Indian market remained under selling pressure throughout the week ended October 1 and also broke its 5-week winning streak on the back of weak global cues.

On the weekly basis, BSE Sensex lost 1,282.89 points (2.13 percent) to close at 58,765.58, while the Nifty50 fell 321.2 points (1.79 percent) to close at 17,532 levels.

Last week, broader markets outperformed the main indices with BSE Midcap index ending flat, while the smallcap index rose 0.7 percent.

However, in September Sensex and Nifty rose more than 3 percent each, while the midcap index added 6.6 percent, smallcap indices jumped 5.7 percent.

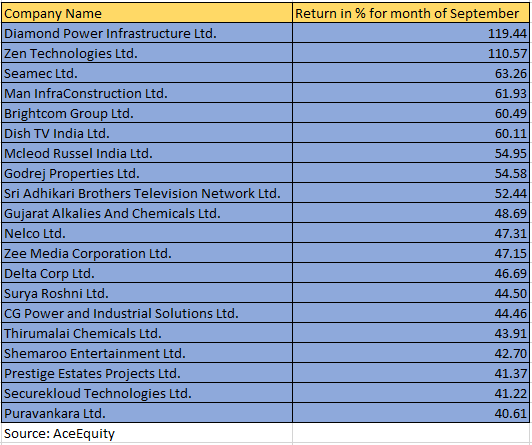

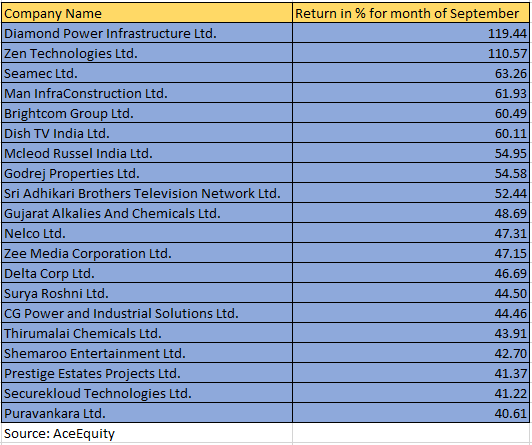

Among smallcaps, 186 stocks rose between 10-119 percent in September 2021 including names like Diamond Power Infrastructure, Zen Technologies, Seamec, Man InfraConstruction, Brightcom Group, Dish TV India, Mcleod Russel India, Godrej Properties, Sri Adhikari Brothers Television Network, Gujarat Alkalies and Chemicals, Nelco and Zee Media Corporation.

On the other hand, 27 stocks lost 10-27 percent. These include Virtual Global Education, Yamini Investments, Andhra Cements, Opto Circuits (India), Aegis Logistics, Walchandnagar Industries, Ramky Infrastructure, AJR Infra and Tolling, CMI, Toyam Industries, Nandan Denim and Punjab Chemicals & Crop Protection, among others.

“In line with global markets, Sensex 30 and Nifty 50 saw a decline this week, falling ~ 2% during the week. BSE Midcap and BSE Smallcap index outperformed the Sensex and Nifty. In terms of sector, the BSE Power index gained 6% and BSE Oil & Gas index moved up by 4.3%. BSE Energy and BSE Metal index too gained ~3% in this week. On the other hand, with ~5% decline, the BSE IT index was the major underperformer,” said Shrikant Chouhan, Head - Equity Research (Retail), Kotak Securities.

“The US 10 year treasury yield rose further this week above the 1.5% mark. Crude oil prices remained on the higher side.”

“On the domestic data front, the performance remains broadly on expected lines. Global and domestic inflation risk from a sharp increase in global energy prices, rising US bond yield, and concerns over the Evergrande issue are near-term challenges for the global and Indian equity markets,” he added.

“FIIs have been net buyers in September 2021. Most of the major emerging markets witnessed FPI inflows in the month of September’21,” Chouhan further said.

The BSE 500 index lost 1.2 percent in the week ended October 1, while it rose 4 percent in the month of September.

“The equity market was off the peaks it had ascended in the last couple of weeks, as the Fed gave more emphatic indications of a tapering of the bond buying program quite soon. Though the initial response from the markets was positive, the likelihood of the rates rising fast with a high retail inflation and higher growth numbers started getting etched in the minds of the market participants," said Joseph Thomas, Head of Research, Emkay Wealth Management.

"The 10 Year benchmark yield moved up above the 1.50 % level and it looks set to move up further. The testimony by the Fed Chairman this week further scaffolded this belief in an impending change of policy."

"What added fuel to fire is the rise in the fuel prices, and the likelihood of this rise getting transmitted to many economies especially the emerging markets through a weaker currency, is an uneasy prospect which is gradually getting more visibility. These very same factors which may be more US-centric and also fuel- price- centric may dominate the markets in the coming week too,” he added.

Where is Nifty50 headed?

Mohit Nigam, Head - PMS, Hem Securities:

Going forward, markets could witness action in IT stocks ahead of upcoming results while auto could show recovery from these levels as the festive season kicks in. Pharma also looks to be another corner on the basis of technical grounds. Nifty50 should find near term support near 17,400 whereas resistance levels could be 17,700.

Rohit Singre, Senior Technical Analyst at LKP Securities

Going forwards Nifty has formed supports near 17,450-17,400 zone and if managed to sustain above said levels one can expect a decent pullback towards immediate & strong hurdle zone of 17,620-17,740 where one can lock immediate profit in longs, also the overall range for the Nifty is coming in between 17,300-18,000 zone.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.