The initial public offering (IPO) of FSN E–Commerce Ventures, which runs Nykaa and Nykaa Fashion, will open for subscription later this week.

FSN is backed by private equity firm TPG and promoted by Falguni Nayar. Here are the 10 key things to know before subscribing to the public issue.

Here are 10 key things to know before subscribing public issue:

1) IPO Dates

The bidding for the third-largest IPO, so far in 2021 (after Zomato and Sona Comstar) will start on October 28 and close on November 1, 2021. Anchor book, if any, will open for a day on October 27.

2) IPO Details

The IPO comprises a fresh issue of Rs 630 crore and an offer for sale (OFS) of 4.19 crore equity shares by several shareholders, including the promoters and some investors.

Promoter Sanjay Nayar Family Trust will sell up to 48 lakh equity shares through OFS, and investors TPG Growth IV SF Pte Ltd and Lighthouse India Fund III will offload 54.21 lakh equity shares and 48.44 lakh equity shares, respectively.

Among other investors, Yogesh Agencies & Investments Pvt Ltd, will sell 25.38 lakh equity shares and JM Financial and Investment Consultancy Services will offload 9.14 lakh equity shares.

Other shareholders - Lighthouse India III Employee Trust, Sunil Kant Munjal, Harindarpal Singh Banga, along with Indra Banga, Narotam Sekhsaria, Rishabh Mariwala, Jeenoo Khakhar, along with Kanika Khakhar and Isha Khakhar, Michael Carlos, Samina Hamied, Sanjay Maliah, Vikram Sud, and Karan Swani will offload 2.34 crore equity shares.

The company has reserved 2.5 lakh equity shares of the total issue size for employees.

To Know All IPO Related News, Click Here

3) Price Band

The company, in consultation with the merchant bankers, has fixed the price band at Rs 1,085-1,125 per equity share.

4) Fund Raising

At the upper band, FSN E-Commerce plans to mop up Rs 5,351.92 crore and Rs 5,184.03 crore from the lower band.

5) Issue objectives

For one, the company will utilise the net proceeds from the fresh issue to invest in two subsidiaries -- FSN Brands and / or Nykaa Fashion – and for setting up new retail stores (Rs 42 crore). The company will also utilise the proceeds for capital expenditure and investment in subsidiaries, like Nykaa E-Retail, Nykaa Fashion and FSN Brands, and for setting up warehouses (Rs 42 crore).

The funds will also be used for repayment of debt availed by the company and its subsidiary Nykaa E-Retail (Rs 156 crore), and to enhance brand awareness and visibility (Rs 234 crore).

The money raised through the OFS route will go to the selling shareholders.

Also read - Fino Payments Bank to float public issue on October 29

6) Company Details and Industry

Incorporated in 2012, FSN E-Commerce is a digital native consumer technology platform, delivering a content-led, lifestyle retail experience. It has a diverse portfolio of beauty, personal care and fashion products, including its own brands.

The company runs the beauty and personal care segment through the Nykaa vertical. Its apparel and accessories vertical is operated through Nykaa Fashion. It also operates an offline channel, comprising 80 stores across 40 cities in India in three different store formats, as of August 2021.

As of August 2021, Nykaa Fashion housed 1,434 brands and 2.8 million SKUs (stock-keeping units) with fashion products across four consumer divisions: women, men, kids and home. Beauty and personal care segment has 2,56,149 SKUs from 2,644 brands.

In financial year 2020-2021, its total gross merchandise value (GMV), at Rs 4,045.98 crore, grew by 50.7 percent over FY20, while, in Q1FY22, its GMV was Rs 1,469.61 crore, which grew 238.8 percent over a year-ago period.

India's retail market is expected to grow from Rs 54.8 lakh crore in 2020 to reach approximately Rs 91.2 lakh crore by 2025. The company also has a large market opportunity of Rs 10.6 lakh crore in the growing beauty, personal care and fashion industry by 2025 in India.

The Indian beauty and personal care market is estimated to grow at approximately Rs 2 lakh crore by 2025 from Rs 1.1 lakh crore in 2020, and the Indian fashion market is expected to grow to approximately Rs 8.7 lakh crore by 2025 from Rs 3.8 lakh crore in 2020.

7) Financials

Nykaa, founded by banker-turned-businesswoman Falguni Nayar, recorded a 38.10 percent growth in revenue from operations at Rs 2,440.89 crore in FY21, compared to the previous year. It clocked a profit of Rs 61.95 crore for FY21 against a loss of Rs 16.34 crore the previous year. It generated EBITDA (earnings before interest, tax, depreciation and amortisation) of Rs 161.43 crore and margin of 6.61 percent for FY21.

During the quarter that ended in June 2021, it clocked revenues of Rs 816.99 crore – a growth of 183.05 percent YoY. Profit during the quarter was Rs 3.52 crore against a loss of Rs 54.5 crore in Q2FY21, with an EBITDA of Rs 26.94 crore and margin of 3.30 percent for the quarter.

8) Key Risks

Investors will have to consider some key risk factors, like stiff competition and the probable entry of new entities, if any, into the same segments, before subscribing to the issue.

Motilal Oswal feels Nykaa's business is susceptible to some risks, including a questionable right to win in the fashion segment, where it faces stiff competition from other verticals and horizontal players, and scaling issues with the inventory-led models.

Increased competitive intensity, with the risk of new entrants with deep pockets entering the segment once it reaches a certain scale, and the collective bargaining power of suppliers/brands that may be threatened by Nykaa's strategy to scale its own brands are some of other risks, said the brokerage.

9) Promoters and Investors

Falguni Nayar, Sanjay Nayar, Falguni Nayar Family Trust, and Sanjay Nayar Family Trust are the promoters. They have a 45.99 percent shareholding in the company. The total shareholding, including that of the promoter group, is 54.22 percent.

The remaining stake is held by public shareholders, including Steadview Capital Mauritius (3.46 percent stake), TPG Growth IV SF Pte Ltd (3.44 percent), Lighthouse India Fund III (3.07 percent), Fidelity Securities Fund (1.3 percent), and Kravis Investment Partners LLC (1.14 percent).

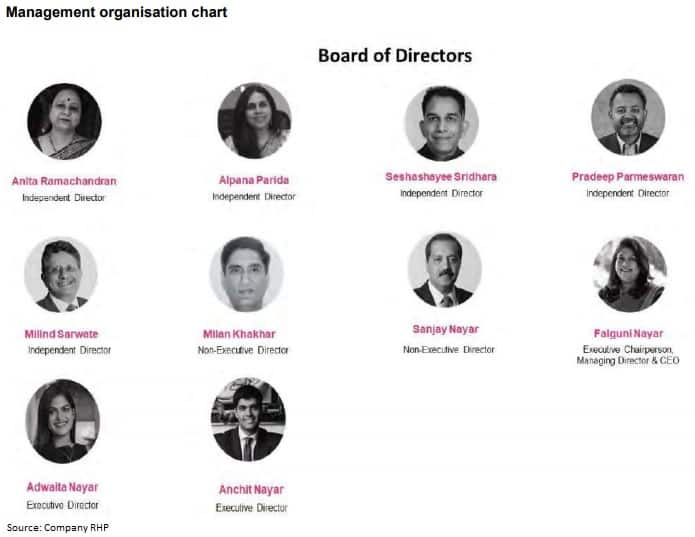

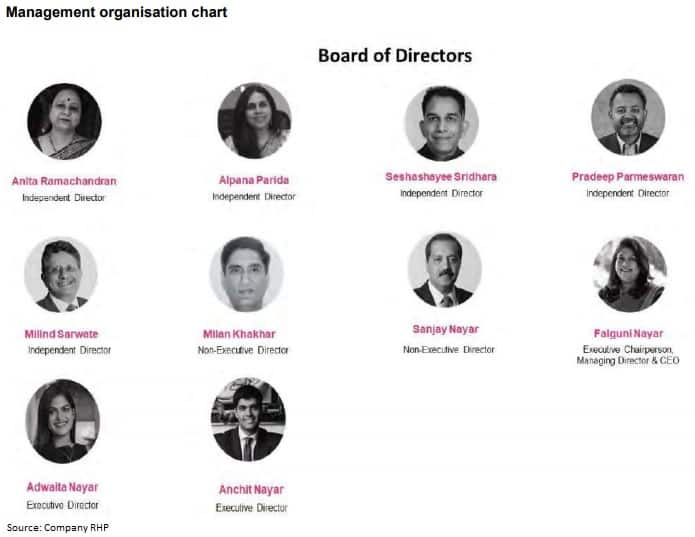

Falguni Nayar is the founder, Executive Chairperson & Managing Director and CEO of the company. She has over 26 years of experience in e-commerce, investment banking and broking.

Sanjay Nayar is a Non-Executive Director. He has over 35 years of experience in banking and private equity. Daughter Adwaita Nayar and son Anchit Nayar are Executive Directors on the board. They also serve as the Chairperson and CEO of Nykaa Fashion, and Chairman and CEO of Nykaa E-Retail, respectively.

Milan Khakhar is the Non-Executive Director, while Anita Ramachandran, Alpana Parida, Pradeep Parameswaran, Seshashayee Sridhara, and Milind Sarwate are independent directors on the board.

10) Grey Market Premium, Allotment, Refunds and Listing Dates

Nykaa shares traded at Rs 1,775-1,805 in the grey market, a premium of Rs 650-680 or 58-60 percent over the upper price band of Rs 1,125 per share, IPO Watch and IPO Central data showed.

The grey market is an unofficial trading platform where trading in IPO shares starts with the announcement of price band and continues till the listing of those shares on the bourses.

The company will finalise share allotment on November 8, and refunds will be given on November 9.

Equity shares will be credited to the demat accounts of eligible investors on November 10, and trading will commence from November 11.

Kotak Mahindra Capital Company, Morgan Stanley India Company, BofA Securities India, Citigroup Global Markets India, ICICI Securities, and JM Financial are the merchant bankers to the issue. Link Intime India is the registrar to the offer.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.