Indian benchmark indices continued to make new record highs but ended with marginal losses in the last week dragged by selling seen in the metal, realty and banking names.

Benchmark indices, Sensex and Nifty, touched their fresh record high levels of 56,118.57 and 16,701.85, on August 18 but on the weekly basis, BSE Sensex fell 107.97 points to close at 55,329.32, and Nifty50 lost 78.6 points to end at 16,450.5 levels.

The broader indices underperform the main indices with BSE Mid-cap and Small-cap indices fell 1-2 percent and Largecap Index was down 0.7 percent in the last week.

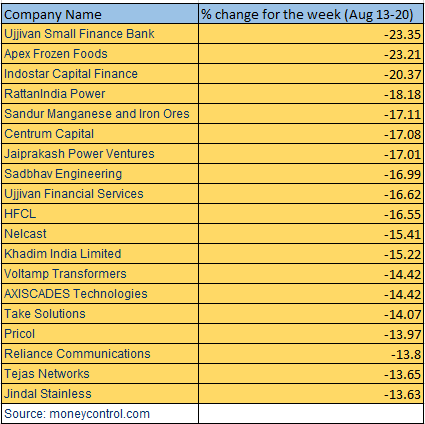

Among smallcaps, 82 stocks fell between 10-23 percent including names like Ujjivan Small Finance Bank, Apex Frozen Foods, Indostar Capital Finance, RattanIndia Power, Sandur Manganese, Centrum Capital and Jaiprakash Power Ventures.

However, VST Tillers Tractors, FIEM Industries, Adani Total Gas, Fortis Healthcare, Aster DM Healthcare, Mindtree and Arvind Fashions added 11-40 percent.

“The level of 16800, which was our medium term target earlier, now becomes the short term target & the medium term target has been raised to 17500. The hourly & the daily momentum indicators are now showing overbought readings; so a minor pause cannot be ruled out; nevertheless the overall structure shows that the rally is far from over,” said Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas.

“Thus the short term traders are recommended to hold on to their long positions & ride the trend for higher targets. On the other hand, the near term support zone shifts higher to 16350-16400,” Ratnaparkhi added.

The BSE 500 index fell nearly 1 percent dragged by Ujjivan Small Finance Bank, Indostar Capital Finance, Vedanta, Ujjivan Financial Services, HFCL, Jindal Stainless, Kaveri Seed Company, Welspun Corp and Jindal Stainless (Hisar).

“After witnessing a splendid rally that continued in the first two sessions of the week, markets have come under profit-taking thereafter amid worries of stretched valuations and lack of fresh positive triggers,” said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

“Technically, the Nifty has formed a shooting star kind of reversal formation and at the same time momentum indicators also suggest a temporary overbought situation. However, the medium-term texture remains bullish and any meaningful short-term correction would be an opportunity to enter into the long side.”

“On the downside, 16350 and 20 day SMA or 16200 would be the key support zone. On the other hand, the 16600/16665 level could act as an immediate hurdle for the index. If the index slips below the 16200 levels or 20 days SMA, the medium-term uptrend could be vulnerable,” said Chouhan.

Where is Nifty50 headed?

The possibility of the US Fed’s stimulus tapering would start as early as this year spooked the markets across the globe including ours. Besides, participants also took note of a sharp rise in global COVID cases, adding to the pressure. We may see a further slide next week and the Nifty may test level closer to 16,200,” said Ajit Mishra, VP - Research, Religare Broking.

“In case of a rebound, 16,550-16,700 zone would act as hurdles. Considering the scenario, we suggest maintaining positions on both sides and prefer index majors over the others,” Mishra added.

On Friday, Nifty formed a bullish candle on daily scale but a bearish candle similar to a shooting star on weekly frame.

“Now it has to continue to hold above 16450-16500 zones to extend the momentum towards 16600 and 16700 zones while on the downside support is seen at 16350 and 16200 levels,” said Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services.

“The market shows that it is going to be crucial for the short-term market scenario to sustain above the 16500 Nifty50 Index level. Early signs has been observed of reversal in the market with deviation occurring in Nifty 50, Nifty mid cap, and Nifty small cap hence, the traders are advised to refrain from building a new buying position until we see further improvement in the market breadth,” said Ashis Biswas, Head of Technical Research at CapitalVia Global Research.

“If the market is unable to sustain the level of 16500, the market can witness lower levels of 16350,” he added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.