Sundaram Asset Management Company Ltd. has received SEBI's approval for the acquisition of Principal Asset Management Pvt. Ltd. Sundaram Asset Management Company had first announced the purchase of the asset management business of Principal in January 2021, and had received the approval of Competition Commission of India in April 2021.

As per the terms of agreement, Sundaram Asset Management Company (Sundaram AMC) will acquire the schemes managed by Principal Asset Management Pvt. Ltd (Principal AMC) and acquire 100% of the share capital of Principal Asset Management Pvt. Ltd., Principal Trustee Company Pvt. Limited, and Principal Retirement Advisors Pvt. Ltd.

--- Advertisement ---

Revealed: A Massive 15x EV Opportunity

We concluded the EV Gold Rush special event yesterday.

And it was a mega success. Thousands of Indians had joined us LIVE.

But for some reason you couldn't make it to the event.

At the event, we revealed our complete research on this massive 15x opportunity in electric vehicles...

Including details of 3 EV stocks that could potentially offer you life-changing gains in the long run.

Click Here to Watch Full Details (Available for a limited time)

------------------------------

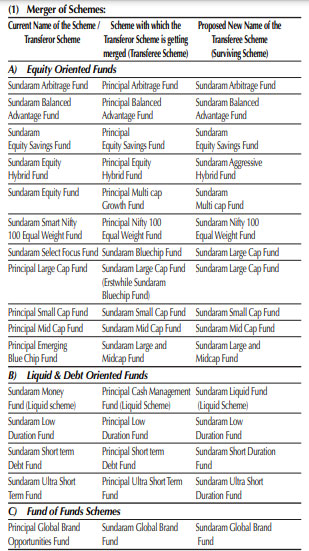

Accordingly, the schemes of Principal Mutual Fund will be transferred to and form part of Sundaram Mutual Fund. In order to avoid existence of similar schemes and to comply with the SEBI circular on scheme categorization, certain schemes of Sundaram Mutual Fund will be merged with the corresponding schemes of Principal Mutual Fund while a few schemes of Principal Mutual Fund will be merged with the corresponding schemes of Sundaram Mutual Fund (see Table 1 below).

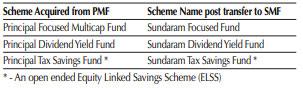

Meanwhile, the following schemes of Principal Mutual Fund will be taken over by Sundaram Mutual Fund and there will be no change in characteristic or features of the scheme except the name.

In a press release, Mr Pedro Borda, Chief Operating Officer (COO), Principal International said, "As part of a systematic review of the company's portfolio of businesses and global market dynamics, we've made the decision to exit the asset management business in India. As we transition the business, customers and distributors will remain our top priority. We believe they will benefit from Sundaram Asset Management's larger mutual fund platform in this market."

This will mark the exit of another foreign entity from mutual fund business in India. In the past few years, foreign entities like Morgan Stanley, ING, PineBridge, Deutsche, Goldman Sachs, JP Morgan, and Black Rock have sold their stake in the Indian asset management industry.

REVEALED: 3 Super Smallcaps You Need to Discover Today

The acquisition will help Sundaram Asset Management Company to become a sizeable player in the Indian mutual fund industry. As on October 31, 2021, Sundaram Mutual Fund had Rs 33,577 crore in assets under management (AUM), whereas Principal Mutual Fund had an AUM of Rs 9,558 crore during the same period.

Commenting on the acquisition, Mr Sunil Subramaniam, Managing Director, Sundaram Asset Management Company said, "This transaction will strengthen our presence in the marketplace with the addition of a range of schemes with a good long term performance track record across the large and mid-cap segments. This will complement our business which has traditionally been weighted towards the mid- and small-cap segment."

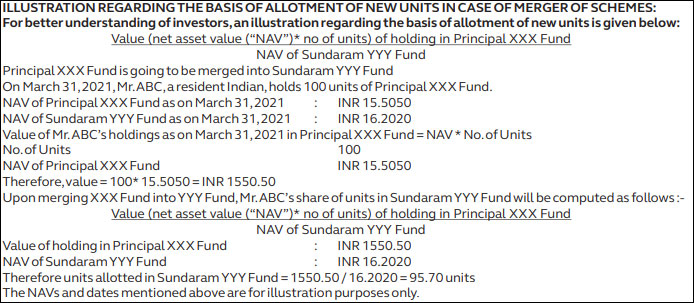

Unit holders of the Transferor Schemes will be allotted new units under the Transferee Schemes/Surviving Schemes and a fresh account statement reflecting the new units allotted will be sent to the unit holders.

According to SEBI's circular, merger of Transferor Scheme(s) with Transferee Scheme(s) is treated as a change in fundamental attributes of the Transferor Scheme(s). However, merger or consolidation is not seen as a change in fundamental attribute of the surviving scheme if there is no change in the fundamental attributes of the transferee scheme and if it does not change the features/ provision (in any manner) which would adversely affect the interest of the unit holders of the surviving scheme(s).

Consequently, unit holders in such schemes of Principal Mutual Fund that will undergo change in fundamental attributes have the option to redeem their investment in the scheme without any exit load at the prevailing NAV, within the notice period of 30 days.

Though there is an option to exit without any load, the proceeds from redemption are subject to capital gains tax depending on the holding period and type of scheme (equity, debt).

--- Advertisement ---

GOOD NEWS: Listen to Some of The Biggest Investment Minds of This Country... Without Leaving Your Couch!

Want to discover the biggest mega-trends and money-making ideas for the next 10 years? Then you'll love to Register for The Equitymaster Annual Conference 2022...

Where top investment gurus will reveal their most lucrative investing and wealth-protection strategies for the next decade. And since This Conference Is Fully Virtual - you can listen to them right from the comfort and safety of your own home...

Get Your Conference Ticket Right Now

------------------------------

It is important to note that exiting is just an option and not a compulsion. If the Principal mutual fund scheme that you have invested in is performing well compared to its category peers and the benchmark index, and if there is no significant difference in the investment strategy/style or portfolio characterisitcs, then it makes sense to continue holding it.

That said, since most schemes of Sundaram Mutual Fund across equity and debt categories have not fared well on risk-reward parameters in the last couple of years, you need to keep a close watch on its performance post the merger.

However, if the merged scheme follows a more aggressive/conservative investment approach than the current scheme and is no longer in congruence with your risk profile, or if the investment objective of the merged scheme does not align with your own investment objective, you can consider exiting the scheme during the free exit load period.

Certain schemes of Sundaram Mutual Fund will also undergo significant changes in its fundamental attributes. For instance, Sundaram Select Focus, a Focused Fund will now be merged with Sundaram Bluechip Fund and will become a Large-cap fund.

But do not conclude that the merger of schemes will improve or deteriorate its performance. Instead, pay attention to the changes and practices put in place by Sundaram AMC post acquisition of Principal AMC and how prudently they manage your money.

It is important to understand the investment philosophy of the fund house and investment processes they follow. Only process-driven fund houses can give you consistent performers over the long term.

Further, before taking any investment decisions evaluate your investment objective, risk appetite, and investment horizon to select the most suitable scheme that scores well on quantitative as well as qualitative parameters.

PS: If you are looking for quality mutual fund schemes (including Equity-linked Saving Schemes) to add to your investment portfolio, I suggest you subscribe to PersonalFN's premium research service, FundSelect. PersonalFN's FundSelect service provides insightful and practical guidance on which mutual fund schemes to Buy, Hold, and Sell.

Currently, with the subscription to FundSelect, you could also get Free Bonus access to PersonalFN's Debt Fund recommendation service DebtSelect.

If you are serious about investing in a rewarding mutual fund scheme, subscribe now!

Author: Divya Grover

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

India's biggest IPO, Paytm hit a low of Rs 1,586 post listing, wiping out more than one-fourth of investors' wealth in only a few minutes of trading.

These penny stocks delivered multibagger returns of up to 30 times since last Diwali.

As the green energy movement grows, Indian companies are on a mission to adopt green hydrogen, the cleanest form of energy in the world.

Co-head of Research at Equitymaster weighs in on the Paytm debacle and which IPOs to look forward to.

Forget loss making new age businesses. Focus on this hypergrowing industry instead that also generates rich profits

More Views on NewsThis is how you can achieve the ambitious goal of a net worth of Rs 100 crore.

Nov 10, 2021The road ahead for smallcaps.

These businesses don't offer long term upside for investors.

Nov 20, 2021The Rs 19 bn issue is set to hit the market soon.

Nov 10, 2021Selling is extremely difficult to get right. All you can hope for is to have a strategy in place and then try and execute it to the best of one's abilities.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!