The market has breached crucial levels on the downside as it continued downtrend for the third consecutive session on November 11 following global inflationary pressure and increase in US bond yields. All sectoral indices, barring metals, closed in the red.

The BSE Sensex broke the 60,000 mark, falling 433.13 points to close at 59,919.69, while the Nifty50 ended below 18,000 levels, down 143.60 points at 17,873.60 and formed a bearish candle on the daily charts.

"Small negative candle was formed on the daily chart with minor lower shadow. Technically, this pattern indicates rangebound action in the market with weak bias. Minor lower shadow in the daily candle indicates an emergence of minor buying from the lower levels. The overall chart pattern signal a choppy movement in the market and may expect continuation of weakness with range bound action for short term," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the short term trend of Nifty continues to be range bound with weak bias. "One may expect Nifty to show choppy movement with weak bias for the short term. Further weakness from here could push Nifty down to the important support of 17,600 levels. Immediate resistance is placed at 17,950 levels,"Shetti says.

The broader markets also traded in line with benchmark indices. The Nifty Midcap 100 index was down 0.82 percent and Smallcap 100 index fell half a percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,790.77, followed by 17,707.93. If the index moves up, the key resistance levels to watch out for are 17,963.87 and 18,054.13.

Nifty Bank

The Nifty Bank plunged 463.05 points or 1.19 percent to 38,560.20 on November 11. The important pivot level, which will act as crucial support for the index, is placed at 38,294.23, followed by 38,028.27. On the upside, key resistance levels are placed at 38,878.03 and 39,195.86 levels.

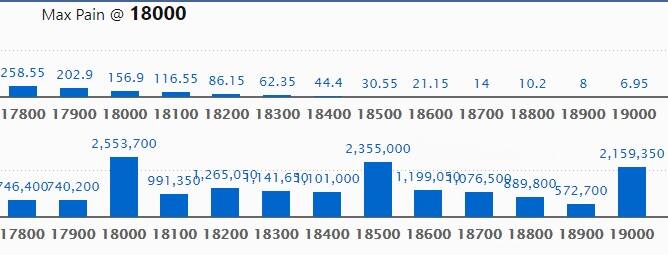

Call option data

Maximum Call open interest of 25.53 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the November series.

This is followed by 18,500 strike, which holds 23.55 lakh contracts, and 19,000 strike, which has accumulated 21.59 lakh contracts.

Call writing was seen at 18,000 strike, which added 3.67 lakh contracts, followed by 17,900 strike, which added 1.74 lakh contracts and 18,200 strike which added 1.63 lakh contracts.

Call unwinding was seen at 19,000 strike, which shed 99,250 contracts, followed by 18,900 strike which shed 80,250 contracts and 18,300 strike which shed 24,650 contracts.

Put option data

Maximum Put open interest of 27.31 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the November series.

This is followed by 17,000 strike, which holds 25.21 lakh contracts, and 17,400 strike, which has accumulated 18.42 lakh contracts.

Put writing was seen at 17,000 strike, which added 2.25 lakh contracts, followed by 17,500 strike which added 2.21 lakh contracts and 17,200 strike which added 1.73 lakh contracts.

Put unwinding was seen at 18,000 strike, which shed 1.43 lakh contracts, followed by 18,100 strike which shed 1.2 lakh contracts, and 17,900 strike which shed 1.1 lakh contracts.

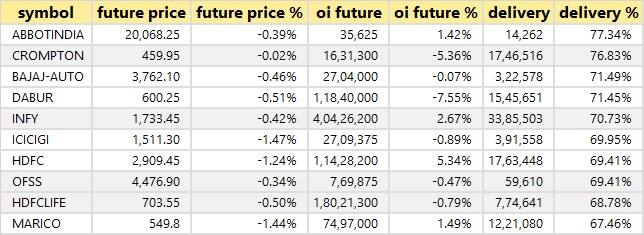

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

21 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

68 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 10 stocks in which long unwinding was seen.

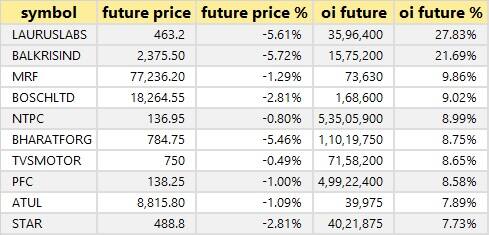

73 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

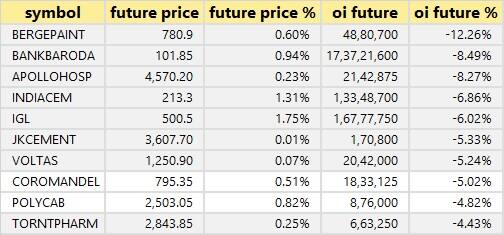

29 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

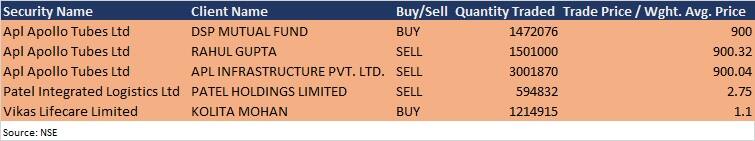

Bulk deals

APL Apollo Tubes: DSP Mutual Fund acquired 14,72,076 equity shares in the company at Rs 900 per share; however, promoter Rahul Gupta sold 15.01 lakh shares at Rs 900.32 per share, and promoter entity APL Infrastructure offloaded 30,01,870 equity shares at Rs 900.04 per share on the NSE, the bulk deals data showed.

Patel Integrated Logistics: Promoter entity PATEL Holdings sold 5,94,832 equity shares in the company at Rs 2.75 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting & Results Calendar

Results on November 12: Coal India, Grasim Industries, Hero MotoCorp, Hindalco Industries, ONGC, Amara Raja Batteries, Apollo Hospitals Enterprise, Ashok Leyland, Mrs Bectors Food Specialities, Bharat Forge, Burger King, Force Motors, Glenmark Pharma, Motherson Sumi Systems, NALCO, NBCC, Paras Defence, and Suzlon Energy among 767 companies that will release their September quarter earnings on November 12.

Results on November 13: Ashoka Buildcon, Godrej Industries, Ipca Labs, JK Cement, PNC Infratech, Sadbhav Infrastructure Project, Shalimar Paints, Sterling and Wilson Solar, Thyrocare Technologies, and Vivimed Labs are among 485 companies that will announce September quarter earnings on November 13.

NMDC: The company's officials will meet analysts and investors on November 12 post Q2FY22 results.

City Union Bank: The company's officials will meet investors and analysts on November 12, in Q2FY22 earnings conference call.

Mahindra Logistics: The company's officials will attend Investor Conference of Spark Capital on November 12.

Texmaco Rail & Engineering: The company's officials will meet analysts and investors on November 15, discuss financial results.

Arvind Fashions: The company's officials will meet analysts and investors on November 15, to discuss financial performance.

G R Infraprojects: The company's officials will meet investors on November 16 to discuss financial performance.

Neogen Chemicals: The company's officials will attend B&K Securities - Periscope Conference on November 16.

Stocks in News

Tata Steel: The company recorded sharply higher profit at Rs 12,547.7 crore in Q2FY22 against Rs 1,665.1 crore in Q2FY21, revenue shot up to Rs 60,282.8 crore from Rs 38,939.9 crore YoY.

RailTel Corporation of India: The Content on Demand (COD) contract awarded to Margo Networks for providing COD service in all Mail/Express and Suburban trains and all Wi-Fi enabled Railway Stations on a build-own-operate (BOO) basis for 10 years has been terminated by RailTel due to non-performance by the contractor.

Indiabulls Housing Finance: The company reported lower consolidated profit at Rs 286.3 crore in Q2FY22 against Rs 323.2 crore in Q2FY21, revenue fell to Rs 2,232.8 crore from Rs 2,533.7 crore YoY. The board approved raising up to Rs 5,000 crore.

Zee Entertainment Enterprises: The company reported higher profit at Rs 270.2 crore in Q2FY22 against Rs 94 crore in Q2FY21, revenue increased to Rs 1,978.8 crore from Rs 1,722.7 crore YoY.

JB Chemicals & Pharmaceuticals: The company reported higher consolidated profit at Rs 97.88 crore in Q2FY22 against Rs 73.92 crore in Q2FY21, revenue increased to Rs 593.01 crore from Rs 443.56 crore YoY.

Bilcare: The company reported consolidated profit at Rs 23.39 crore in Q2FY22 against loss of Rs 0.97 crore in Q2FY21, revenue jumped to Rs 203.53 crore from Rs 151.65 crore YoY.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,637.46 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 445.76 crore in the Indian equity market on November 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Seven stocks - Bank of Baroda, BHEL, Escorts, Indiabulls Housing Finance, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for November 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.