ImmunoGen (IMGN) Q3 Loss Narrower Than Expected, Revenues Lag

ImmunoGen (IMGN) reports narrower-than-expected loss but misses revenue estimates. The company lowers its operating expense guidance for 2021.

ImmunoGen, Inc. IMGN incurred a loss of 18 cents per share for third-quarter 2021, narrower than the Zacks Consensus Estimate of 19 cents but wider than the year-ago loss of 13 cents.

Revenues came in at $9.2 million, which missed the Zacks Consensus Estimate of $20 million. Revenues were significantly down 49.4% year over year.

Quarter in Detail

Third-quarter revenues included $6.5 million in non-cash royalty revenues, down 63.9% year over year. This substantial decline was due to the reduction in non-cash revenues on account of the completion of the first tranche of payments under the transaction, covering the sale of its partner Roche’s RHHBY Kadcyla.

ImmunoGen recorded license and milestone fees of $2.7 million for the third quarter compared with $0.1 million in the year-ago period. This significant increase was on account of the recognition of $2.5 million as an anticipated partner-development milestone fee.

For the quarter, research and development expenses increased 34.3% from the year-ago level to $33.1 million. The significant increase was due to higher clinical study expenses related to its pipeline candidates.

General and administrative expenses were almost flat at $10.3 million for third-quarter 2021.

ImmunoGen’s cash and cash equivalents were $245.8 million at September 2021-end compared with $239.5 million at the end of June 2021.

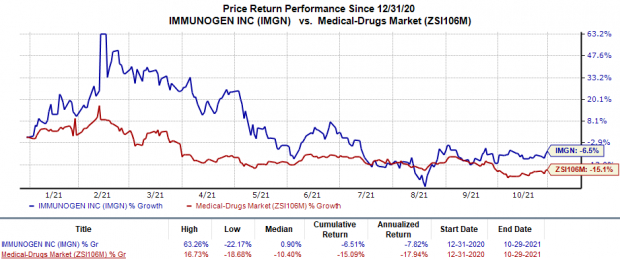

Shares of the company have plunged 6.5% so far this year in comparison with the industry’s decrease of 15.1%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

2021 Guidance Updated

ImmunoGen reiterated its previous guidance for 2021 for revenues, while revising the same for operating expenses and cash resources. The company expects revenues for the full year between $65 million and $75 million. The Zacks Consensus Estimate for 2021 revenues stands at $70 million.

The company now expects operating expenses in the range of $190-$200 million, down from the previous guidance of $200-$210 million.

It expects to end 2021 with cash and cash equivalents in the range of $190-$200 million, up from the previous guidance of $140-$150 million. Further, it expects cash resources to be enough to fund its operations through fourth-quarter 2022.

Pipeline Updates

ImmunoGen is evaluating its lead pipeline candidate, mirvetuximab soravtansine, in a pivotal study — SORAYA — in platinum-resistant ovarian cancer patients. The company has completed the enrolment of patients in the study and anticipates top-line data from the same in fourth-quarter 2021. It also expects the data from this study to form the basis of the candidate’s regulatory filing under accelerated pathway for ovarian cancer, which the company is expected to file with the Food and Drug Administration (FDA) in first-quarter 2022.

The company continues to enroll patients in the confirmatory phase III MIRASOL study, which compared mirvetuximab soravtansine head-to-head with single-agent chemotherapy in platinum-resistant ovarian cancer patients with high folate receptor alpha expression. It anticipates top-line data in the third quarter of 2022.

The company is also evaluating combination regimens of mirvetuximab soravtansine with Merck’s MRK Keytruda, Roche’s Avastin and carboplatin as a second or third-line treatment for ovarian cancer in a phase Ib/II FORWARD II study.

Meanwhile, an investigator-sponsored phase II study has enrolled first patients to evaluate mirvetuximab plus carboplatin in the neoadjuvant setting for treating ovarian cancer. ImmunoGen has also initiated a single-arm study — PICCOLO — to evaluate mirvetuximab monotherapy for treating recurrent platinum-sensitive ovarian cancer.

The company has another promising candidate, IMGN632, in its pipeline. It is being developed in clinical studies as monotherapy or in combination with Bristol-Myers’ BMY Vidaza or AbbVie/Roche’s Venclexta for treating acute myeloid leukemia. It is also developing IMGN632 monotherapy in phase I/II in patients with blastic plasmacytoid dendritic cell neoplasm and acute lymphocytic leukemia.

Zacks Rank

Currently, Immunogen has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY): Free Stock Analysis Report

Bristol Myers Squibb Company (BMY): Free Stock Analysis Report

Merck & Co., Inc. (MRK): Free Stock Analysis Report

ImmunoGen, Inc. (IMGN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research