Sunak Delivers Johnson-Style Budget That Ramps Up U.K. Spending

(Bloomberg) --

Rishi Sunak raised funding for every government department and offered fresh support for working families, while pledging to stabilize the public finances, in a budget that channeled the upbeat instincts of his boss, Boris Johnson.

Setting out his plans in Parliament, the chancellor of the exchequer sought to raise the national spirits by declaring that a “new economy” post-Covid would usher in “a new age of optimism.”

He began his speech flagging higher employment, better public services and rising wages and he went on to announce cuts to levies on alcoholic drinks and a massive, one year discount on business rates for the hospitality companies battered by the pandemic.

He saved the most significant announcement for last: a cut in the so-called taper rate at which the poorest workers lose benefits as their incomes increase -- at a cost next year of 2 billion pounds ($2.8 billion). He also announced 1.7 billion pounds of funding to invest in local infrastructure in more than 100 areas as part of the government’s core promise of “leveling up” opportunities across the country and evening out geographical disparities.

“Taxes are rising to their highest level as a percentage of GDP since the early 1950s,” Sunak said. “I don’t like it, but I cannot apologise for it as the result of the unprecedented crisis we faced and the extraordinary action we took in response.”

He said he aims to start cutting taxes before the next election.

The backdrop for Sunak’s policy program is an economy that is accelerating out of the pandemic but faces a range of challenges including supply disruption, a massive increase in the government debt burden and, perhaps most importantly, accelerating inflation and the prospect of higher interest rates.

“We need to strengthen our public finances so that when the next crisis comes, we have the fiscal space to act,” Sunak said. He also said the country hasn’t yet turned the corner on infections, warning of “challenging months ahead.”

The chancellor signaled the need to repair the country’s finances after racking up hundreds of billions of extra debt to protect workers and businesses through the pandemic. Unveiling new fiscal rules that will guide his approach to rebuilding the economy from its worst recession in a century, he vowed that in “normal times,” the government would only borrow to invest and that underlying public sector net debt must be falling as a percentage of output.

With inflation already well above the Bank of England’s 2% target and forecast to rise to at least double that, it’s already raising the cost of repaying the country’s debt, a quarter of which is linked to inflation indexes. Sunak also faces the prospect of an interest-rate hike that would add to borrowing costs: For every percentage point that interest rates go up, the Treasury estimates it would cost an extra 23 billion pounds a year.

“The House will recognize the challenging backdrop of rising inflation,” the chancellor said. “Our public finances are twice as sensitive to changes in interest rates as they were before the pandemic and six times as sensitive as they were before the financial crisis.”

The Conservative chairman of Parliament’s Treasury Committee, Mel Stride, said Sunak has “spent quite a lot” of the fiscal headroom provided by a record rebound in Britain’s economic growth and will be judged on how prudent he is going forward.

He warned about the possibility that interest rates will rise and how that will affect the servicing of the U.K.’s debt. Conservative MP Robert Halfon, who repeatedly calls for the cost of living to be reduced, congratulated Sunak on a “budget for workers.”

Sunak may also have one eye on the prospect of a general election that must be held in 2024 at the latest, but that many in Westminster say could be called earlier.

Sunak announced tens of billions of pounds of investment in infrastructure, education and skills as well as several measures to help Britons struggling with the rising cost of living. But he also warned of the need to build up a financial buffer in case of future economic shocks, despite a significant improvement in the outlook for the British economy.

One surprise was Sunak’s pledge to increase foreign aid spending to 0.7% of economic output by 2024-25, just a year after announcing a cut to 0.5%. That cut broke a manifesto pledge and was condemned by all five living former British prime ministers.

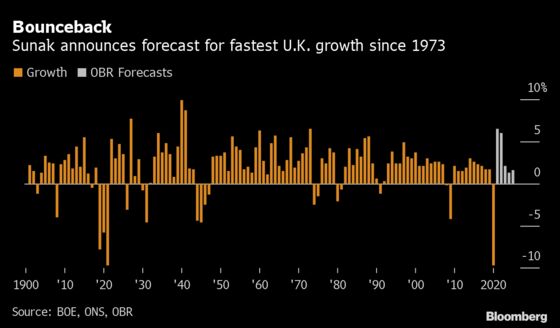

Sunak’s firepower was boosted by a significantly improved outlook for the British economy from the Office for Budget Responsibility, the government’s independent fiscal watchdog. It revised upwards its forecast for growth this year to 6.5% from 4%, and downwards its forecast for the long-term economic scarring caused by the pandemic to 2% of output from 3%.

With growth filling the government cofferes, the OBR’s borrowing forecast for the next five years was lowered by 154 billion pounds, while planned debt sales for this fiscal year were cut by a fifth.

| Key Budget Measures |

|---|

|

©2021 Bloomberg L.P.