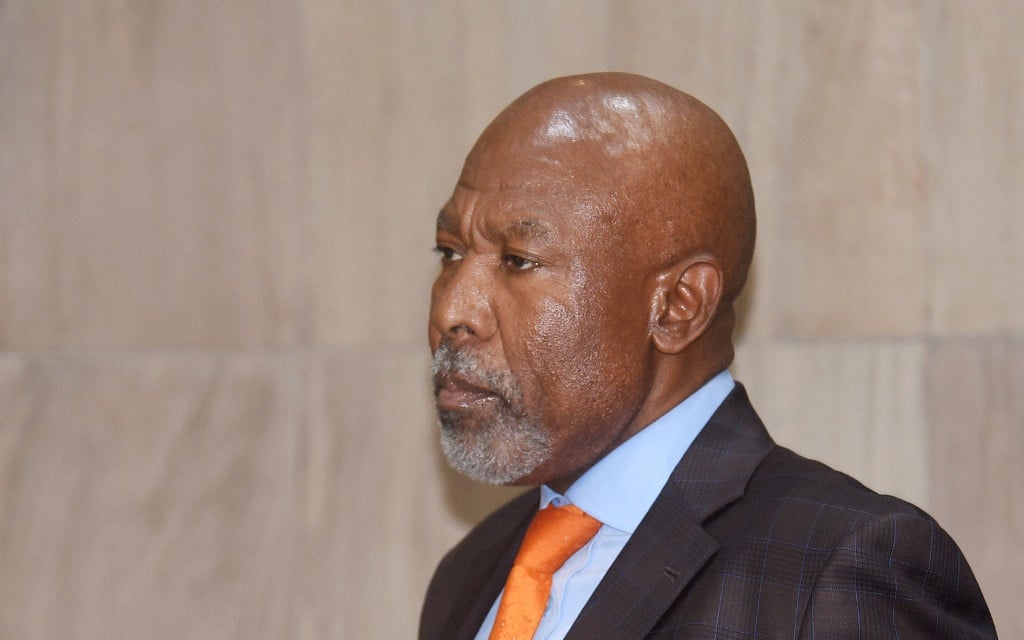

- Electricity supply shortages remain a risk to economic recovery, says Reserve Bank Governor Lesetja Kganyago.

- The unrest in parts of the country in July, is also expected to result in a contraction for the third quarter, and may possibly dampen business confidence, he says.

- The economic recovery has been helped by a commodities boom, but the Reserve Bank expects this to be temporary.

Load shedding may have been worse this year if SA's economic recovery had been faster, according to Reserve Bank Governor Lesetja Kganyago.

The governor on Wednesday briefed the Standing Committee on Finance on the central bank's annual report. He also provided an overview of the economic outlook.

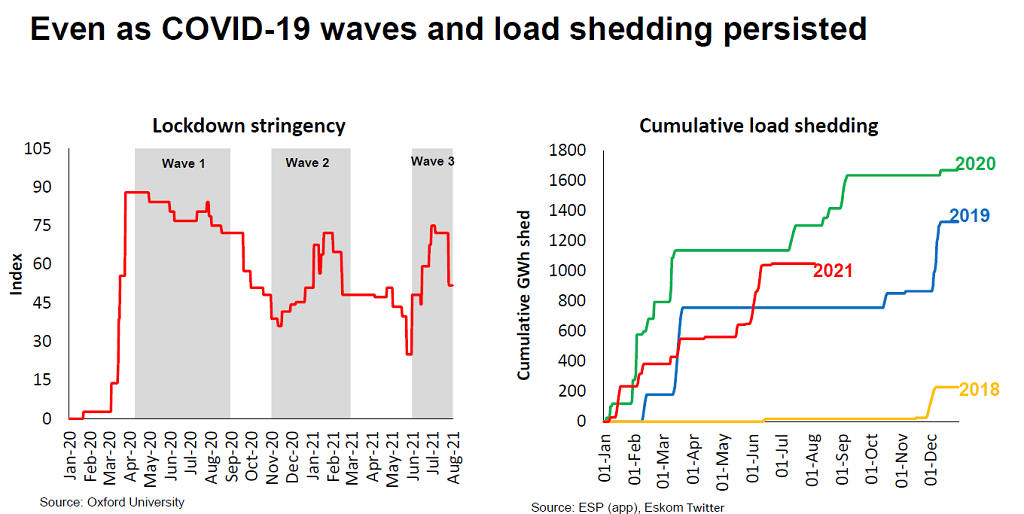

Prior to the pandemic hitting South African shores in early 2020, the economy was already suffering a range of "comorbidities", Kganyago explained. In spite of harsh lockdown restrictions in place, which restricted economic activity, power utility Eskom implemented load shedding. The cumulative load shedding for 2020, was more than that experienced in 2019, Kganyago pointed out. As the economy reopened and entered into recovery mode in 2021, load shedding continues to hit the country, he added.

"You can imagine if the acceleration of the economy was even faster than what we experienced so far, we would have even more significant load shedding," he said.

Electricity supply shortages remain a risk to economic recovery, as do the possibilities of future Covid-19 waves, he highlighted.

Another risk to recovery is the unrest which hit parts of the country in July. The footprint of the negative shock of the unrest spans three provinces Gauteng, KwaZulu-Natal and Mpumalanga, which account for 58% of GDP.

"The social unrest is expected to temporarily interrupt the 2021 GDP growth recovery. We do not have a full handle as yet, as to what the extent of the shock is," Kganyago said. The Reserve Bank expects it to be a reduction of 0.4%.

"It is too early to tell, we need to see more data to fully appreciate what the impact of this unrest has been on GDP growth," he added.

The Reserve Bank expects the riots to likely to have an impact on investment, which will feed through to business confidence, Kganyago said.

The unrest is also expected to dampen third quarter growth and there may possibly be a contraction. The Reserve Bank expects GDP growth to reach 2019 levels only in 2023. By comparison, some advanced economies have already returned to 2019 levels following sharp contractions last year due to the pandemic.

Similarly, South Africa's investment levels are lagging behind emerging market peers like Brazil, Russia, India, China as well as Turkey, Argentina and Chile. The low investment levels are also a reflection of a slower rate of recovery in imports, Kganyago highlighted.

The country has been reporting trade surpluses, helped by a boost in commodities as the global economy started to recover in late 2020. Commodities have been central to the rebound, Kganyago said. The prices of these exports have recovered faster than the prices of imports too.

The country is expected to run a current account surplus this year, but this may turn in 2022, possibly to a "moderate" deficit, Kganyago said.

But the commodities boom is expected to be temporary, said Kganyago. The Reserve Bank flagged a correction in commodity process as a potential risk to economic recovery. The country should be using the "temporary" boom to help build its defences, he added.

Most recently, higher than expected tax revenues from the mining sector has helped finance Covid-19 responses, such as the reinstatement of the R350 social relief of distress grant.

Globally there is a resurgence in inflation, which is perceived as transitory. Some emerging markets have started tightening monetary policy due to the resurgence. For the moment, inflation is not a "big risk" for South Africa, Kganyago said. Domestic inflation data for July shows that it has slowed to its lowest level in three months, at 4.6%.

However, there may be shocks from energy prices and a realignment in global exchange rates that feed into domestic inflation. "At the moment we see domestic inflation contained, and remaining within our target range, over the next two years."

If inflation quickens as a result of global reflation, then the Reserve Bank may have to adjust its monetary policy stance.

Currently with inflation contained - borrowing costs are at 56-year lows. The repo rate is at its lowest, at 3.5%, since 1970.