Top Searches

- News

- City News

- delhi News

- Delhi: 12 target 'very high value' NRI a/c with Rs 200 crore, held

Delhi: 12 target 'very high value' NRI a/c with Rs 200 crore, held

Delhi: 12 target 'very high value' NRI a/c with Rs 200 crore, held

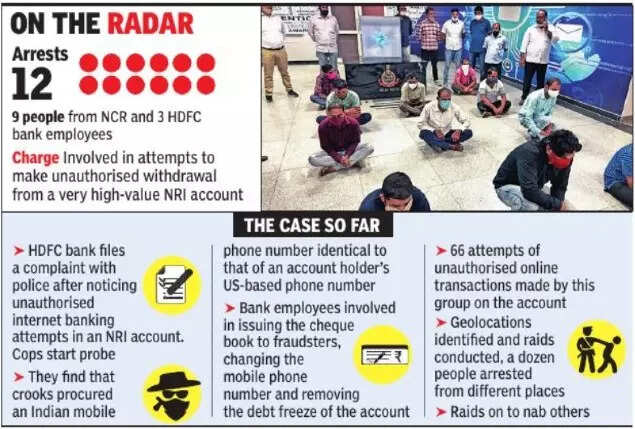

NEW DELHI: Twelve people, including three employees of a private bank, have been arrested on charges of trying to siphon off money from a 'very high value' NRI bank account that had around Rs 200 crore in it. The accused had procured an Indian mobile phone number identical to the account holder's US-based phone number for facilitating the transfer of funds.

Following a complaint filed by HDFC Bank, technical investigation revealed that 66 attempts of unauthorised online transactions were made on the account, Delhi Police DCP (cyber cell) KPS Malhotra said. "Further, the accused tried to withdraw cash from the account using a fraudulently obtained cheque book. They even later tried to update the mobile phone number in the KYC documents by replacing the existing registered mobile number," said Malhotra.

A team led by ACP Raman Lamba was tasked to identify the culprits based on technical footprint and human intel.

The three bank employees included a relationship manager, who issued the cheque book, updated the mobile phone number and removed the debt freeze on the account. The bank employees were named as D Chaurasia, A Singh and a woman whose identity was not disclosed.

The interrogation of the accused revealed that the mastermind had come to know that the NRI account was dormant and had a lot of funds. With the help of the female bank employee, they got a cheque book issued and also got the debt freeze removed. Further probe revealed that she was promised Rs 10 lakh and insurance business of Rs 15 lakh, the target assigned to her by the bank for appraisal.

Even earlier, attempts had been made to withdraw money from this account. Two cases were registered, one at Ghaziabad and another at Mohali in Punjab.

The cheque book of the account later came in the possession of one R Jaiswal. He distributed leaves of the cheque book to his accomplices to get them cleared and promised to share 50% of the money withdrawn from the account. He was to give consent to the bank over the phone on behalf of the actual account holder. Chaurasiya and Singh attempted to update the phone number linked to the account, while the other associates tried to log in to internet banking to transfer funds.

"The attempts to withdraw funds, log in to internet banking and update the mobile phone number was only possible due to the connivance of the bank employees," Malhotra said.

Following a complaint filed by HDFC Bank, technical investigation revealed that 66 attempts of unauthorised online transactions were made on the account, Delhi Police DCP (cyber cell) KPS Malhotra said. "Further, the accused tried to withdraw cash from the account using a fraudulently obtained cheque book. They even later tried to update the mobile phone number in the KYC documents by replacing the existing registered mobile number," said Malhotra.

A team led by ACP Raman Lamba was tasked to identify the culprits based on technical footprint and human intel.

Multiple geolocations were identified and raids were conducted at 20 locations across Delhi, Haryana and Uttar Pradesh. This led to the arrest of 12 people.

The three bank employees included a relationship manager, who issued the cheque book, updated the mobile phone number and removed the debt freeze on the account. The bank employees were named as D Chaurasia, A Singh and a woman whose identity was not disclosed.

The interrogation of the accused revealed that the mastermind had come to know that the NRI account was dormant and had a lot of funds. With the help of the female bank employee, they got a cheque book issued and also got the debt freeze removed. Further probe revealed that she was promised Rs 10 lakh and insurance business of Rs 15 lakh, the target assigned to her by the bank for appraisal.

Even earlier, attempts had been made to withdraw money from this account. Two cases were registered, one at Ghaziabad and another at Mohali in Punjab.

The cheque book of the account later came in the possession of one R Jaiswal. He distributed leaves of the cheque book to his accomplices to get them cleared and promised to share 50% of the money withdrawn from the account. He was to give consent to the bank over the phone on behalf of the actual account holder. Chaurasiya and Singh attempted to update the phone number linked to the account, while the other associates tried to log in to internet banking to transfer funds.

"The attempts to withdraw funds, log in to internet banking and update the mobile phone number was only possible due to the connivance of the bank employees," Malhotra said.

FacebookTwitterLinkedinEMail

Start a Conversation

end of article