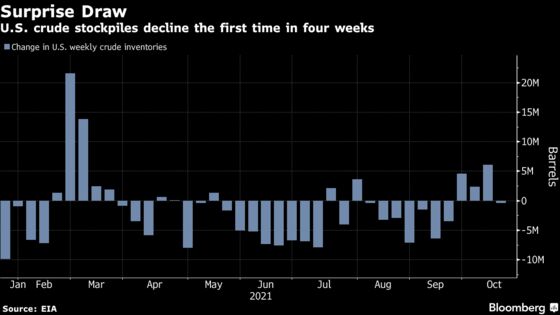

Oil Climbs From 7-Year High on Surprise Drop in U.S. Stockpiles

(Bloomberg) -- Oil extended gains in Asian trading following a surprise draw in U.S. crude stockpiles and a robust decline in fuel supplies.

Futures in New York edged toward $84 a barrel after climbing more than 1% on Wednesday to settle at the highest level in seven years. U.S. crude inventories dropped by 431,000 barrels last week, according to government data, compared with a Bloomberg survey that had forecast a fourth weekly increase. Gasoline and distillate inventories also decreased more than expected.

The market has tightened significantly recently as coal and natural gas shortages drive greater crude consumption, underpinning a rally in prices. Saudi Arabia said any extra oil from OPEC+ would do little to tame the surging cost of gas, predicting oil demand may rise as much as 600,000 barrels a day if the northern hemisphere’s winter is colder than normal.

“The supply-side slack in oil that emerged during the 2020 lockdowns is gone,” said Victor Shum, Singapore-based vice president of energy consulting for IHS Markit. “Oil demand is not back to pre–Covid-19 levels, but the balance between demand and supply is.”

| Prices |

|---|

|

U.S. gasoline stockpiles fell by 5.37 million barrels for a second weekly draw, while distillates decreased by 3.91 million barrels, the Energy Information Administration reported on Wednesday. Crude inventories at the key storage hub of Cushing slid by 2.32 million barrels to the lowest level since 2018.

See also: Did Iraq Just Make a Veiled Call for More Oil?: Oil Strategy

India became the second major Asian oil importer this week to sound the alarm over high crude prices. The global economic recovery will become fragile if prices aren’t “predictable, stable and affordable,” Oil Minister Hardeep Singh Puri said at the CERAWeek India Energy Forum on Wednesday, echoing the sentiments of Japanese Prime Minister Fumio Kishida.

| Other market news: |

|---|

|

©2021 Bloomberg L.P.