Indian stocks were completely caught in a bear trap on Friday, with benchmark indices witnessing the biggest single day fall since 12 April this year, as a new COVID-19 variant detected in South Africa rattled investors globally. Increasing COVID-19 cases in Europe and major FIIs selling further weighed on investor sentiment in the domestic market. Barring pharma, all sectors succumbed to the selling pressure.

The BSE Sensex plummeted nearly 1,700 points to 57,107, while the Nifty50 managed to defend crucial 17,000 mark, dropping more than 500 points to 17,026. Broader markets too joined the fall with Nifty Midcap 100 and Smallcap 100 indices retreating around 3 percent each.

However, stocks that were in focus or bucked the trend include Indiabulls Housing Finance and Cipla which were the two gainers in the futures & options segment. Indiabulls Housing Finance climbed 8.78 percent to close at Rs 246.55, and Cipla rallied 7.42 percent to Rs 966.70.

Meghmani Organics was locked in 20 percent upper circuit to close at Rs 103.20, while BEML gained 2.39 percent to close at Rs 1,657.85.

Here's what Mehul Kothari of Anand Rathi Shares & Stock Brokers, recommends investors should do with these stocks when the market resumes trading today:

The stock has outperformed during the recent crack in domestic markets and this indicates strength. At this juncture, it is consolidating above the placement of 200-day SMA (simple moving average).

In addition, it is on the verge of breaking out from that consolidation. Thus, once the stock starts trading above Rs 265, it will be prepared for higher levels like Rs 300 – 350.

Traders and investors should continue to hold the stock. Overall support for the counter is at Rs 200.

Much of the pharma stocks were in a bad phase since past few months. However Cipla and its peers got a new life post the recent Covid outbreak worldwide. As a result the stock witnessed heavy buying interest recently.

On the levels front, Rs 870 is a very crucial level for traders and investors. Above that the stock would continue to remain strong and has potential to rise towards Rs 1,000 – 1,200 mark. Thus participants can hold the stock for time being.

The stock was at 20 percent upper circuit during the latest trading session and that has brought in to a strong territory. The upside was accompanied with humongous volumes.

Thus traders and investors should continue to hold the stock with a recent low of Rs 80 as a stop loss. On the upside, the stock is poised to reach Rs 120 – 140 levels in the coming months.

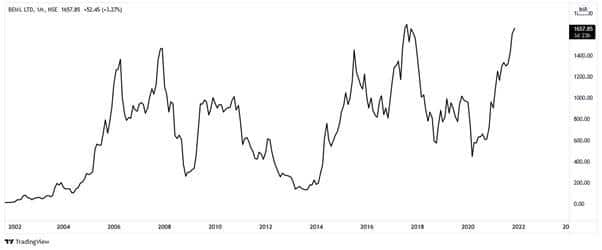

Given here is the monthly line chart of BEML which depicts that the stock is currently hovering at the all-time high resistance of Rs 1,700. At this point in time, looking at the current condition of the markets traders and investors should exit the stock once and wait for a monthly close to re-enter.

Only a monthly close above Rs 1,700 would reinforce the stock for much higher levels else the stock might enter a consolidation phase for some time. On the downside, the support is placed at Rs 1,500.