The market remained rangebound throughout the session and finally settled with moderate losses, snapping two-day gains on November 9 as the selling pressure was seen in select banking and financials, and power stocks.

The BSE Sensex fell 112.16 points to 60,433.45, while the Nifty50 declined 24.20 points to 18,044.30 and saw a bearish candle formation on the daily charts.

"A small negative candle was formed on the daily chart with lower shadow. This indicates a continuation of rangebound action in the market below the crucial overhead resistance of 18,100 levels. Though the Nifty moved into a narrow high low range in the last two sessions, the formation of lower shadows could signal the possibility of an upside breakout of the immediate hurdle in the short term," said Subash Gangadharan, Senior Technical and Derivative Analyst at HDFC Securities.

The broader market indices like Nifty Midcap 100 and Smallcap 100 indices have outperformed the benchmark index, rising 1.16 percent and 0.49 percent respectively.

Gangadharan says the market seems to be reluctant to pick up the upside momentum and is stuck at the hurdle of around 18,100 levels. "Eventually, the market could break above this hurdle in the short term and move towards the next resistance of 18,350 levels in the near term."

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,980.67, followed by 17,917.13. If the index moves up, the key resistance levels to watch out for are 18,110.17 and 18,176.13.

Nifty Bank

The Nifty Bank corrected 69.45 points to close at Rs 39,368.80 on November 9. The important pivot level, which will act as crucial support for the index, is placed at 39,207.93, followed by 39,047.06. On the upside, key resistance levels are placed at 39,545.13 and 39,721.47 levels.

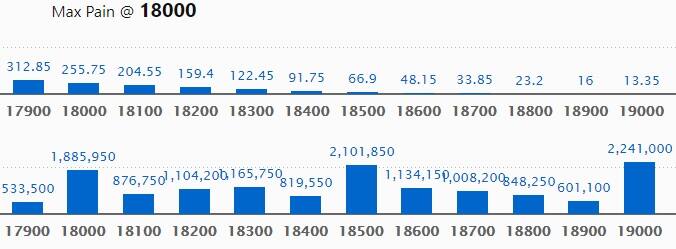

Call option data

Maximum Call open interest of 22.41 lakh contracts was seen at 19000 strike, which will act as a crucial resistance level in the November series.

This is followed by 18500 strike, which holds 21.01 lakh contracts, and 18000 strike, which has accumulated 18.85 lakh contracts.

Call writing was seen at 18300 strike, which added 1.52 lakh contracts, followed by 18100 strike, which added 1.37 lakh contracts and 18900 strike which added 93,650 contracts.

Call unwinding was seen at 17900 strike, which shed 7.05 lakh contracts, followed by 18000 strike which shed 1.75 lakh contracts and 17800 strike which shed 21,700 contracts.

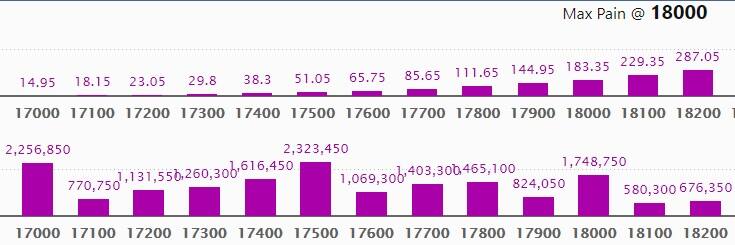

Put option data

Maximum Put open interest of 23.23 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the November series.

This is followed by 17000 strike, which holds 22.56 lakh contracts, and 18000 strike, which has accumulated 17.48 lakh contracts.

Put writing was seen at 17400 strike, which added 1.47 lakh contracts, followed by 18100 strike which added 1.35 lakh contracts and 17800 strike which added 84,150 contracts.

Put unwinding was seen at 17900 strike, which shed 6.49 lakh contracts, followed by 18000 strike which shed 1.66 lakh contracts, and 17700 strike which shed 38,200 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

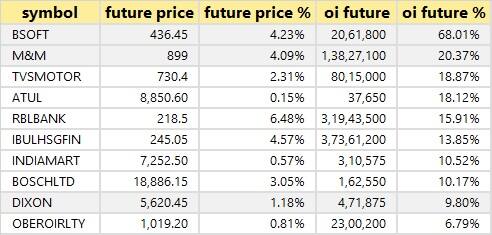

61 stocks saw long build-up

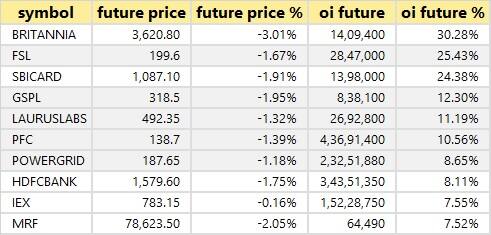

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

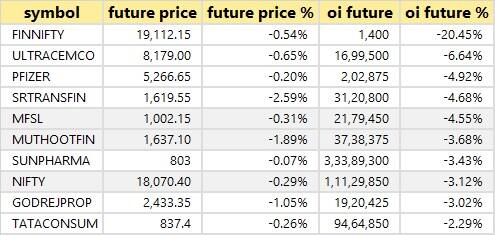

23 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 10 stocks in which long unwinding was seen.

50 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

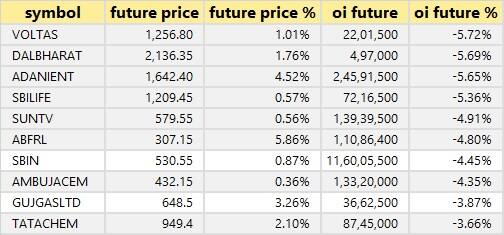

57 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

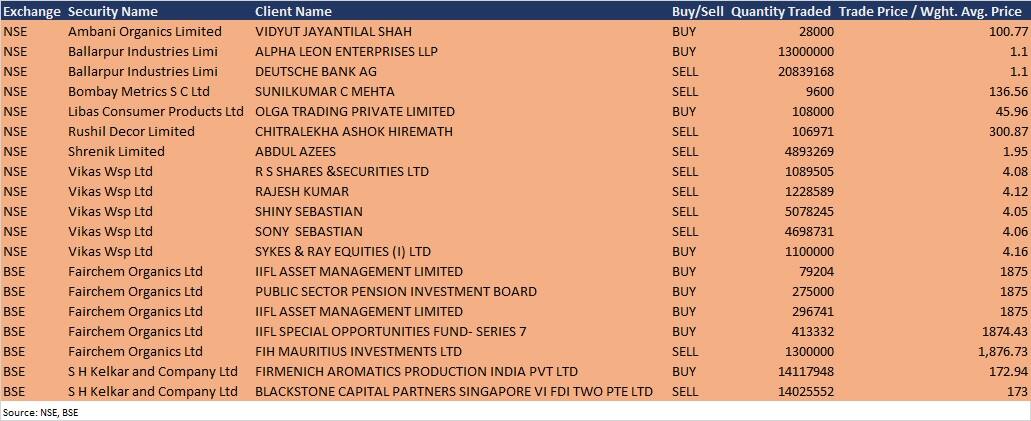

Bulk deals

Fairchem Organics: FIH Mauritius Investments sold 13 lakh equity shares in the company at Rs 1,876.73 per share. However, IIFL Asset Management acquired 3,75,945 equity shares and Public Sector Pension Investment Board bought 2.75 lakh shares in the company at Rs 1,875 per share, and IIFL Special Opportunities Fund- Series 7 purchased 4,13,332 shares at Rs 1,874.43 per share on the BSE, the bulk deals data showed.

S H Kelkar and Company: Firmenich Aromatics Production India bought 1,41,17,948 equity shares in the company at Rs 172.94 per share, whereas Blackstone Capital Partners Singapore VI FDI Two Pte Ltd sold 1,40,25,552 equity shares at Rs 173 per share on the BSE, the bulk deals data showed.

Ballarpur Industries: Alpha Leon Enterprises LLP bought 1.3 crore equity shares in the company at Rs 1.1 per share; however, Deutsche Bank AG sold 2,08,39,168 equity shares at the same price on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting & Results Calendar

Results on November 10: Bank of Baroda, Zomato, Affle India, Berger Paints, Glenmark Life Sciences, India Cements, Krishna Institute of Medical Sciences, Mazagon Dock Shipbuilders, Metropolis Healthcare, Nuvoco Vistas Corporation, Oil India, Pidilite Industries and Tata Teleservices are among 268 companies that will release September quarter earnings on November 10.

Dr Lal PathLabs: The company's officials will attend BofA India Virtual Conference on November 10.

Olectra Greentech: The company's officials will meet analysts and investors on November 10.

Adani Transmission: The company's officials will meet Ventura Securities on November 10.

Pioneer Embroideries: The company's officials will meet analysts and investors on November 12 to discuss financial results.

EIH: The company's officials will meet analysts and investors on November 15 to discuss financial results.

Stocks in News

FSN E-Commerce Ventures (Nykaa): The company will make its debut on the BSE and the NSE on November 10. The issue price has been fixed at Rs 1,125 per share.

Petronet LNG: The company reported lower consolidated net profit at Rs 817.6 crore Q2FY22 against Rs 919.5 crore in Q2FY21, revenue jumped to Rs 10,813 crore from Rs 6,235.8 crore YoY.

Power Grid Corporation Of India: The company reported higher consolidated profit at Rs 3,376.4 crore in Q2FY22 against Rs 3,094.1 crore in Q2FY21; revenue increased to Rs 10,266.98 crore from Rs 9,529.68 crore YoY.

BHEL: The company posted consolidated loss of Rs 46.5 crore in Q2FY22 against loss of Rs 552.4 crore in Q2FY21. Revenue shot up to Rs 5,112.2 crore from Rs 3,696 crore YoY.

Indraprastha Gas: The company reported sharply higher profit at Rs 400.5 crore in Q2FY22 against Rs 307.94 crore in Q2FY21. Revenue jumped to Rs 2,015.99 crore from Rs 1,440.74 crore YoY.

CreditAccess Grameen: The company reported lower standalone profit at Rs 71.99 crore in Q2FY22 against Rs 78.17 crore in Q2FY21; revenue from operations increased to Rs 509.91 crore from Rs 470.67 crore YoY.

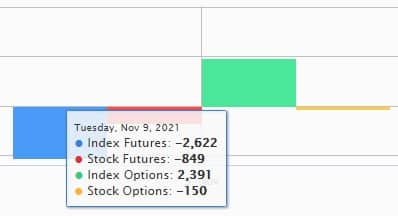

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,445.25 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,417.63 crore in the Indian equity market on November 9, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Escorts, Punjab National Bank and Sun TV Network - are under the F&O ban for November 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.