Asian Stocks, U.S. Futures Fall Amid Tech Concern: Markets Wrap

(Bloomberg) -- Asian stocks and U.S. futures fell Friday amid some disappointment over earnings and as a China Evergrande Group payment deadline looms. Treasuries pared a drop spurred by inflation worries.

Equities posted modest losses in Japan and Australia and fluctuated in South Korea. The S&P 500 edged up to a record but the mood soured after the cash session when Snap Inc. -- owner of the Snapchat app -- tumbled on a tempered earnings outlook, hurting other technology shares in late trading. Nasdaq 100 and S&P 500 futures retreated, with the former underperforming.

The 10-year U.S. Treasury yield slipped below 1.70%. The Federal Reserve is getting closer to trimming bond purchases and traders are ramping up expectations for interest-rate hikes to quell price pressures. Market-implied expectations for U.S. inflation have hit multiyear highs. The dollar was steady.

Meanwhile, Australia’s central bank bought bonds to defend its yield target. In China, Evergrande has until this weekend to pay an $83.5 million bond coupon. Concerns linger about possible contagion if it defaults as well as the implications for Chinese growth of a wider property-sector slowdown.

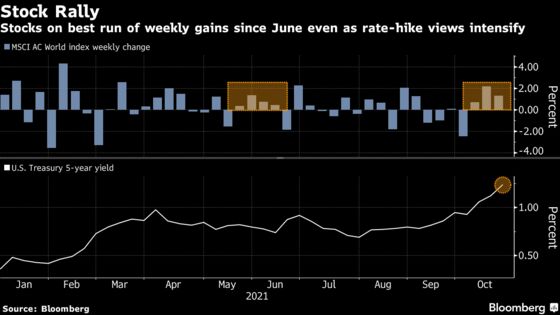

Global stocks are set for a third weekly advance, helped by the ongoing global recovery from the health crisis. The rally is being shadowed by the prospect of a faster-than-expected tightening of monetary policy to curb inflation, which is being stoked by an energy crunch and creaking supply chains.

“The U.S. economy is still on solid footing, but now inflation remains the biggest threat,” Edward Moya, senior market analyst at Oanda Corp., wrote in a note, adding investors are waiting for more earnings reports as well as the final shape of President Joe Biden’s economic agenda.

| Read More |

|---|

| Inflation-Protected Treasuries Log Banner Day as Money Pours In |

| Facebook and Alphabet Pummeled After Snap Warns on Ads |

Congressional Democrats are at odds over both the tax and spending sides of a bill to enact the bulk of Biden’s agenda, putting in question the goal of party leaders to strike a deal by the end of the week.

The earnings report from Snap included a warning that global supply chain issues are weighing on advertising spending. Shares in other tech companies exposed to digital advertising, like Facebook Inc. and Twitter Inc., weakened in late trading.

Elsewhere, crude oil fluctuated and Bitcoin steadied after slipping back from its recent record.

For more market analysis, read our MLIV blog.

Events to watch this week:

- Fed Chair Jerome Powell takes part in policy panel discussion, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 9:20 a.m. in Tokyo. The S&P 500 rose 0.3%

- Nasdaq 100 futures retreated 0.5%. The Nasdaq 100 rose 0.7%

- Japan’s Topix index lost 0.3%

- Australia’s S&P/ASX 200 shed 0.1%

- South Korea’s Kospi index was flat

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was at $1.1624

- The Japanese yen was at 113.98 per dollar

- The offshore yuan was at 6.3944 per dollar

Bonds

- The yield on 10-year Treasuries fell one basis point to 1.69%

- Australia’s 10-year bond yield was two basis points higher at 1.81%

Commodities

- West Texas Intermediate crude fell was at $82.50 a barrel

- Gold was at $1,784.44 an ounce, up 0.1%

©2021 Bloomberg L.P.