It was a black Monday for Dalal Street as bears retained their tight control on December 20. Fast-rising Omicron cases globally dampened the market sentiment.

The BSE Sensex plunged 1,190 points or 2.09 percent to 55,822, while the Nifty50 declined 371 points or 2.18 percent to 16,614 and formed a bearish candle on the daily charts. However, the market saw a bit of recovery in the last couple of hours of trade.

"The Nifty witnessed a gap-down open and moved lower for rest of the session and tested a low of 16,410, post which some buying came in and pulled the index higher by 200 odd points. Finally, the index ended the session with a loss of 371 points," says Karan Pai, Technical Analyst at GEPL Capital.

He feels the Nifty seems to be making brisk move towards 16,200 (200-day SMA). "If the index manages to breach below this level, we might see the prices move lower towards the 15,800 mark."

"Looking at the price action, one can be forgiven for thinking this is a sell-on-rally scenario. On the upside, 17,000 which is the psychological level, will act as a key resistance," said Pai.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,402.9, followed by 16,191.6. If the index moves up, the key resistance levels to watch out for are 16,832.8 and 17,051.4.

Nifty Bank

The Nifty Bank plunged 1,178.80 points or 3.31 percent to 34,439.85 on December 20. The important pivot level, which will act as crucial support for the index, is placed at 33,895.16, followed by 33,350.43. On the upside, key resistance levels are placed at 35,107.87 and 35,775.84 levels.

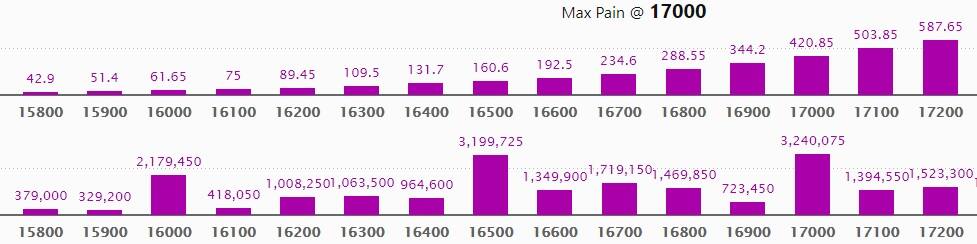

Call option data

Maximum Call open interest of 25.54 lakh contracts was seen at 17000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17500 strike, which holds 22.42 lakh contracts, and 17200 strike, which has accumulated 18.02 lakh contracts.

Call writing was seen at 16800 strike, which added 9.27 lakh contracts, followed by 16600 strike which added 9 lakh contracts, and 16700 strike which added 7.88 lakh contracts.

Call unwinding was seen at 17400 strike, which shed 3.52 lakh contracts, followed by 17300 strike which shed 1.83 lakh contracts and 17500 strike which shed 1.32 lakh contracts.

Put option data

Maximum Put open interest of 32.40 lakh contracts was seen at 17000 strike, followed by 16500 strike, which holds 31.99 lakh contracts, and 16000 strike, which has accumulated 21.79 lakh contracts.

Put writing was seen at 16300 strike, which added 2.68 lakh contracts, followed by 15800 strike which added 2.53 lakh contracts and 15700 strike which added 2.45 lakh contracts.

Put unwinding was seen at 17000 strike, which shed 13.64 lakh contracts, followed by 16000 strike which shed 9.04 lakh contracts and 17200 strike which shed 5.2 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

No stock saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, there was not a single stock in which a long build-up was seen.

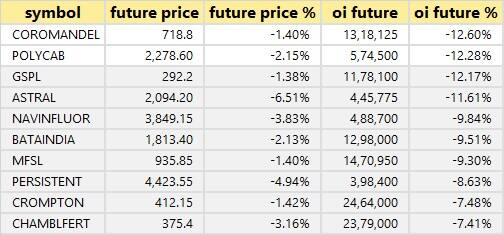

139 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

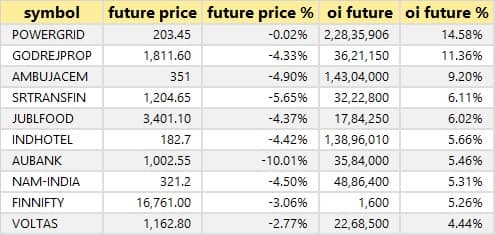

44 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

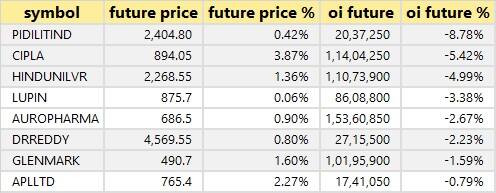

8 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 8 stocks in which short-covering was seen.

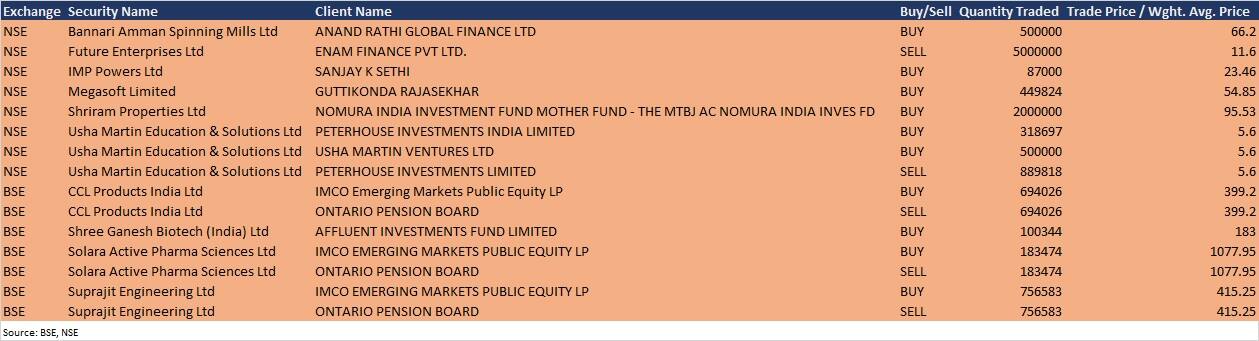

Bulk deals

CCL Products India: IMCO Emerging Markets Public Equity LP acquired 6,94,026 equity shares in the company at Rs 399.20, however, Ontario Pension Board sold 6,94,026 equity shares at Rs 399.20 per share on the BSE, the bulk deals data showed.

Shree Ganesh Biotech (India): Affluent Investments Fund bought 1,00,344 equity shares in the company at Rs 183 per share on the BSE, the bulk deals data showed.

Solara Active Pharma Sciences: IMCO Emerging Markets Public Equity LP acquired 1,83,474 equity shares in the company at Rs 1,077.95 per share, however, Ontario Pension Board offloaded 1,83,474 equity shares at Rs 1,077.95 per share on the BSE, the bulk deals data showed.

Suprajit Engineering: IMCO Emerging Markets Public Equity LP purchased 7,56,583 equity shares in the company at Rs 415.25 per share, however, Ontario Pension Board sold 7,56,583 equity shares at Rs 415.25 per share on the BSE, the bulk deals data showed.

Shriram Properties: Nomura India Investment Fund Mother Fund - The MTBJ AC Nomura India Investment Fund acquired 20 lakh equity shares in the company at Rs 95.53 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Ajmera Realty & Infra India: The company's officials will meet HDFC Securities on December 21, and Ventura Securities on December 24.

Sastasundar Ventures: The company's officials will meet analysts and investors on December 21.

ACC: The company's officials will meet ICICI Prudential Mutual Fund on December 21.

Clean Science and Technology: The company's officials will meet Equentis Wealth on December 21.

Xpro India: The company's officials will meet analysts and investors on December 22 and December 23.

Fine Organic Industries: The company's officials will meet investors on December 21.

Mrs. Bectors Food Specialities: The company's officials will meet investors and analysts on December 21 and December 22.

Somany Home Innovation: The company's officials will meet Dolat Capital on December 21.

Tata Consumer Products: The company's officials will meet Point72 Asset Management on December 21.

Stocks in News

CE Info Systems (MapmyIndia): The company will make its debut on the bourses on December 21. The final issue price is Rs 1,033 per share.

RailTel Corporation of India: The company has received work order from Defence R & D Organisation for expansion and enhancement of CIAG network capacity at a total cost of Rs 68.31 crore. The entire work is to be completed in a period of seven months.

Adani Enterprises: The company received Letter of Awards (LoAs) from Uttar Pradesh Expressways Industrial Development Authority (UPEIDA) for three Greenfield Ganga Expressway Projects - Group II, Ill and IV from Badaun to Prayagraj in Uttar Pradesh on a DBFOT (toll) basis.

Rolex Rings: The company has entered into the Memorandum of Understanding (MOU) with the Government of Gujarat for development of Textile & Apparel Park, IT Park and Toy Park at Gondal district.

KPI Global Infrastructure: The company has received confirmation of the order for executing solar power project of 2.50 MWdc capacity under 'Captive Power Producer (CPP)' segment.

Wipro: The company will acquire Texas-headquartered Edgile to strengthen its leadership in strategic cybersecurity services.

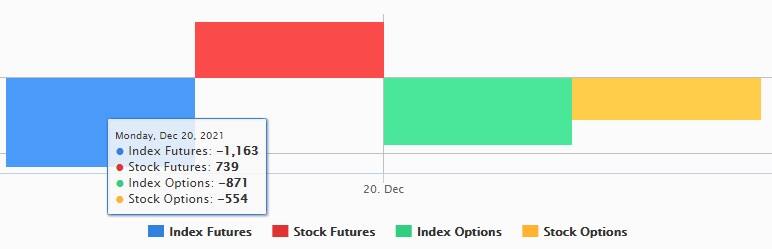

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 3,565.36 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 2,764.02 crore in the Indian equity market on December 20, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Escorts, and Indiabulls Housing Finance - are under the F&O ban for December 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.