in the coming months amid growing disruptions at ports,” said Julian Evans-Pritchard, senior China economist at Capital Economics, in a note. China reported a total of 143 local confirmed Covid-19 cases for January 13, its health authority said on Friday, including in the key northern port city of Tianjin. But Zhang Zhiwei, chief economist at Pinpoint Asset Management, said exports may already be benefiting from Omicron’s disruption to other countries’ supply chains. “We expect China's exports to remain strong in Q1 because of resilient global demand and worsening pandemic in many developing countries.

Currently the strong exports may be the only driver helping China's economy,” said Zhang.

Import growth The world's second-largest economy staged an impressive recovery from the pandemic, with exports helping to buoy growth as several other sectors were faltering, but there are signs the momentum is flagging. A property downturn and strict Covid-19 curbs could hurt the 2022 outlook, with some analysts pointing to the slowdown in import growth as evidence that this is already happening. Imports rose 19.5 per cent year-on-year in December, the customs data showed, missing a forecast for a 26.3 per cent rise and down sharply from a 31.7 per cent gain in November. “Imports dropped back sharply, consistent with continued domestic weakness, especially in the property sector,” said Evans-Pritchard. Customs data showed China's imports of the key steelmaking ingredient iron ore slipped from the month before on steel production curbs and slowing property construction. “We expect import growth to remain muted in H1 this year as China's domestic demand will continue to be dampened by the property slowdown and weak consumption,” said Louis Kuijs, head of Asia economics at Oxford Economics, in a note. China's economic growth is likely to slow to 5.2 per cent in 2022, before steadying in 2023, a Reuters poll showed, as the central bank steadily ramps up policy easing to ward off a sharper downturn. China releases fourth quarter gross domestic product data on Monday. For all of 2021, total exports rose 29.9 per cent, compared to a 3.6 per cent gain in 2020. Imports for the year gained 30.1 per cent percent, after falling 1.1 percent in 2020.(This story has not been edited by Business Standard staff and is auto-generated from a syndicated feed.)

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU