Buy This Cheap Stock Now for More Growth?

TPH's strong bottom-line revisions help it land a Zacks Rank #1 (Strong Buy) right now and it's topped our quarterly earnings estimate by an average of 32% in the trailing...

TRI Pointe Homes TPH is one of the largest public homebuilders in the U.S. and the firm beat our third quarter earnings and revenue estimates in October.

TPH builds premium homes and communities across 10 states and Washington D.C. TRI Pointe’s portfolio includes key growth markets within California, Texas, Colorado, Arizona, and beyond. TRI Pointe’s revenue climbed by over 16% in both FY17 and FY18, before it slipped by 5% in 2019.

The company then bounced back with 6% sales growth last year amid the covid-boosted housing market boom. The U.S. housing market remains hot after a stellar 2020, driven by the accommodating interest rate environment and more. The 30-year fixed-rate mortgage remains historically low at 3.09%, even though they have climbed off their rock-bottom levels of 2.65% from early 2021.

On top of that, millennials continue to drive the housing market and there is still huge demand for more single-family homes. U.S. home construction is currently hovering near its slowest pace since 1995 and the market is about 5 million homes short of demand.

The tight market should help TRI Pointe and many other homebuilders going forward. TPH’s backlog was up 14% at the end of last quarter at 3,619 homes, with the dollar value of the backlog 17% higher at $2.4 billion. Plus, TPH’s average sales price popped 4% to $671K.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Looking ahead, Zacks estimates call for TRI Pointe’s revenue to surge 21% in FY21 and another 8% in FY22 to reach $4.2 billion. Meanwhile, the firm’s adjusted earnings are projected to soar 80% this year to $3.91 a share and then climb 10% higher in 2022.

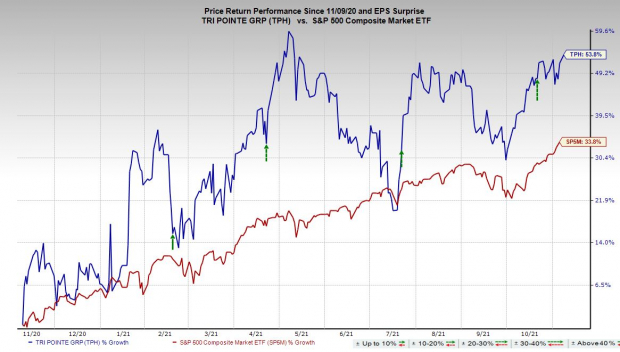

TRI Pointe stock has surged 125% in the last five years to lag not too far behind its industry. More recently, its shares are up 55% in the last 12 months to nearly double its highly-ranked industry that includes Toll Brothers TOL and others. The stock has also easily topped the S&P 500’s 34% run over this stretch.

The stock has moved sideways in the last six months. Plus, at around $25 a share, TPH trades 20% below its current Zacks consensus price target of $29.80 per share. Along with its cheap price, TPH trades close to its own year-long lows at 5.8X forward 12-month earnings. This also marks a 35% discount to its own highs and 20% value against its industry.

Bottom Line

TPH’s strong bottom-line revisions help it land a Zacks Rank #1 (Strong Buy) right now and it’s topped our quarterly earnings estimate by an average of 32% in the trailing four quarters. The stock also lands an “A” grade for Value and three of the five brokerage recommendations Zacks has are “Strong Buys.”

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toll Brothers Inc. (TOL): Free Stock Analysis Report

Tri Pointe Homes Inc. (TPH): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research