- News

- City News

- thiruvananthapuram News

- Kerala: Malpractices flagged as early as 2015-2016 in Karuvannur Service Cooperative Bank

Kerala: Malpractices flagged as early as 2015-2016 in Karuvannur Service Cooperative Bank

Karuvannur Cooperative Service Bank

THIRUVANANTHAPURAM: The cooperation department’s audit division had been flagging serious irregularities and malpractices in the Karuvannur Service Cooperative Bank since the annual audit of 2015-16, it is learnt. However, no corrective action was initiated until the skeletons began tumbling out of the closet.

The cooperation department had, on August 11, suspended 16 of its audit wing officials on the basis of an inquiry into the irregularities in the bank.

A comparison by TOI of the interim report submitted by the nine member inquiry committee and the audit reports of the last five years shows that most of the observations in the interim report were there in the audit reports too.

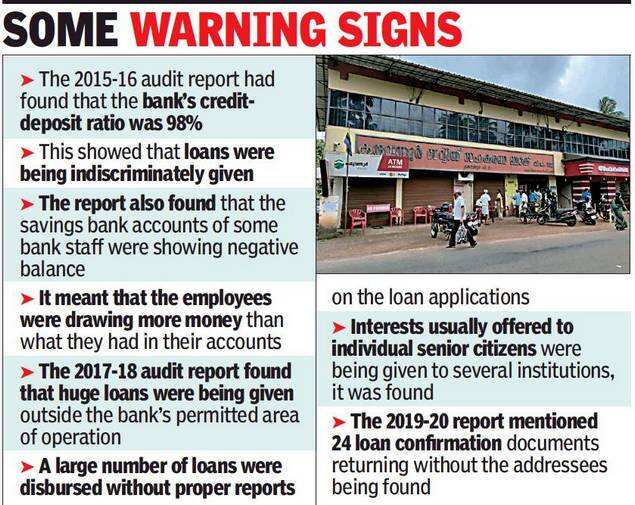

Two major observations in the 2015-16 audit report were enough to prove that all wasn’t well in the bank. The bank’s credit-deposit ratio, which should never go beyond 75%, was found to be 98% and the savings bank accounts of its employees were showing negative balance. While the first observation showed that loans were being indiscriminately given, the second showed that the employees were drawing more money than what they had in their accounts.

The 2017-18 audit report found that the bank had lent loans heavily outside its permitted area of operation, a violation of cooperation acts and rules. In March alone, a large number of loans were disbursed without proper reports, including the legal reports on the loan applications. This has been explained clearly in the interim report too. It was also found that interests usually offered to individual senior citizens were being given to several institutions, another violation of law.

In the 2019-20 audit, the auditors had flagged loans being offered by flouting all norms posing a serious threat to the very existence of the bank. As many as 24 loan confirmation documents sent to the customers returned unable to locate the addressees, thereby unable to take any legal action against them.

The probe committee, meanwhile, found that after giving membership to people outside the area of operation, the bank did not maintain their identity proofs. From this it can be inferred that such memberships, against which huge loans were granted, were fake. As per rules, for providing membership and loan, the person should be a permanent resident within the area of operation of the bank or should own a property there.

While the rules say that the property on which the loans are sanctioned needs to be evaluated, records show that loans were disbursed beyond permissible limits (a maximum of Rs 50 lakh for an individual) and for this the property value was accordingly corrected. This means that loans exceeding the limits were given without proper evaluation of the property. Worse still, such loans were granted multiple times over the same property. Also, discrepancies were found in the signatures of the applicants in the various loan documents, showing that the applicants were bogus.

The committee also found that a team functioning under a bank member, Kiran, was engaged in locating people, property, preparing the Gehan, evaluating the property for estimating the loan amount etc. As many as 52 loans, totalling Rs 215.71 crore, were sanctioned by mortgaging eight different properties and a share from each of these went into the account of Kiran, it was found.

The cooperation department had, on August 11, suspended 16 of its audit wing officials on the basis of an inquiry into the irregularities in the bank.

A comparison by TOI of the interim report submitted by the nine member inquiry committee and the audit reports of the last five years shows that most of the observations in the interim report were there in the audit reports too.

Two major observations in the 2015-16 audit report were enough to prove that all wasn’t well in the bank. The bank’s credit-deposit ratio, which should never go beyond 75%, was found to be 98% and the savings bank accounts of its employees were showing negative balance. While the first observation showed that loans were being indiscriminately given, the second showed that the employees were drawing more money than what they had in their accounts.

The 2017-18 audit report found that the bank had lent loans heavily outside its permitted area of operation, a violation of cooperation acts and rules. In March alone, a large number of loans were disbursed without proper reports, including the legal reports on the loan applications. This has been explained clearly in the interim report too. It was also found that interests usually offered to individual senior citizens were being given to several institutions, another violation of law.

In the 2019-20 audit, the auditors had flagged loans being offered by flouting all norms posing a serious threat to the very existence of the bank. As many as 24 loan confirmation documents sent to the customers returned unable to locate the addressees, thereby unable to take any legal action against them.

The probe committee, meanwhile, found that after giving membership to people outside the area of operation, the bank did not maintain their identity proofs. From this it can be inferred that such memberships, against which huge loans were granted, were fake. As per rules, for providing membership and loan, the person should be a permanent resident within the area of operation of the bank or should own a property there.

While the rules say that the property on which the loans are sanctioned needs to be evaluated, records show that loans were disbursed beyond permissible limits (a maximum of Rs 50 lakh for an individual) and for this the property value was accordingly corrected. This means that loans exceeding the limits were given without proper evaluation of the property. Worse still, such loans were granted multiple times over the same property. Also, discrepancies were found in the signatures of the applicants in the various loan documents, showing that the applicants were bogus.

The committee also found that a team functioning under a bank member, Kiran, was engaged in locating people, property, preparing the Gehan, evaluating the property for estimating the loan amount etc. As many as 52 loans, totalling Rs 215.71 crore, were sanctioned by mortgaging eight different properties and a share from each of these went into the account of Kiran, it was found.

FacebookTwitterLinkedinEMail

Start a Conversation

end of article

Quick Links

Delhi Air PollutionDelhi TemperatureChennai WeatherBangalore TemperatureCovid vaccination centres in DelhiCoronavirus in DelhiRTPCR test in GurgaonHyderabad RainPollution level in BangaloreDelhi SmogDelhi TemperatureNoida AQIGurgaon AQI todayFire in MumbaiMumbai RainsCovid 19 RT PCR Test in NoidaDelhi AQI todaySrinagar encounter