- Home

- Outlook Arena

- Outside View

- Outside View (PersonalFN)

- Mirae Asset Tax Saver Fund: Finding Value in Growth-oriented Businesses

Mirae Asset Tax Saver Fund: Finding Value in Growth-oriented BusinessesOct 18, 2021

Equity Linked Saving Schemes (ELSS), also known as tax saving mutual funds, are diversified equity funds that come with the dual advantage of wealth-building potential and tax-saving benefits. These funds come with a lock-in of period of 3 years.

With the market at all-time high (the S&P BSE Sensex has crossed the 61,000 mark), it can be risky to invest in equity-oriented mutual funds with a horizon of less than 5 years. Remember that market corrections are eternal part of equity investing. If at the end of the lock-in period the NAV of your ELSS is lower than your initial purchase price, then it is better to stay invested for a couple of years more until the market bounces back.

It is also important to choose ELSS wisely. Prefer schemes that maintain a well-diversified portfolio of stocks to manage market volatility.

Mirae Asset Tax Saver Fund is a tax saving mutual fund that has built an exceptional track record since its inception and figures among top quartile performers across various time periods.

--- Advertisement ---

21st Century's BIGGEST Revolution is Happening... Are You in?

The biggest revolution of the 21st century is Electric Vehicles.

But let me warn you that the usual way of investing in EVs may lead you to more trouble than profits.

After spending thousands of manhours on research, we've found a hidden way to profit from this EV revolution... which holds far more potential than buying regular big-name EV stocks.

And we're going to reveal it all at our exclusive online event.

Register Me for Free

------------------------------

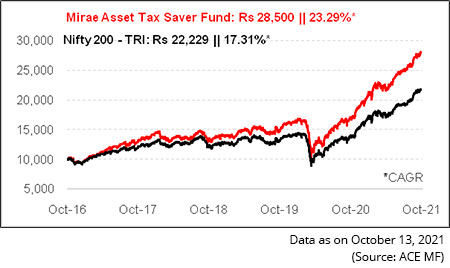

Graph 1: Growth of Rs 10,000 if invested in Mirae Asset Tax Saver Fund 5 years ago

Launched in December 2015, Mirae Asset Tax Saver Fund is known for its superior fund management and cautious stock selection process. The fund holds a diversified portfolio of strong growth companies spread across market caps and sectors that are available at reasonable price. Mirae Asset Tax Saver Fund has delivered strong returns since its inception about 6 years ago during both upside and downside market conditions, generating superior risk-adjusted returns for its investors. With a CAGR of 23.3% in the last five years, Mirae Asset Tax Saver Fund has significantly outperformed the benchmark Nifty 200 - TRI by a CAGR of around 6 percentage points. An investment of Rs 10,000 in the fund five years ago would have now appreciated to Rs 28,500, as against a valuation of Rs 22,229 for the simultaneous investment in the benchmark. Despite the short-term track record, Mirae Asset Tax Saver Fund has proven its ability to consistently generate superior returns for its investors and stands among the prominent contender in the tax saving mutual funds category.

Table: Mirae Asset Tax Saver Fund's performance vis-a-vis category peers

| Scheme Name | Corpus (Cr.) | 1 Year | 2 Year | 3 Year | 5 Year | 7 Year | Std Dev | Sharpe |

|---|---|---|---|---|---|---|---|---|

| Quant Tax Plan | 433 | 97.24 | 62.36 | 39.44 | 26.00 | 25.16 | 25.60 | 0.33 |

| BOI AXA Tax Advantage Fund | 517 | 71.04 | 44.25 | 32.36 | 22.06 | 19.45 | 20.13 | 0.33 |

| Mirae Asset Tax Saver Fund | 9,832 | 67.34 | 38.80 | 28.76 | 23.29 | -- | 22.19 | 0.28 |

| Canara Rob Equity Tax Saver Fund | 2,772 | 61.17 | 37.56 | 28.54 | 20.61 | 17.15 | 20.62 | 0.29 |

| DSP Tax Saver Fund | 9,756 | 70.85 | 32.70 | 26.59 | 18.08 | 17.76 | 22.16 | 0.25 |

| JM Tax Gain Fund | 65 | 69.81 | 31.19 | 26.56 | 18.98 | 17.81 | 22.75 | 0.25 |

| Axis Long Term Equity Fund | 34,371 | 67.25 | 30.98 | 26.07 | 20.06 | 18.65 | 20.45 | 0.25 |

| IDFC Tax Advt(ELSS) Fund | 3,439 | 84.90 | 40.88 | 25.98 | 20.26 | 18.45 | 25.47 | 0.22 |

| Union Long Term Equity Fund | 436 | 63.51 | 34.36 | 25.40 | 16.53 | 13.64 | 20.81 | 0.25 |

| UTI LT Equity Fund (Tax Saving) | 3,041 | 66.84 | 35.12 | 24.78 | 17.46 | 15.36 | 21.46 | 0.24 |

| NIFTY 200 - TRI | 59.53 | 30.23 | 21.88 | 17.31 | 14.72 | 22.03 | 0.2 |

Data as on October 13, 2021

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

Mirae Asset Tax Saver Fund has stood strong against its popular peers, and has managed to outperform its category average as well as the benchmark by a noticeable margin across time periods. Over the long term horizon of 5-year period, Mirae Asset Tax Saver Fund has generated returns at 23.3% CAGR, which is among the highest in the category and clearly outpaces the benchmark. In addition, the short-term performance of the fund is exemplary.

More importantly, the fund has achieved this feat at a reasonable risk, thus rewarding its investors with superior risk-adjusted returns as well. The fund's volatility (22.2%) is nearly in line with that of the category average and the benchmark Nifty 200 - TRI; while its risk-adjusted return denoted by Sharpe Ratio (0.28) is among the highest in the category.

Find Out: How to Profit from 21st Century's BIGGEST Revolution

Investment strategy of Mirae Asset Tax Saver Fund

Mirae Asset Tax Saver Fund has a mandate to hold at least 80% of its assets in equities. The fund has no bias towards any particular theme or investment style and holds a well-diversified portfolio of strong growth companies available at a reasonable price. The universe of stocks for the portfolio comprises majorly of companies having robust business models, enjoying sustainable competitive advantage and achieving high return ratios.

Following a top-down and bottom-up approach of investing, the fund manager broadly analyses the macro-economy and invest in stocks of high-growth companies expected to benefit from macro-economic, sectoral, and industry trends. While picking companies, the fund manager tests the business on various quantitative and qualitative parameters and gives importance to ROCE, growth, ROI, value, and management. He seeks out for growth businesses, and within that, looks for value (buy at reasonable rate). The fund manager uses the DCF (Discounted Cash Flow) mechanism to estimate the fair valuation level of stocks.

The fund aims to identify long-term investment opportunities in stocks of high-quality businesses available at reasonable prices and follow the buy-and-hold investment strategy until its full potential is derived. Mirae Asset Tax Saver Fund has a moderate portfolio turnover of 80-100% in the last one year.

The fund usually holds predominant exposure to large caps (65-75% of its assets) along with substantial allocation in mid and small caps (25-30% of its assets).

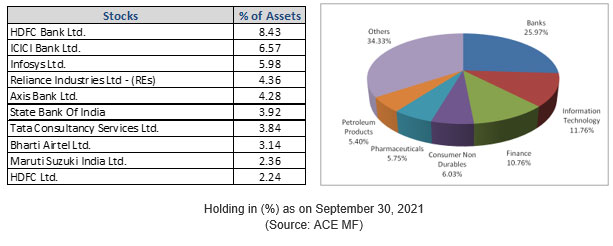

Graph 2: Top portfolio holdings in Mirae Asset Tax Saver Fund

Mirae Asset Tax Saver Fund usually holds a well-diversified portfolio of stocks spread across market caps, but with a large-cap bias. As on September 30, 2021, Mirae Asset Tax Saver Fund held as many as 60 stocks in the portfolio. The top 10 stock holdings in the portfolio accounted for around 45% of the total assets. Large-cap names such as, HDFC Bank, ICICI Bank, Infosys, Reliance Industries, and Axis Bank, among others, appear in the list of its top holdings. Most of these stocks have been part of the fund's top holdings for over two years now.

In the last one year, stocks of ICICI Bank, Infosys, HDFC Bank, SBI, Axis Bank, Indian Energy Exchange, Prince Pipes and Fittings, Tata Steel turned out to be major contributors to Mirae Asset Tax Saver Fund's returns in the last one year.

Mirae Asset Tax Saver Fund's portfolio is skewed towards Banking and Finance stocks that collectively form a major 36.7% of its portfolio. The fund also held substantial exposure in Infotech, Consumption, Pharma, Petroleum Products, Consumer Durable, Auto & Auto Ancillaries, and Engineering with an allocation in the range of 4% to 12% of its assets. The top 10 sectors together occupied 82% of Mirae Asset Tax Saver Fund's portfolio. Although Mirae Asset Tax Saver Fund's portfolio is skewed towards cyclicals, it is fairly diversified towards defensives as well.

--- Advertisement ---

21st Century's BIGGEST Revolution is Happening... Are You in?

The biggest revolution of the 21st century is Electric Vehicles.

But let me warn you that the usual way of investing in EVs may lead you to more trouble than profits.

After spending thousands of manhours on research, we've found a hidden way to profit from this EV revolution... which holds far more potential than buying regular big-name EV stocks.

And we're going to reveal it all at our exclusive online event.

Register Me for Free

------------------------------

Suitability

Mirae Asset Tax Saver Fund invests in high growth-oriented stocks but at the right valuations, this has primarily helped it outscore the market across time periods. It maintains a diversified portfolio of quality stocks with a long term view and has proved to be agile enough to take advantage of various investment opportunities present across segments. As a result, Mirae Asset Tax Saver Fund has managed to keep the risk low and perform well even in uncertain market conditions.

However, more than 35% of its asset is skewed towards stocks in the banking and finance sectors. If the sector comes under stress, it could weigh on the performance of the fund. Nonetheless, with an experienced fund manager at the helm, Mr Neelesh Surana, whose stock convictions have played out well in the past, the fund has the ability to do well in the future as well.

Mirae Asset Tax Saver Fund is suitable for investors looking for a growth-oriented fund in the ELSS space with a long term view.

PS: If you are looking for quality mutual fund schemes (including Equity-linked Saving Schemes) to add to your investment portfolio, I suggest you subscribe to PersonalFN's premium research service, FundSelect. PersonalFN's FundSelect service provides insightful and practical guidance on which mutual fund schemes to Buy, Hold, and Sell.

Currently, with the subscription to FundSelect, you could also get Free Bonus access to PersonalFN's Debt Fund recommendation service DebtSelect.

If you are serious about investing in a rewarding mutual fund scheme, subscribe now!

Note: This write up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Author: Divya Grover

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

Disclaimer:

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

More Views on News

India's Big PSU Selloff: Watch Out for these Top Stocks (Views On News)

Oct 15, 2021The government's plan to divest its stakes in PSUs could spark off a rally in these four stocks.

Modi's Big Move Could Boost these 5 Defence Stocks (Views On News)

Oct 11, 2021To corporatise the defence sector, the Ministry of Defence (MoD) has dissolved the 250-year-old Ordnance Factory Board (OFB).

5 Exciting 'Unlisted' Companies and How to Play Them (Views On News)

Oct 7, 2021Here's how you can invest in some of the most exciting start-ups of the decade.

Insider Alert! Promoters are Increasing their Stakes in these 5 Companies (Views On News)

Oct 19, 2021Promoters of many small and mid-cap companies are raising their stakes since the last few quarters.

Time to Trade Housing Finance Stocks (Fast Profits Daily)

Oct 19, 2021Housing Finance Stocks are offering a great short-term trading opportunity right now. Don't miss it.

More Views on NewsMost Popular

Is it Time to Switch from Tata Power to NTPC? (Profit Hunter)

Oct 11, 2021Given the huge run up in Tata Power, does it make sense to switch to NTPC?

This Proxy EV Stock Just got a Power Crisis Boost (Profit Hunter)

Oct 8, 2021After months of research, I've come across few stocks that excite me far more than the mainstream electric vehicle companies.

Rs 1 Lakh Invested in These Cryptos at the Start of 2021 Became Rs... (Views On News)

Oct 8, 2021These cryptos would have multiplied investors' wealth by as much as 10,000% in just nine months.

Top 5 'Digital India' Stocks (Views On News)

Oct 6, 2021These companies are leading the Government's US$1 tn 'Digital India' initiative.

5 Exciting 'Unlisted' Companies and How to Play Them (Views On News)

Oct 7, 2021Here's how you can invest in some of the most exciting start-ups of the decade.

MoreOUR TOP 5 IDEAS

- Free Report: Multibagger Stock Ideas 2022

- Are You Making One of These 15 Costly Mistakes While Investing. Learn more!

- Covid-19 Proof Multibagger Stocks - Download this FREE Report Now

- Free Report: How to Profit from Sensex 100,000

- No Guessing, No Hunches, and No Missed Trends Ever! Join Us on YouTube Now.

S&P BSE SENSEX

Oct 19, 2021 (Close)

Equitymaster requests your view! Post a comment on "Mirae Asset Tax Saver Fund: Finding Value in Growth-oriented Businesses". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!