- Based on SARS' funding requirements and the funding allocated to it, the revenue service will run into a R9 billion deficit over the next three years.

- SARS' revenue allocation has remained largely flat, but government this year announced it would receive an additional R3 billion for the next three years.

- If government's fiscal situation improves, then SARS may hopefully get the funding it requires, says Commissioner Edward Kieswetter.

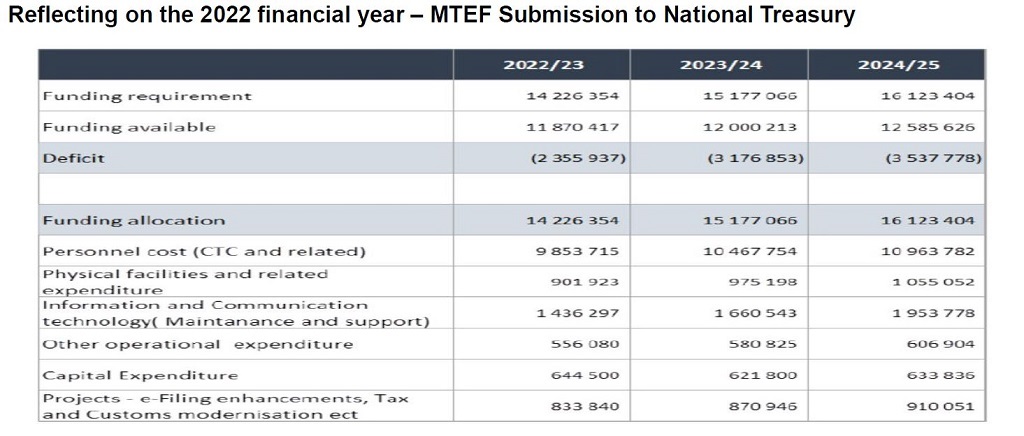

Based on the South African Revenue Service's funding requirements and the funding allocated to it, it will run into a R9 billion deficit over the next three years, members of Parliament heard this week.

SARS officials, including Commissioner Edward Kieswetter this week briefed the Standing Committee on Finance on the revenue service's 2020/21 annual report.

Notably, SARS collected R1.249 trillion during the year, exceeding the revised targets of R1.212 trillion. SARS essentially collected R38 billion more, Kieswetter said.

Revenue collections were largely driven by personal income taxes, VAT and corporate income tax.

During the briefing, Kieswetter lamented that SARS is underfunded. For example, for the 2022/23 financial year, its funding requirement is over R14 billion, but it is allocated just over R11 billion.

Deputy Finance Minister David Masondo, who was at the committee briefing, noted concerns raised by SARS over its funding requirements and highlighted that it is set to receive an additional R3 billion over the medium term. This was announced during the February budget.

Masondo said that everyone in government has been affected by "serious challenges" linked to the fiscus. He however noted that it is important to invest in SARS, but resource constraints have to be taken into account.

Kieswetter told Fin24 that SARS funding has remained largely flat, at just around R10 billion.

But the revenue service will be making use of the additional R3 billion to support its digitalisation strategy and target compliance. Of the additional R1 billion allocated for the 2021/22 financial year - a third will be used to recruit people with technical skills and two-thirds would be used for capital projects to accelerate its modernisation programme.

"Today we cannot process tax data on paper and with people only. We have to use super computers to crunch through terabytes of data to help us detect risk and draw trends, get insights. That help us with artificial intelligence to find out the 'needle in the haystack'," he said.

About R35 billion in the current year's additional revenue has been recovered through fraud detection. Another R50 billion has been recovered from compliance activities - such as better investigations and using "legal instruments" to find, go after and hold taxpayers to book, he said.

He is hopeful that as the financial position of government improves, SARS can get back to the funding level it requires.

Boosting compliance

Billy Joubert - senior associate director for transfer pricing at Deloitte South Africa - said that there is scope to broaden the tax base through improving compliance. The prevalence of corruption however does little to enhance tax morale, he added.

A public survey conducted by SARS on tax morality during 2020/21 reflected an uptick, but this did not necessarily translate into tax compliance. The latter is a function of people's ability to pay, rather than a decision not to, Kieswetter said. But he also acknowledged that non-compliance is also a function of criminal activities.

"People feel more likely to pay tax when there is trustworthiness in the system, when they find it easy to engage with SARS and when we are deemed to be operationally efficient," said Kieswetter.

"We still see many employers collect taxes and then do not pay it over to SARS," said Kieswetter. "We have begun to pursue criminally many of these employers," he told the committee. Some small businesses also struggle to comply due to cash flow issues or administrative issues.

During the 2020/21 financial year, efforts by SARS to enhance compliance saw R172 billion in revenue recovered. These measures include voluntary disclosure programmes, clamping down on criminal and illicit activities, debt collections and refund leakage protection or preventing fraudulent refund claims. Refund fraud detection prevented R57 billion in refunds being paid out.