Ruble Jumps as Russia Hikes Rate More Than Expected to 7.5%

(Bloomberg) --

The ruble rallied and bonds tumbled after the Bank of Russia surprised with its biggest interest-rate increase since July while raising its inflation forecasts and warning further hikes were possible.

The central bank lifted the key rate 75 basis points to 7.5% Friday, its sixth straight hike. Only one economist in a survey of 44 correctly forecast the move, with the rest expecting an increase between 25 basis points and 50 basis points.

“The balance of risks for inflation is markedly tilted to the upside,” the central bank said in a statement that included higher predictions for inflation this year as well as the key rate in 2022. “The Bank of Russia holds open the prospect of further key rate rises at its upcoming meetings,” it said.

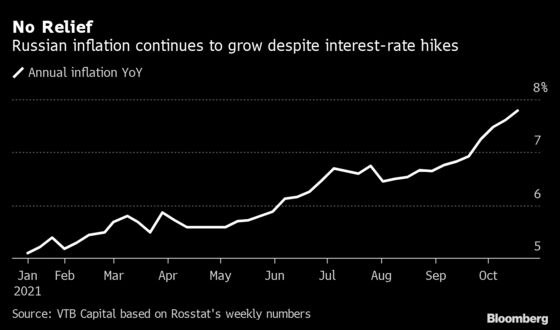

Unyielding price growth at home and abroad has forced Bank of Russia Governor Elvira Nabiullina to take bold moves, even as economic growth starts to slow. The central bank has now boosted rates by a total of 325 basis points this year in an effort to contain inflation, which is running nearly double its target. A slowdown in the economic recovery may be further intensified by new Covid-19 restrictions imposed by authorities this week.

“Globally, inflation is becoming a bigger threat” and “the main central banks in developed economies may begin their hiking cycles earlier than previously expected,” said Tatiana Orlova at Oxford Economics. “The language of the CBR statement is hawkish, and I wouldn’t be surprised if it had at least one more hike up its sleeve.”

Bank of Russia lifted the inflation forecast to 7.4%–7.9% for the end of 2021 from 5.7%-6.2% previously. Policy makers raised their average key rate forecast for next year to 7.3%-8.3% from 6%-7% before, according to the statement.

Market Action

The ruble extended gains after the decision, advancing as much as 1.8% against the the dollar to 69.8150, its largest intraday rise since May 7. The currency pared its advance to 1.1% by 2:37 p.m. in Moscow. Expectations of more rate increases, along with rising oil prices, have helped make the ruble the best performer among major emerging markets so far this month.

Bond yields surged before paring their advance to nine basis points at 7.70%. Yields on 10-year notes are up more than 20 basis points this week.

Inflation is still running near six-year highs as global price pressures add to local ones fueled by a delayed harvest. Even if some of those factors prove temporary, the central bank has warned that they could feed into a lasting increase in inflationary expectations, which rose again in October to 13.6%.

After Brazil, Russia has been one of the most aggressive among emerging markets in raising rates to combat rising inflation this year. By contrast, Turkey this week surprised with a big cut, pushing the lira lower.

Nabiullina will hold an online news briefing at 3 p.m. Moscow time. Follow our live blog here.

©2021 Bloomberg L.P.