Taiwan's OSATs have seen their plants in Suzhou, Jiangsu province little affected by a power supply cut enforced by China under its carbon reduction policy, but they are more concerned that year-end labor shortage may impact their production and shipments, according to industry sources.

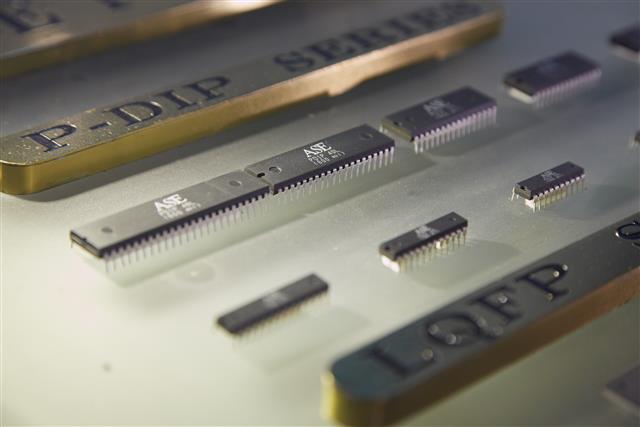

The OSATs including ASE Technology and its affiliate Siliconware Precision Industries (SPIL), King Yuan Electronics (KYEC), Sigurd Microelectronics and Powertech Technology (PTI), as well as their Chinese peers JCET, Tongfu Microelectronics and Tianshui Huatian Technology are all maintaining normal production in Suzhou, now a backend operations hub in China, as the power supply reduction being implemented in some Chinese provinces is not applied to the semiconductor industry and those enterprises engaged in developing specialty and innovative tech solutions, the sources said.

All the Taiwanese and Chinese OSATs are expected to sustain full capacity utilization at their Suzhou plants through the end of the year, but labor shortage remains a headache for their relatively labor-intensive backend operations despite continuous pay raises, the sources said, adding that the shortage will be more severe around the year-end, when employees tend to change jobs after returning home for holidays.

Taiwan's OSATs noted that they will keep a watchful eye on possible power supply policy changes so that they can take corresponding countermeasures, and they will continue to keep their service platforms open to clients in China, the US and Taiwan, the sources said. In contrast, their Chinese peers have recently adjusted their capacity allocations, granting more support to domestic chipmakers in line with the government's semiconductor self-sufficiency efforts, the sources added.

If the power supply cut extends to backend houses, the shortage of chips supply would lengthen further, and price hikes at foundry and backend houses would also linger and their shipments would be affected, eventually driving up prices for terminal consumer electronics devices, the sources noted.