It was a volatile session but the market managed to eke out gains and snapped four-day losing streak on October 25, supported by banking and financials. Bank Nifty ended at record closing high, whereas IT, FMCG and Auto stocks were under pressure.

The BSE Sensex rose 145.43 points to close at 60,967.05, while the Nifty50 gained 10.50 points at 18,125.40 and formed bearish candle which resembles Hammer kind of pattern formation on the daily charts.

"A small negative candle was formed with lower shadow on the daily chart, beside the similar candle of Friday. Technically, this pattern indicate a rangebound action with minor upside recovery from the lows. This is not a convincing attempt by bulls to make a comeback," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the short term trend of Nifty is rangebound with minor positive bias. "Having slowed down of downside momentum and placed at the crucial supports, one may expect chances of upside bounce from the lower levels. Any failure to sustain the upside bounce or a decisive move below 17,950-17,900 levels could extend sharp weakness for the short term."

A confirmation of upside reversal by positive close could open an upside bounce in the market, according to him.

The broader markets remained under pressure with the Nifty Midcap 100 index falling 1.7 percent and Smallcap 100 index declining 2.34 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,982.13, followed by 17,838.87. If the index moves up, the key resistance levels to watch out for are 18,255.03 and 18,384.67.

Nifty Bank

The Nifty Bank climbed new milestone of 41,000 mark, rising 868.75 points or 2.15 percent to 41,192.40 on October 25. The important pivot level, which will act as crucial support for the index, is placed at 40,523.8, followed by 39,855.2. On the upside, key resistance levels are placed at 41,845.3 and 42,498.2 levels.

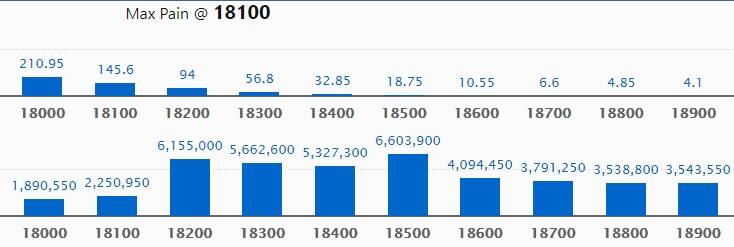

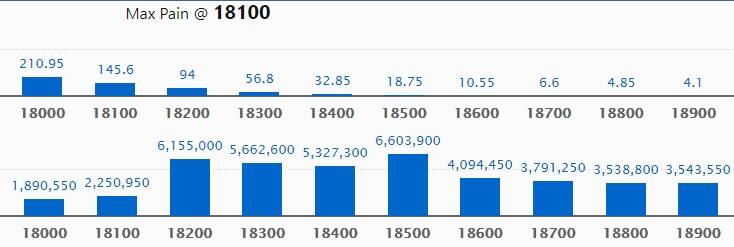

Call option data

Maximum Call open interest of 66.03 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level in the October series.

This is followed by 18200 strike, which holds 61.55 lakh contracts, and 18300 strike, which has accumulated 56.62 lakh contracts.

Call writing was seen at 18900 strike, which added 17.44 lakh contracts, followed by 18600 strike, which added 8.24 lakh contracts and 18700 strike which added 5.53 lakh contracts.

Call unwinding was seen at 18800 strike, which shed 7.99 lakh contracts, followed by 18000 strike, which shed 3.66 lakh contracts, and 18200 strike which shed 2.59 lakh contracts.

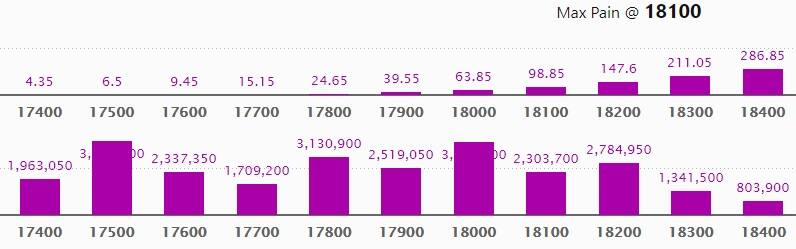

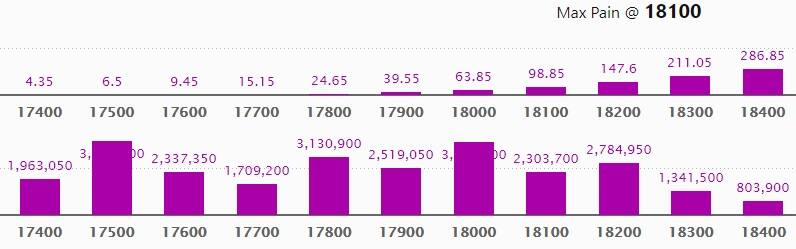

Put option data

Maximum Put open interest of 39.40 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the October series.

This is followed by 18000 strike, which holds 38.91 lakh contracts, and 17800 strike, which has accumulated 31.30 lakh contracts.

Put writing was seen at 17600 strike, which added 5.8 lakh contracts, followed by 17400 strike which added 4.69 lakh contracts and 17800 strike which added 4.26 lakh contracts.

Put unwinding was seen at 18200 strike, which shed 5.36 lakh contracts, followed by 18300 strike which shed 3.41 lakh contracts, and 18500 strike which shed 2.26 lakh contracts.

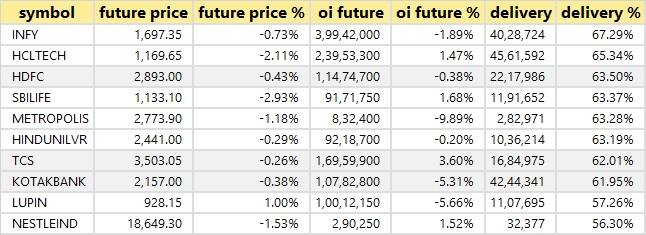

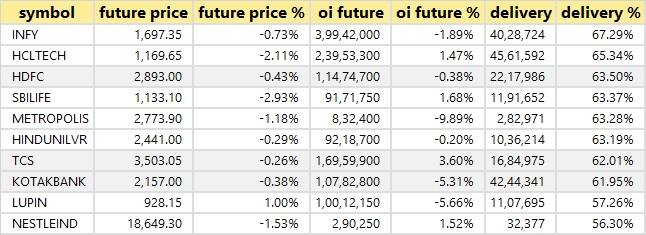

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

19 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

74 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

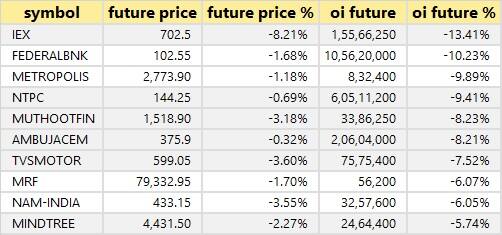

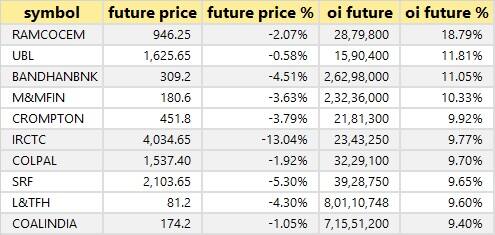

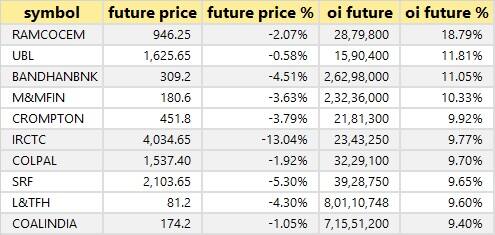

69 stocks saw short build-up

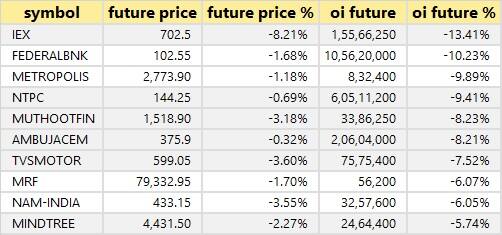

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen.

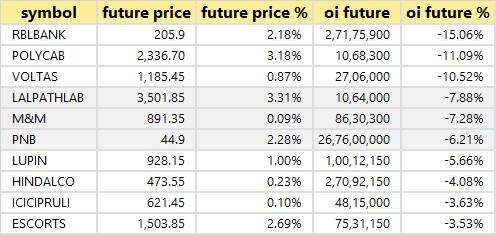

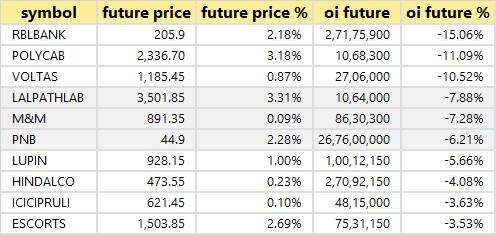

19 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

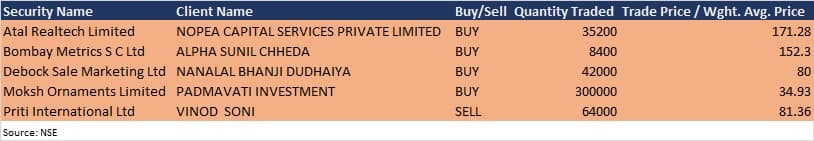

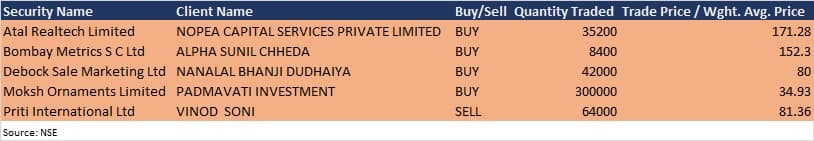

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting & Results Calendar

Results on October 26: Axis Bank, Kotak Mahindra Bank, Bajaj Finance, ABB India, Cipla, Ambuja Cements, Asahi Songwon Colors, Best Agrolife, Birlasoft, Canara Bank, Central Bank of India, Century Enka, Cera Sanitaryware, Coromandel Engineering, Gati, Greaves Cotton, Greenlam Industries, Hikal, IRB Infrastructure Developers, Jindal Stainless, Dr Lal PathLabs, Mahindra Lifespace Developers, Meghmani Finechem, Mahanagar Gas, Meghmani Organics, Mangalore Refinery & Petrochemicals, Nippon Life India Asset Management, Persistent Systems, PI Industries, Sharda Cropchem, Shiva Cement, Surya Roshni, Symphony, Torrent Pharmaceuticals, Triveni Turbine, Wabco India, and Zensar Technologies will release September quarter earnings on October 26.

Wipro: The company's officials will meet analysts and institutional investors in BNP Paribas Sustainable Future Forum Corporate Access Days, on October 26.

SBI Life Insurance Company: The company's officials will meet analysts and investors on October 27, to update the performance of the company.

Punjab National Bank: The company's officials will meet analysts and investors on October 28, to discuss financial results.

CCL Products (India): The company's officials will meet analysts and investors on October 28, to discuss financial results.

Adani Green Energy: The company's officials will meet investors and analysts on October 29, to discuss the financial performance.

Coromandel International: The company's officials will meet analysts and investors on October 29, to discuss financial results.

Wall Street Finance: The company's officials will meet analysts and investors on November 1, to discuss financial results.

Genus Power Infrastructures: The company's officials will meet analysts and investors on November 1, to discuss operational and financial performance.

Sequent Scientific: The company's officials will meet analysts and investors on November 2, to discuss Q2FY22 financial results.

TeamLease Services: The company's officials will meet investors on November 12, to discuss Q2FY22 results.

Stocks in News

Ceat: The company reported sharply lower profit at Rs 42 crore in Q2FY22 against Rs 181.9 crore in Q2FY21, but revenue increased to Rs 2,451.8 crore from Rs 1,978.5 crore YoY. Board has given approval for fund raising up to Rs 500 crore via debt.

Tech Mahindra: The company has reported lower profit at Rs 1,338.7 crore in Q2FY22 against Rs 1,353.2 crore in Q2FY21, revenue rose to Rs 10,881.3 crore from Rs 10,197.6 crore QoQ. Its subsidiaries acquired two companies (Infostar LLC, and WMW by Born London, UK) for Rs 885 crore.

Indus Towers: The company has reported higher profit at Rs 1,558.5 crore in Q2FY22 against Rs 1,130.7 crore in Q1FY21, revenue rose to Rs 6,876.5 crore from Rs 6,359.1 crore YoY.

Orient Cement: The company has reported sharply higher profit at Rs 56.88 crore in Q2FY22 against Rs 34.82 crore in Q2FY21, revenue rose to Rs 613.12 crore from Rs 477.5 crore YoY.

Home First Finance Company India: The company reported higher profit at Rs 44.86 crore in Q2FY22 against Rs 14.3 crore in Q2FY22, revenue jumped to Rs 146.1 crore from Rs 108.7 crore YoY.

HDFC Asset Management Company: The company reported higher profit at Rs 344.38 crore in Q2FY22 against Rs 338.06 crore in Q2FY21, revenue rose to Rs 542.33 crore from Rs 456.25 crore YoY.

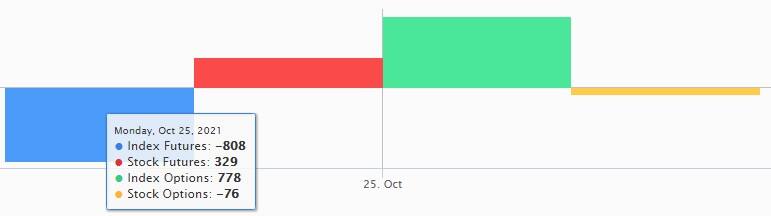

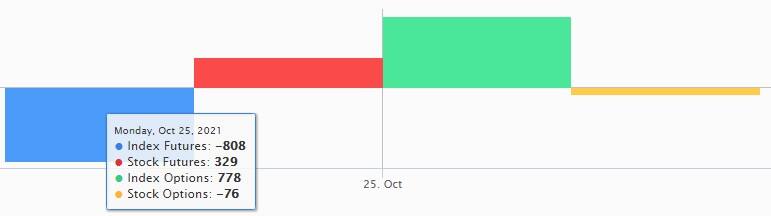

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,459.10 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 2,390.23 crore in the Indian equity market on October 25, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - Escorts, Indiabulls Housing Finance, Indian Energy Exchange, NMDC, SAIL, and Sun TV Network - are under the F&O ban for October 26. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.