Stocks Set to Rise, Bond Curve Steeper After Fed: Markets Wrap

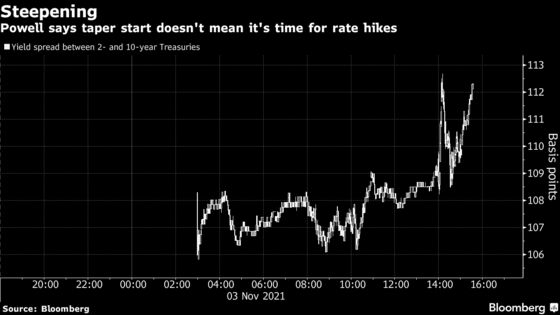

(Bloomberg) -- Asian stocks look set to rise following record highs in the U.S. after the Federal Reserve unveiled an expected tapering of stimulus and said it will be patient on raising interest rates. The Treasury yield curve steepened.

Australian shares posted modest gains Thursday, while futures climbed for Japan and Hong Kong. U.S. contracts edged up in the wake of all-time highs for the S&P 500, Dow Jones Industrial Average, Nasdaq 100 and Russell 2000. The Fed indicated it was alert to inflation risks but still sees them as likely transitory due to pandemic-related supply and demand imbalances.

Longer-end U.S. Treasury yields advanced relative to shorter maturities, while measures of bond-market inflation expectations ticked up -- suggesting residual concerns about restraining price pressures. Traders largely maintained bets on the timing of rate moves: the first hike is seen around July, with some 55 basis points of increases by the end of 2022. The dollar held a drop.

Oil retreated on rising U.S. inventories and progress toward Iran nuclear talks that could lead to more supplies. OPEC+ meets Thursday to review output plans. Bitcoin was around $63,000 after another sharp soon that quickly reversed.

Global stocks are at all-time highs, bolstered by solid corporate earnings, the prospect of a gradual reduction in monetary policy largesse and the view that supply-chain and labor disruptions will eventually be resolved. The risk to the sanguine view is more enduring inflation and faster rate hikes, a possibility that has whipsawed bond markets.

Monetary policy can “send a message saying rates do need to rise but in a controlled way and not as aggressively as some market pricing suggests,” Chris Iggo, chief investment officer for core investments at AXA Investment Managers, wrote in a note. “If they can do that, the risk of a market rout in bonds and equities will be reduced,” he said.

European Central Bank President Christine Lagarde said the monetary authority was “very unlikely” to hike rates next year. Economists are split on whether the Bank of England will boost borrowing costs Thursday.

Meanwhile, the Treasury announced the first reduction in its quarterly sale of longer-term debt in more than five years on Wednesday, reflecting diminishing borrowing needs as the wave of pandemic-relief spending ebbs.

U.S. companies added the most jobs in four months, suggesting employers are making progress in filling a near-record number of open positions. Service providers expanded at a record pace in October, powered by resilient demand and stronger business activity.

Here are some events to watch this week:

- OPEC+ meeting on output, Thursday

- Bank of England rate decision, Thursday

- U.S. trade, initial jobless claims, Thursday

- U.S. unemployment, nonfarm payrolls, Friday

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 8:12 a.m. in Tokyo. The S&P 500 rose 0.7%

- Nasdaq 100 futures increased 0.3%. The Nasdaq 100 rose 1.1%

- Nikkei 225 futures rose 1%

- Australia’s S&P/ASX 200 Index added 0.3%

- Hang Seng Index futures rose 0.3% earlier

Currencies

- The Japanese yen was at 114.04 per dollar

- The offshore yuan was at 6.3938 per dollar

- The Bloomberg Dollar Spot Index was little changed

- The euro traded at $1.1612

Bonds

- The yield on 10-year Treasuries advanced five basis points to 1.60%

- Australia’s 10-year sovereign bond yield was at 1.85%

Commodities

- West Texas Intermediate crude fell 0.6% to $80.37 a barrel

- Gold was at $1,774.78 an ounce, up 0.3%

©2021 Bloomberg L.P.