US investing has gained a lot of attention. Many new fund offers in US funds, brokers and platforms are offering an easy way to invest in the US stocks. Overall, it is a good sign for investors who are looking to diversify their wealth across different markets. Yes, a lot of investors have been lured by the eye-popping returns over the last decade.

However, chasing past performance rarely yields good results in the future. In the case of international investing – diversification is the real deal. Investors get to lower portfolio volatility, get exposure to the US dollar and buy into growth stories in some of the world’s leading companies. There remains a lot of literature on investing in the US and very little on countries outside the US. So, let’s talk about emerging markets.

What Are Emerging Markets?

There may not be an exact definition for Emerging Markets (EMs), however, generally speaking, economies that exist between the stages of developing and developed are considered emerging markets. The emerging-market phase occurs when economies see their most rapid growth. MSCI (one of the world’s renowned research providers) identifies 27 countries as emerging markets as of 2021.

Source: MSCI, paper ‘Emerging Markets Views’ published in March 2014, and MSCI EM Index Factsheet as of April 2021.

Source: MSCI, paper ‘Emerging Markets Views’ published in March 2014, and MSCI EM Index Factsheet as of April 2021.

What are some of the key attributes of EMs (emerging markets): Potential for rapid GDP Growth

Typically, EMs are perceived to experience rapid economic growth. Over the past few decades, EMs' contribution to world GDP has grown considerably from less than 30% in the 1980s to almost 50% in the 2020s. Many large EMs have a higher GDP growth rate over other EMs and developed markets globally.

Favourable Demographics and Consumption

One key characteristic of EM markets is that its demand leads by exports and domestic consumption. This is primarily because ~85% of the worlds’ population is accounted by EM. A further whopping 90% of the world’s population under age 30 is from EMs, and as per estimates, nearly 58% of the world’s middle-class populations will be from EMs by 2030. Thus, the growing middle class and their consumption are key factors in the growth of EMs.

Key drivers for the growth of EM are - rapid economic growth, high savings rate, increasing urbanisation, focus on creating more jobs. In addition, there are many EMs that are rich in natural resources that can act as a revenue stream for the government.

Increasing penetration of innovation and digitization

Back in history, EMs were considered workshops of the world as low-cost manufacturers, raw material suppliers, and hub for outsourcing services. However, over past couple of decades, EMs are increasingly becoming leader in innovation and digitization. Countries like Taiwan and Korea are leading manufacturers and suppliers of essential technology and electronics for the world.

Risk associated with EMs

The progression from being EM to becoming a developed economy may not always be smooth. EM countries tend to experience greater political, economic, currency and legal risks than developed counterparts. Moreover, EM countries generally are less equipped to manage economic losses due to political disturbance or large natural calamities. However, if caution is exercised, the rewards of investing in an emerging market can outweigh the risks.

Despite their volatility, the most growth and the high-returning stocks tend to be found in the fastest-growing economies.

How to invest in EMs?

Globally, investors tend to prefer investing in a diversified basket of EM countries as against a specific country to manage a country-specific risk that can be quite high in certain situations. There are multiple routes to invest in the EMs, such as direct equity, mutual funds or passive funds. Each route may have its pros and cons, however, many retail and large investors tend to prefer passive fund route due to ease and cost-effectiveness. Any passive fund that aims to replicate EM benchmark that includes a diversified basket of EMs can be a very good starting point. It helps to eliminate stock-specific or country-specific risk, that too at relatively low cost.

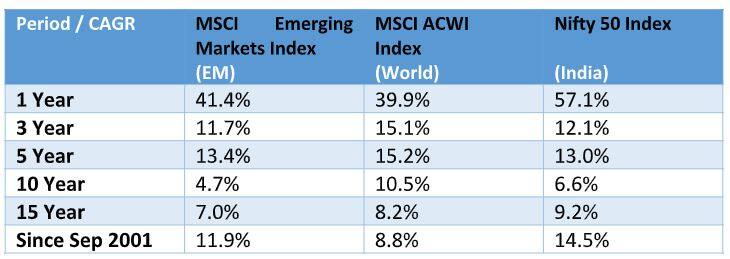

Source: FactSet; Total Returns Index Data in USD, Data from 30-Sep-2001 to 30-Jun-2021. EM - MSCI Emerging Market Index, World – MSCI ACWI Index, India – Nifty 50 Index

Source: FactSet; Total Returns Index Data in USD, Data from 30-Sep-2001 to 30-Jun-2021. EM - MSCI Emerging Market Index, World – MSCI ACWI Index, India – Nifty 50 Index

Source: FactSet; Total Returns Data in USD, Data from 30-Sep-2001 to 30-Jun-2021. EM - MSCI Emerging Market Index, World – MSCI ACWI Index, India – Nifty 50 Index.

Source: FactSet; Total Returns Data in USD, Data from 30-Sep-2001 to 30-Jun-2021. EM - MSCI Emerging Market Index, World – MSCI ACWI Index, India – Nifty 50 Index.

Conclusion

In conclusion, global diversification should not be limited to the US. Investors must look at other regions such as emerging markets and other developed markets such as UK, EU and Japan. Historically, it has been tough to predict which region has the highest returns, so investing across the board has helped most investors. Emerging markets offer higher growth rates and access to some of the world’s most exciting businesses outside the US.

(The author is Head of Passive Funds Motilal Oswal AMC)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.