The market shed about a third-of-a-percent on December 24 after a rally of nearly 3 percent in the previous three consecutive sessions. The broader markets also saw profit-booking with the Nifty Midcap 100 and Smallcap 100 indices rising 1 percent and half-a-percent, respectively.

The BSE Sensex was down 191 points to close at 57,124.31, while the Nifty50 managed to hold 17,000 mark, down 68.80 points at 17,003.80, and formed a bearish candle on the daily charts.

"The Nifty50 registered another indecisive formation called Hanging Man which indicates exhaustion of momentum and usually formed near the short-term turning points. However, at this juncture, technical indicators are generating mixed signals as Nifty weekly charts registered a Hammer kind of formation owing to four-day rally from the lows of 16,410 to Friday's high of 17,155 levels," says Mazhar Mohammad, Chief Strategist – Technical Research and Trading Advisory at Chartviewindia.in.

During the week, the BSE Sensex was down 0.2 percent and Nifty50 fell 0.1 percent.

Mazhar said the next week will remain very critical for bulls as the index not only required to sustain above 16,900 levels but also needed to get past the 17,155 levels to build on to positive momentum.

"In the event of bulls managing to push the index beyond 17,155 levels the initial target can be 17,379 levels and beyond that 17,540 can't be ruled out but a close below 16,900 can open the doors to retest recent corrective swing low of 16,410 levels," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,890.4, followed by 16,777. If the index moves up, the key resistance levels to watch out for are 17,136.4 and 17,269.

Nifty Bank

The Nifty Bank plunged 334.10 points or 0.95 percent to 34,857.10 on December 24. The important pivot level, which will act as crucial support for the index, is placed at 34,517.7, followed by 34,178.3. On the upside, key resistance levels are placed at 35,262.2 and 35,667.3 levels.

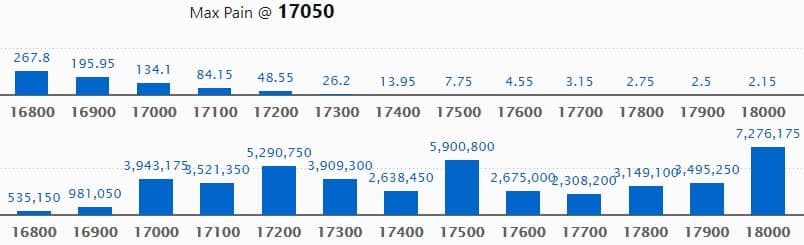

Call option data

Maximum Call open interest of 72.76 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17500 strike, which holds 59 lakh contracts, and 17200 strike, which has accumulated 52.90 lakh contracts.

Call writing was seen at 17200 strike, which added 23.44 lakh contracts, followed by 17900 strike which added 23.36 lakh contracts, and 17500 strike which added 20.17 lakh contracts.

Call unwinding was seen at 17000 strike, which shed 2.17 lakh contracts, followed by 16600 strike which shed 72,150 contracts and 16500 strike which shed 30,225 contracts.

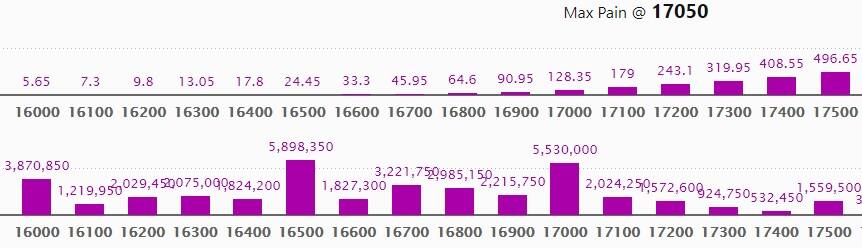

Put option data

Maximum Put open interest of 58.98 lakh contracts was seen at 16500 strike, which will act as a crucial support level in the December series.

This is followed by 17000 strike, which holds 55.30 lakh contracts, and 16000 strike, which has accumulated 38.70 lakh contracts.

Put writing was seen at 16500 strike, which added 11.61 lakh contracts, followed by 16700 strike which added 8.6 lakh contracts and 16000 strike which added 8.25 lakh contracts.

Put unwinding was seen at 17000 strike, which shed 1.8 lakh contracts, followed by 17100 strike which shed 1.17 lakh contracts and 18000 strike which shed 56,250 contracts.

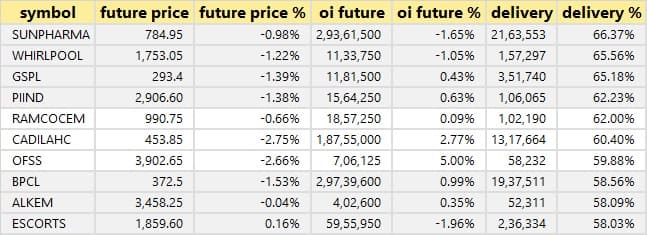

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

17 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

72 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

87 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

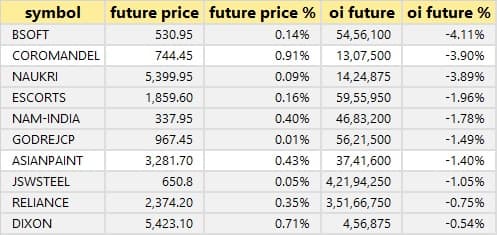

14 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

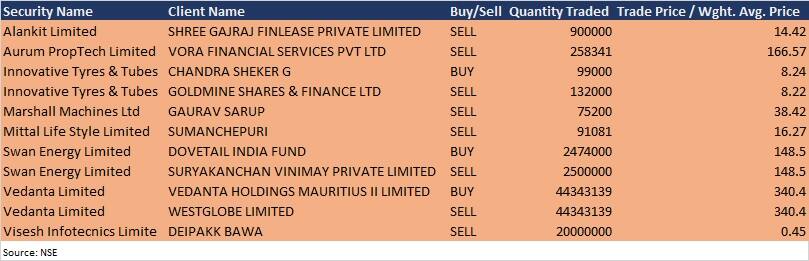

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting

Tatva Chintan Pharma Chem: The company's officials will meet East Lane Capital on December 27.

Sundram Fasteners: The company's officials will meet AlfAccurate Advisors on December 27.

CARE Ratings: The company's officials will meet New Market Capital on December 27.

Greaves Cotton: The company's officials will meet Edelweiss India on December 28 and Polunin Capital Partners on December 30.

Tata Consumer Products: The company's officials will meet Ventura Securities on December 29.

Stocks in News

HP Adhesives: The company will make a debut on the bourses on December 27. The final issue price is Rs 274 per share.

Adani Transmission: The company has received the Letter of Intent (LoI) for the acquisition of a renewable energy evacuation system under Khavda-Bhuj Transmission Ltd. With an estimated capex of more than Rs 1,200 crore, company's execution of the project will help evacuate about 3 GW of renewable energy from Khavda, Gujarat. Also the company received the LoI for the acquisition of Karur Transmission Ltd.

Visagar Polytex: The company approved raising of funds of Rs 49.75 crore through Rights Issue of equity shares up to 29.27 crore in the ratio of 1:1.

Banas Finance: The company approved raising of funds up to Rs 49.80 crore through Rights issue.

Emami Realty: CARE has upgraded the credit rating of the long-term banks facilities to 'BBB; Stable' from 'BBB-; Stable.

GMR Infrastructure: GMR Airports Netherlands B.V., a step down subsidiary of GMR Airports, signed the Shareholders’ Agreement (SHA) and Share Subscription Agreement (SSA) with Angkasa Pura II (AP II) for the development and operation of Kualanamu International Airport (Project) in Medan, Indonesia.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 715 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 43.24 crore in the Indian equity market on December 24, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Escorts, Indiabulls Housing Finance, and Vodafone Idea - are under the F&O ban for December 27. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.