Beyond Meat (BYND) Declines 12% on Slashed Q3 Revenue Outlook

Beyond Meat (BYND) cuts revenue outlook for the third quarter due to the macro and micro-economic factors. Also, operational challenges and adverse weather conditions are headwinds.

Shares of Beyond Meat, Inc. BYND have declined 11.8% on Oct 22 as the company trimmed revenue outlook for third-quarter 2021. Management believes that demand in the said quarter was hurt by the broader macro and micro-economic factors, also including the COVID-19 Delta-variant impacts. The company witnessed lower retail orders for a longer duration from a Canadian distributor, which coincided with the reopening of restaurants, delays in distribution expansion and shortfalls at some U.S. foodservice customers, attributed to the effects of the Delta variant.

Consequently, management lowered its net revenue outlook to $106 million for the third quarter, based on the preliminary results. This updated view is weaker than the prior guided range of $120-$140 million, which was issued on its last quarter’s earnings call on Aug 6. Beyond Meat generated net revenues of $94.4 million in the year-ago quarter.

We note that the company witnessed challenges in operations, resulting in unfulfilled orders with adverse weather conditions causing the loss of potable water for two weeks at a Pennsylvania facility and water damage to inventory in the other. These factors might have dampened the company’s revenues in the quarter to be reported apart from the aforesaid headwinds.

However, these impacts were somewhat offset by higher orders from an international customer in the same quarter. Beyond Meat is slated to release third-quarter 2021 earnings on Nov 10, 2021, after the closing bell.

What’s More?

We note that this presently Zacks Rank #4 (Sell) company has been witnessing higher operating costs for a while now. Increased marketing expenses along with higher production trial activities and elevated outbound freight costs are elevating costs. Escalated transportation expenses are also hurting the company’s performance. Higher costs stemming from marketing and promotional activities as well as expenses associated with operating amid the pandemic are also a concern.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

These factors might affect the company’s bottom-line results for the quarter to be reported. The Zacks Consensus Estimate for the September quarter’s earnings is currently pegged at a loss of 34 cents, indicating deterioration from the loss of 28 cents reported in the year-earlier quarter.

Nonetheless, Beyond Meat remains focused on product innovations and launches. The company is also witnessing a continued rise in its household penetration as well as a strong purchase frequency, buyer rates and repeat rates. These along with its prudent efforts to boost offerings and expand distribution capabilities might provide some cushion.

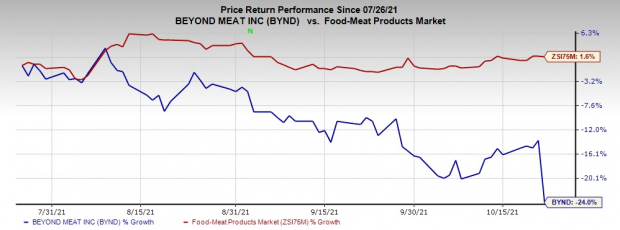

Shares of Beyond Meat have decreased 24% in the past three months against the industry’s 1.6% growth.

Consumer Staples Picks You Can’t Miss

United Natural Foods UNFI, currently flaunting a Zacks Rank #1 (Strong Buy), delivered an earnings surprise of 13.1% in the trailing four quarters, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sanderson Farms SAFM, sporting a Zacks Rank of 1 at present, delivered an earnings surprise of 496.3% in the last four quarters, on average.

General Mills GIS has an expected long-term earnings growth rate of 7.5% and a Zacks Rank #2 (Buy), presently.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS): Free Stock Analysis Report

United Natural Foods, Inc. (UNFI): Free Stock Analysis Report

Sanderson Farms, Inc. (SAFM): Free Stock Analysis Report

Beyond Meat, Inc. (BYND): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research