Tokyo Stock Exchange to Extend Trading Day by 30 Minutes

(Bloomberg) -- The Tokyo Stock Exchange plans to extend the trading day by 30 minutes, the first change to cash equity trading hours in more than a decade.

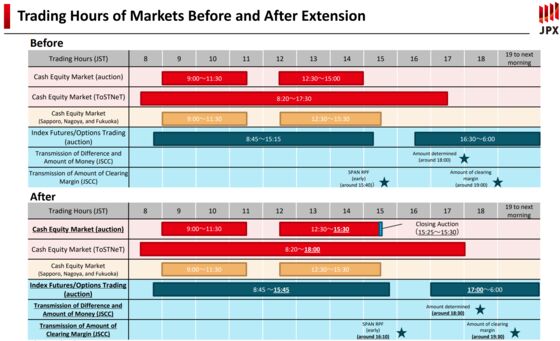

The market would close at 3:30 p.m. local time if the proposed changes are implemented. The changes are planned at the same time as a large upgrade of its trading systems in the second half of the fiscal year ending March 2025.

“Given that trading hours on cash equity markets in Japan are shorter than those in Europe and the U.S., and even Asian countries, extending them on a permanent basis will expand trading opportunities for investors and improve market convenience,” Japan Exchange Group Inc., which operates the exchange, said in a statement.

The Tokyo bourse currently trades between 9 a.m. and 3 p.m. local time, with a lunch break between 11:30 a.m. and 12:30 p.m. The five-hour trading day is considerably shorter than many other regional rivals. Japan is the world’s third-largest stock market with total market capitalization of about $6.8 trillion, according to Bloomberg-compiled data.

The exchange’s working group had also discussed measures including abolishing the lunch break, but settled on the 30-minute extension.

Closing Auction

“I think it was kind of inevitable that this was going to happen to bring TSE in line with other market centers in Asia which have longer hours of trading,” said Serdar Armutcu, head of electronic trading at Mita Securities in Tokyo. “I think it will have the impact to bring additional liquidity but I don’t expect it will be significantly more.”

Tokyo Stock Exchange last tweaked trading hours in 2011, shortening its lunch break by 30 minutes to the current one hour. A later closing time would be the first extension since 1954, when it was changed from 2 p.m. to 3 p.m.

A previous recommendation in 2014 for the exchange to consider an evening session failed to result in changes. The plans were dropped following lobbying from traditional brokerages, who opposed longer hours due to increased costs. However, the subsequent years have seen an increase in the number of investors using online brokerages.

The exchange will also discuss the introduction of a five-minute closing auction, widely used in overseas exchanges including the London Stock Exchange to determine the closing price of each stock.

©2021 Bloomberg L.P.