Bear of the Day: FedEx (FDX)

FedEx stock has become a victim of its own success and it faces substantial near-term headwinds in the form of rising labor costs and supply chain bottlenecks...

FedEx FDX is likely prepared to grow for years to come and the global delivery firm’s expanded reach within e-commerce helped it soar during the pandemic. But the stock has become a victim of its own success and FDX faces substantial near-term headwinds in the form of rising labor costs and supply chain bottlenecks.

FDX’s Story

FedEx over the last several years cut ties with Amazon AMZN, modernized its automation efforts, and invested heavily in optimizing its last-mile residential deliveries. All these efforts were done in the name of e-commerce expansion. The firm remains committed to its business-to-business segment, but e-commerce is where much of its growth will come from for years.

The global shipping powerhouse pulled in $69 billion in FY20. The company’s e-commerce efforts then paid off in a big way last year, when FedEx’s FY21 revenue soared 21% to $84 billion—period ended on May 31.

FedEx executives last year cut their timeline for overall industry expansion, as the coronavirus pushed e-commerce adoption into overdrive. But it is experiencing some turbulence at the moment, largely due to broader economic factors outside of its control.

FedEx said last quarter that the tight labor market added $450 million to costs, in the form of higher wages, increased overtime, and other expenses. Executives also said that supply chain setbacks have lowered demand for shipping, with digital sales even taking a hit as more shoppers head to stores or pick up digital orders themselves.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

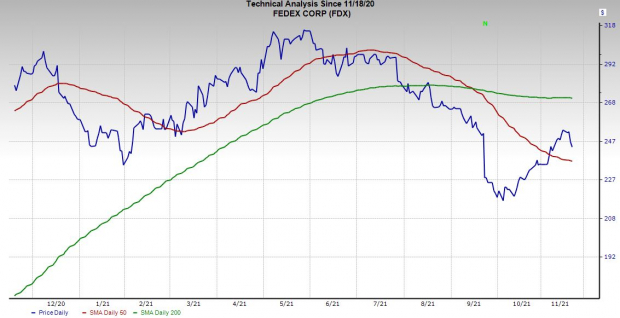

FDX has now fallen 13% in the last year compared to the Zacks Transportation sector’s 10% climb. More recently, FedEx shares are down 9% in the past three months, which included a nice comeback that coincided with the broader market rally that began in early October.

FDX’s consensus earnings estimates have fallen since it released its Q1 FY22 results and provided updated guidance on September 21. Its Zacks consensus estimates for the current quarter dropped 14% since then, with its FY22 EPS projection 8.5% lower and FY23’s 4.5% off the pace.

FedEx’s downward earnings revisions activity helps it land Zacks Rank #5 (Strong Sell) at the moment. The stock is also headed back down toward its 50-day moving average recently. Therefore, it might be best to stay away from FedEx stock for the time being.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

FedEx Corporation (FDX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research