China Sees Grimmer October as Car and Home Sales Drop

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

China’s economy is showing signs of a further slowdown with car and housing sales dropping again this month even as exports continue their strong performance and the government seeks to allay concerns over growth.

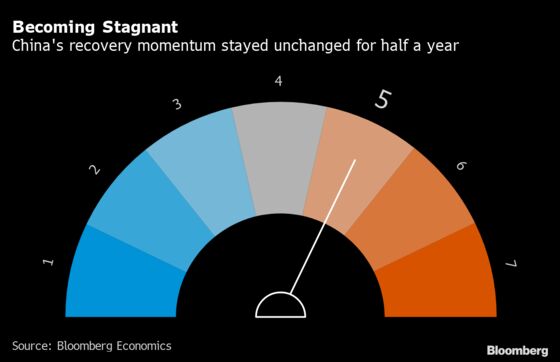

That’s the outlook from Bloomberg’s aggregate index of eight early indicators for October. While the overall number stayed unchanged, under the surface there was a continued deterioration in some of the real-time economic data.

Economic growth was already lower last quarter, partly due to a higher base of comparison from a year ago, but also dragged down by power shortages, repeated Covid outbreaks, and turmoil in the housing sector. The government and central bank have signaled they’re not rushing to counteract that with stimulus, prompting a number of economists to cut their growth forecasts for this year and next.

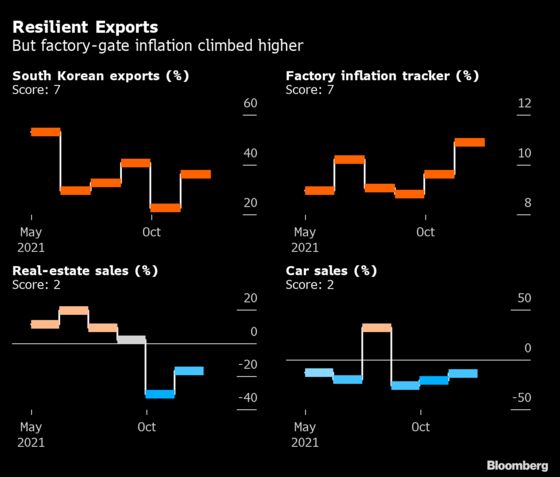

Real-estate sales dropped again, as buyers hold back due to concerns about which companies will survive the current debt crisis facing China Evergrande Group and other developers. Car sales also fell in the first three weeks of the month, continuing the slump of the past five months. The industry has been hit by both weak demand and a shortage of necessary computer chips.

However, the export sector has continued to support the economy, posting monthly growth rates of at least 10% for the last 12 months, and reaching a record $306 billion in September. That expansion looks set to continue for a while at least, with South Korean exports expanding 36% so far this month.

Sales from Korean firms to China jumped 31%, indicating solid demand despite supply chain headaches and the energy crunch disrupting Chinese factories.

Despite government efforts to control rising prices, factory-gate inflation shows no signs of easing this month, with a set of data tracked by Bloomberg Economics surging to the highest level on record. The official producer price index rose the fastest since November 1995 in September, hitting profits and causing losses at electrical power companies, further worsening the power shortage.

Confidence among small and medium-sized enterprises fell in October, with the performance sub-index dropping for a sixth straight month and the growth momentum indicator hitting an eight-month low, according to a survey of more than 500 companies by Standard Chartered Plc. Demand, sales and production, and profitability all declined, the results showed.

“The lagged impact of nationwide power rationing in late September likely resulted in cuts to orders and production,” Standard Chartered’s economists Hunter Chan and Ding Shuang wrote in the report. “Surging raw-material costs continued to erode SME manufacturers’ profitability, weakening investment appetite.”

In addition, a drop in the new export orders sub-index suggests a broad-based weakening of demand, they wrote.

Early Indicators

Bloomberg Economics generates the overall activity reading by aggregating a three-month weighted average of the monthly changes of eight indicators, which are based on business surveys or market prices.

- Major onshore stocks - CSI 300 index of A-share stocks listed in Shanghai or Shenzhen (through market close on 25th of the month).

- Total floor area of home sales in China’s four Tier-1 cities (Beijing, Shanghai, Guangzhou and Shenzhen).

- Inventory of steel rebar, used for reinforcing in construction (in 10,000 metric tones). Falling inventory is a sign of rising demand.

- Copper prices - Spot price for refined copper in Shanghai market (yuan/metric tonne).

- South Korean exports - South Korean exports in the first 20 days of each month (year-on-year change).

- Factory inflation tracker - Bloomberg Economics created tracker for Chinese producer prices (year-on-year change).

- Small and medium-sized business confidence - Survey of companies conducted by Standard Chartered.

- Passenger car sales - Monthly result calculated from the weekly average sales data released by the China Passenger Car Association.

©2021 Bloomberg L.P.