The domestic equity market continued its uptrend for the second consecutive session on December 8. A dovish policy by the Reserve Bank of India (RBI), positive Asian cues and across-the-board buying pushed the benchmark indices sharply higher.

The BSE Sensex surged 1,016 points or 1.76 percent to 58,649.68, while the Nifty50 climbed 293.10 points or 1.71 percent to 17,469.80 and formed bullish candle on the daily charts.

"Another long bull candle was formed on the daily chart with gap up opening. The upmove of the last two sessions has erased the negative sentiment created by last Friday and this Monday. This is positive indication for the short term," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Shetti further says the market is now placed at the important juncture. "A decisive move above 17,550-17,600 levels could open further sharp upside towards 18,000 mark in a quick period of time. Any failure to sustain above this area is likely to trigger weakness from the highs towards the low of 17,250-17,200 levels in the near term."

The broader markets also traded in line with benchmark indices as the Nifty Midcap 100 and Smallcap 100 indices spiked 1.61 percent and 1.83 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,357.6, followed by 17,245.4. If the index moves up, the key resistance levels to watch out for are 17,533.3 and 17,596.8.

Nifty Bank

The Nifty Bank was one of the big drivers for the market, rising 666.30 points or 1.82 percent to 37,284.70 on December 8. The important pivot level, which will act as crucial support for the index, is placed at 36,998.27, followed by 36,711.84. On the upside, key resistance levels are placed at 37,477.97 and 37,671.23 levels.

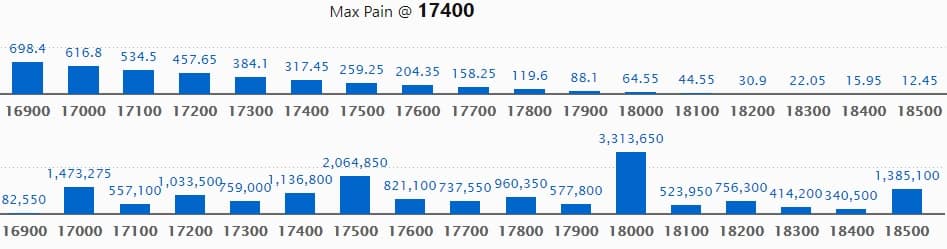

Call option data

Maximum Call open interest of 33.13 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17,500 strike, which holds 20.64 lakh contracts, and 17,000 strike, which has accumulated 14.73 lakh contracts.

Call writing was seen at 17,600 strike, which added 63,650 contracts, followed by 17,900 strike which added 56,400 contracts, and 17,400 strike which added 23,450 contracts.

Call unwinding was seen at 17,200 strike, which shed 2.03 lakh contracts, followed by 17,100 strike which shed 1.64 lakh contracts and 18,000 strike which shed 1.26 lakh contracts.

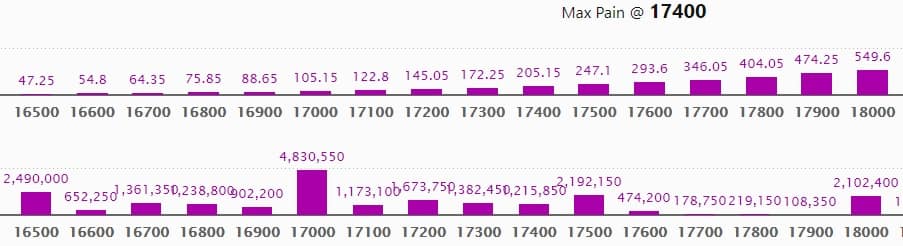

Put option data

Maximum Put open interest of 48.30 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the December series.

This is followed by 16,000 strike, which holds 30.84 lakh contracts, and 16,500 strike, which has accumulated 24.90 lakh contracts.

Put writing was seen at 17,500 strike, which added 3.53 lakh contracts, followed by 17,400 strike which added 3.2 lakh contracts and 17,300 strike which added 2.43 lakh contracts.

Put unwinding was seen at 17,000 strike, which shed 1.05 lakh contracts, followed by 16,800 strike which shed 1.01 lakh contracts and 16,600 strike which shed 69,600 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

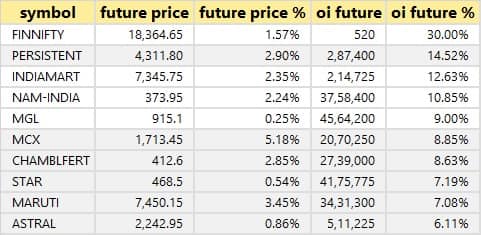

80 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

1 stock saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 1 stock in which long unwinding was seen.

![]()

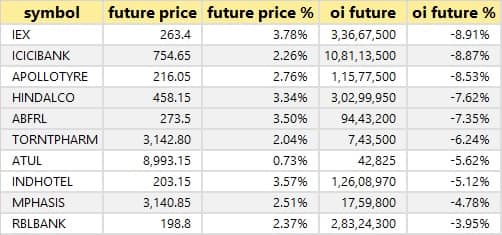

13 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

97 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

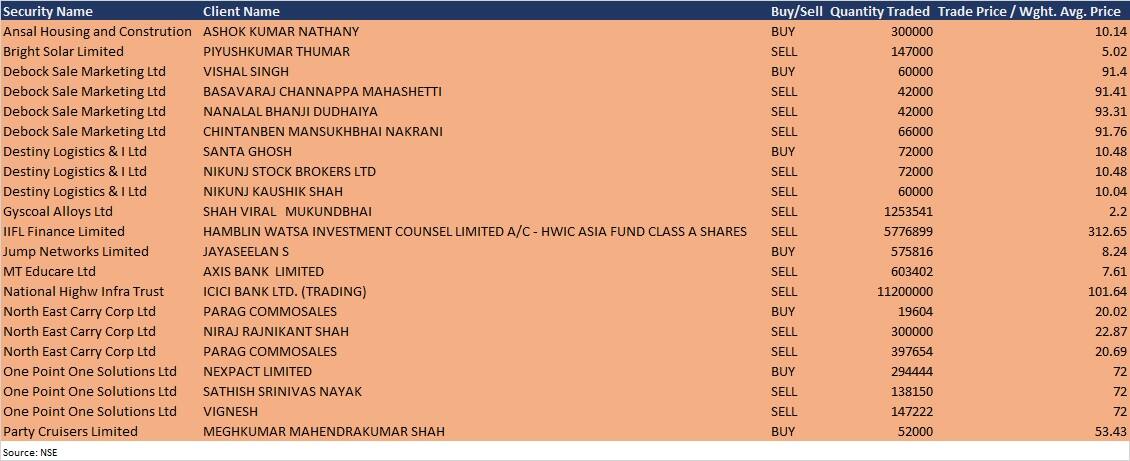

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting

Fermenta Biotech: The company's officials will interact with the analyst and institutional investors on December 9 to discuss the financial performance.

Granules India: The company's officials will meet Avendus Capital Public Markets Alternate Strategies LLP, Arohi Asset Management, Catamaran etc on December 9.

Shaily Engineering Plastics: The company's officials will meet investors on December 9.

Max Ventures and Industries: The company's officials will participate in Ambit's Emerging Giants Conference on December 9.

Quess Corp: The company's officials will meet analysts and institutional investors on December 10.

Stocks in News

RailTel Corporation of India: The company has received work order from Ircon International for design, supply, installation, testing & commissioning of tunnel communication system consisting of emergency call & service telephone, CCTV, tunnel radio and PA system in tunnel environment on Dharam - Banihal section of Jammu Kashmir Rail Link Project under Ferozepur division of Northern Railway at a total cost of Rs 210.77 crore. The entire work is to be completed in a period of twelve months.

HCL Technologies: The company and apoBank, the largest cooperative primary bank in Germany, have signed with Atruvia AG an agreement to acquire IT consulting company Gesellschaft für Banksysteme GmbH (gbs).

Nazara Technologies: Founders of Arrakis Tanitim Organizasyon Pazarlama San.Tic. Ltd. Sti. (Publishme, Turkey) has subscribed to 30.82% stake in Publishme Global FZ LLC. Accordingly, Nazara through its wholly owned subsidiary company i.e. Nazara Technologies FZ-LLC, is now holding 69.18% stake in Publishme Global FZ-LLC.

REC: The company approved the proposal for sale and transfer of Kallam Transmission to the successful bidder, selected through Tariff Based Competitive Bidding Process.

Venus Remedies: The company has been selected for production-linked incentive scheme (PLI) of the Government of India.

Gland Pharma: The company received a tentative approval from the United States Food and Drug Administration (US FDA) for Cangrelor for injection.

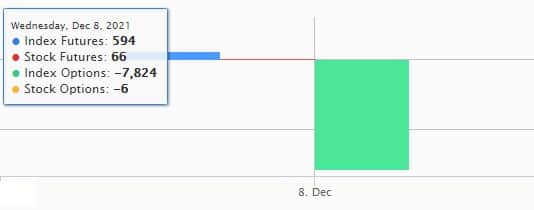

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 579.27 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,735.50 crore in the Indian equity market on December 8, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Indiabulls Housing Finance - is under the F&O ban for December 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.