Stocks Struggle Amid Mixed Earnings; Dollar Steady: Markets Wrap

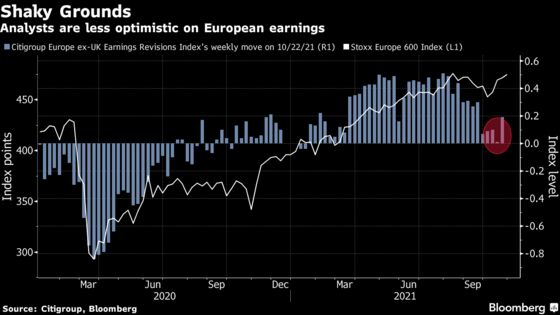

(Bloomberg) -- The rally in European stocks faded on Wednesday amid mixed earnings reports, a decline in commodity prices and renewed concerns about the region’s econom.

Mining stocks led a retreat in the Stoxx Europe 600 index as prices of raw materials including aluminum and iron ore fell along with crude oil. Germany’s DAX underperformed after Europe’s biggest economy cut its 2021 growth forecast, citing the lingering effects of the pandemic and a supply squeeze.

Deutsche Bank AG dropped more than 3% after disappointing earnings, while Banco Santander SA declined despite a bullish outlook. Heineken NV fell after reporting a drop in demand for beer. On the plus side, Dutch semiconductor equipment maker ASM International NV advanced after revenue forecasts beat analyst estimates. Temenos AG surged as much as 16% after Bloomberg reported EQT AB is exploring an acquisition of the Swiss banking software specialist.

S&P 500 and Nasdaq 100 futures were steady amid a mixed response to big-tech earnings released later in the U.S. session. Equities fell in Japan, and Chinese technology shares slid on concerns about more scrutiny from Washington after the U.S. banned China Telecom’s American business. Treasury yields inched higher and the dollar was steady.

Investors are counting on earnings to support equity prices, and so far the reporting season has been solid overall. But worries remain that over time rising raw material and wage costs and supply-chain snarls could crimp margins and weigh on the global economy recovery.

“Downside risks to the economy remain but investors are opting to look beyond these as companies continue to give us plenty of reason to be optimistic about what lies ahead,” Craig Erlam, senior market analyst at Oanda, wrote in a note. Such “enthusiasm may come and go, creating plenty of two-way action in the markets,” he added.

The debt crisis in China’s property sector continues to hang over the market: authorities told billionaire Hui Ka Yan to use his personal wealth to alleviate China Evergrande Group’s woes. Meanwhile, a top Chinese regulator called on companies to make “active preparations” to meet payments on offshore bonds.

Meanwhile, the energy crunch continues to ripple across the global economy. Coal stockpiles at U.S. power plants plunged to the lowest in at least 24 years. WTI crude oil slid under $84 a barrel.

Gold retreated back below $1,800 an ounce and Bitcoin plunged below $60,000. On the virus front, a Food and Drug Administration panel gave its backing to the Pfizer Inc. and BioNTech SE vaccine for young children.

Here are some events to watch this week:

- Earnings: Amazon, Apple, Samsung Electronics, China Vanke, PetroChina, Ping An Insurance Group

- Australia CPI, Wednesday

- U.S. wholesale inventories, U.S. durable goods, Wednesday

- Bank of Japan monetary policy decision, briefing, Thursday

- ECB rates decision, President Christine Lagarde briefing, Thursday

- U.S. GDP, initial jobless claims, Thursday

- G-20 joint finance and health ministers meeting ahead of the weekend leaders’ summit, Friday

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 fell 0.1% as of 9:05 a.m. London time

- Futures on the S&P 500 rose 0.2%

- Futures on the Nasdaq 100 rose 0.2%

- Futures on the Dow Jones Industrial Average rose 0.1%

- The MSCI Asia Pacific Index fell 0.4%

- The MSCI Emerging Markets Index fell 0.8%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1604

- The Japanese yen rose 0.4% to 113.71 per dollar

- The offshore yuan was little changed at 6.3841 per dollar

- The British pound was little changed at $1.3754

Bonds

- The yield on 10-year Treasuries was little changed at 1.62%

- Germany’s 10-year yield declined one basis point to -0.13%

- Britain’s 10-year yield declined three basis points to 1.08%

Commodities

- Brent crude fell 1.3% to $85.31 a barrel

- Spot gold fell 0.3% to $1,787.19 an ounce

©2021 Bloomberg L.P.