Top Searches

- News

- Business News

- India Business News

- Paytm’s Rs 18.3k cr IPO sees 18% subscription on day 1

Paytm’s Rs 18.3k cr IPO sees 18% subscription on day 1

Paytm’s Rs 18.3k cr IPO sees 18% subscription on day 1

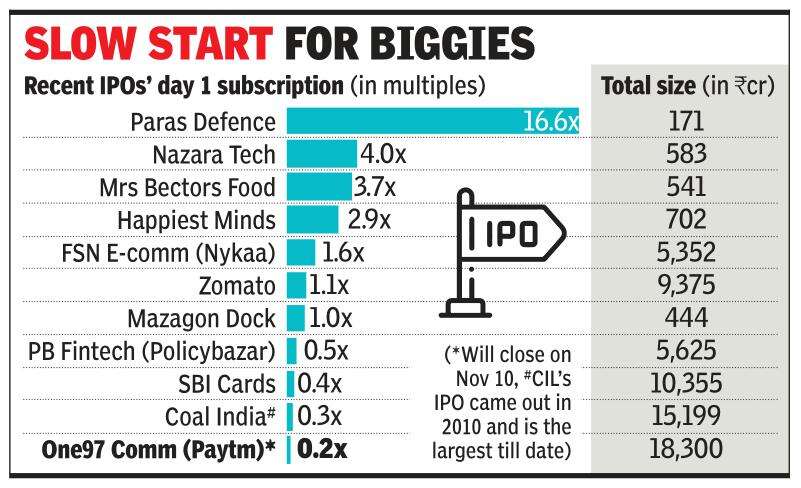

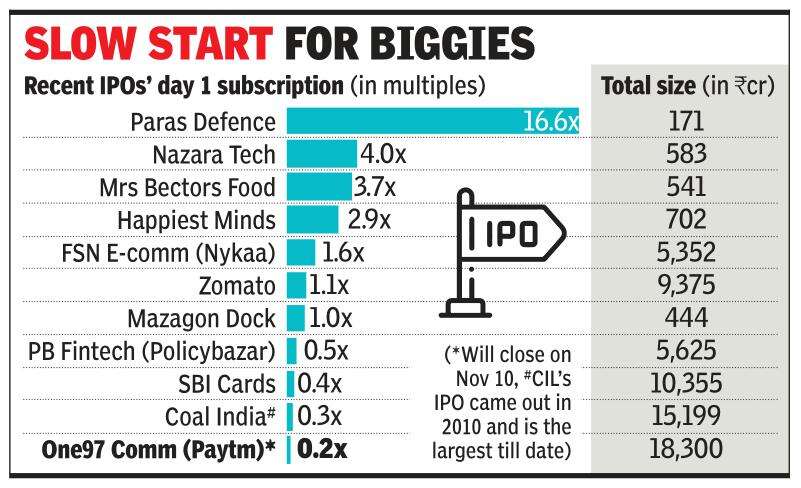

MUMBAI: The Rs 18,300-crore initial public offering (IPO) for tech-enabled payments system pioneer One97 Communications, which operates under the Paytm brand, was subscribed 18% on the first day on Monday. The Paytm IPO is set to be the biggest in Indian history, eclipsing the nearly Rs 15,200-crore IPO for Coal India that was launched 11 years ago.

The Paytm offer got a strong response from retail investors with the portion reserved for this category subscribed 78%, BSE data showed. The part reserved for institutional investors was subscribed 6% while the part reserved for non-institutional investors (popularly known as high net worth investors, or HNIs) was subscribed 2%. Most of the applications from investors in these two categories usually come on the last day of the offer.

The Paytm IPO was launched on the fifth anniversary of the Prime Minister’s demonetisation announcement that was aimed at limiting use of cash in the economy and also weed out black money. Paytm was one of the top beneficiaries of the government’s move, that was launched on November 8, 2016.

On Wednesday, the company raised Rs 8,235 crore from a clutch of anchor investors that was part of the total mobilisation from this IPO. Global fund management majors like Blackrock, Canada Pension Plan Investment Board, the government of Singapore and a host of others had picked up 3.8 crore shares of the company at the upper end of the Rs 2,080-2,150 price band for the IPO, a company release had said. The offer will close on Wednesday.

The Paytm offer got a strong response from retail investors with the portion reserved for this category subscribed 78%, BSE data showed. The part reserved for institutional investors was subscribed 6% while the part reserved for non-institutional investors (popularly known as high net worth investors, or HNIs) was subscribed 2%. Most of the applications from investors in these two categories usually come on the last day of the offer.

The Paytm IPO was launched on the fifth anniversary of the Prime Minister’s demonetisation announcement that was aimed at limiting use of cash in the economy and also weed out black money. Paytm was one of the top beneficiaries of the government’s move, that was launched on November 8, 2016.

On Wednesday, the company raised Rs 8,235 crore from a clutch of anchor investors that was part of the total mobilisation from this IPO. Global fund management majors like Blackrock, Canada Pension Plan Investment Board, the government of Singapore and a host of others had picked up 3.8 crore shares of the company at the upper end of the Rs 2,080-2,150 price band for the IPO, a company release had said. The offer will close on Wednesday.

FacebookTwitterLinkedinEMail

Start a Conversation

end of article

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST