Power stocks were in focus in the morning trade on August 24, a day after the government announced an ambitious Rs 6 lakh crore asset monetisation plan spread over four years.

Finance Minister Nirmala Sitharaman on August 23 announced a Rs 6 lakh crore National Monetisation Pipeline (NMP) that will look to unlock value in infrastructure assets across sectors ranging from power to road and railways.

The transmission assets considered for monetisation during FY 2022-25 aggregate to 28,608 circuit (ckt) km. These include transmission assets of 400 KV and above of Power Grid Corporation of India Limited (PGCIL).

The total value of assets considered for monetisation is estimated at Rs 45,200 crore over FY 2022-25, the NMP document said.

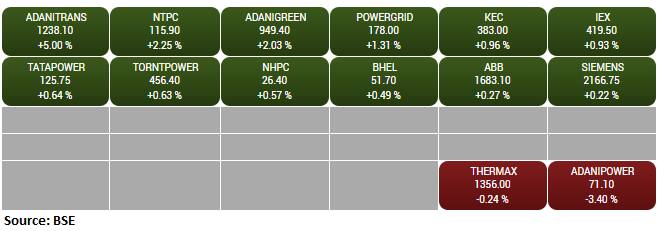

The BSE Power Index added over 1 percent led by the Adani Transmission, NTPC, Adani Green, Power Grid, KEC International.