Table of Contents

If you are a property buyer in Maharashtra, you would need to register your sale deed at a government office after paying the stamp duty and registration charges. This entire process is overseen by the Inspector General of Registration and Controller of Stamps, also known as IGR Maharashtra. This government unit collects revenue through stamp duty and other charges as applicable on the registration of documents such as leave and license registration, mortgage, etc. Here is everything you need to know about IGR Maharashtra.

What is IGR Maharashtra

It could be easily said that the Registration and Stamps Office of Maharashtra state, is one of the most digitally advanced departments in the country. The sole responsibility of the office of the Inspector General of Registration and Controller of Stamps, is to register documents as per the Registration Act and collect revenue. To help the citizens and to deliver services effectively, the department relies on modern technology, to register and collect documents using well defined procedures, within a specific time frame and in a transparent manner.

IGR Maharashtra: Property valuation

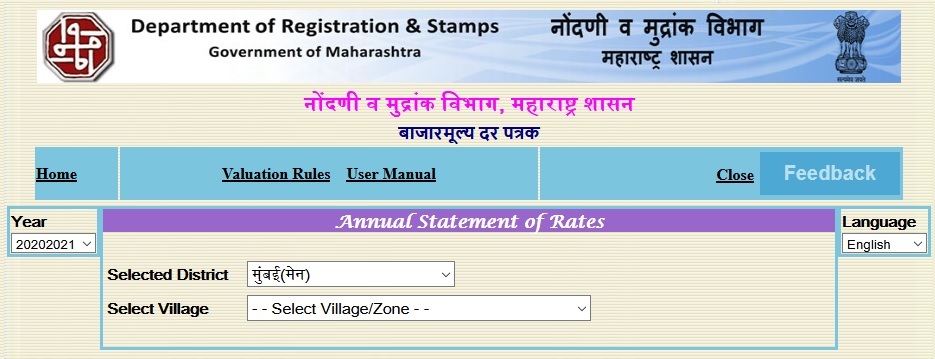

Citizens can assess the stamp duty amount for registration purposes through IGRS Maharashtra. For this purpose, it is important to know the true market value of the property. The department prepares an Annual Statement of Rates (ASR), also known as ready reckoner rates, every year. This can be obtained from the sub-registrar’s office or online, using the following steps:

Step 1: Visit IGRS Maharashtra website (click here) and click on e-ASR >> Process under ‘Online Services’.

Step 2: You will be redirected to a new page where a map will be displayed. Click the area where your property is located.

Step 3: You will be able to see the ready reckoner rates of the area.

What are ready reckoner rates?

Ready reckoner rates are the government-decided price, below which properties in an area cannot be transferred in the government’s records. This pre-fixed rate, which is changed from time to time by states, is also known by other names, such as guidance value, circle rate, etc. In Maharashtra, however, this rate is most commonly known as ready reckoner rate or RR rate, for short.

IGR Maharashtra: Stamp duty refund

The Maharashtra Stamp Act, 1958, allows refund of stamps purchased by citizens, if the purpose of its use is cancelled or if the stamp is damaged before its use or if it is overpaid.

To apply for a refund, the application has to be submitted to the stamp collector from where the stamps have been purchased, along with the necessary documents within the prescribed time and format.

Documents required for stamp duty refund:

- Online information filling token.

- Document with original stamp.

- Affidavit of the person, if the stamp is purchased by hand.

- Authorised letter or certified copy of power of attorney, if an authorised person is applying for the refund.

If the stamps were purchased by franking:

- Invoice of the franchise stamp dealer, accruing stamp duty to the government.

- Stamp sale certificate / excerpt of stamp sales register.

See also: All you need to know about bhu naksha Maharashtra

IGR Maharashtra: How to calculate stamp duty

Property buyers can easily calculate stamp duty on IGR Maharashtra portal by following these steps:

Step 1: Visit IGR Maharashtra and click on the ‘Stamp Duty Calculator’ option under the ‘Online Services’ section.

Step 2: You will be redirected to a new page where you can select the type of document which needs to be registered.

Step 3: Select the ‘Sale deed’ option to register your property papers and then select the jurisdiction from: Municipal Corporation, Municipal Council, Cantonment and Gram Panchayat.

Step 4: Enter the consideration value and market value to get the stamp duty amount displayed on the screen.

IGR Maharashtra: Notice of Intimation

IGR Maharashtra now permits you to file the ‘Notice of Intimation’ (NOI) online, for mortgage or loan deposit title deed, without the need to go to the sub-registrar’s office (SRO). This service is live all across Maharashtra. To do so, click on the ‘online services’ tab on the IGR Maharashtra homepage and then select ‘filing (for citizens)’ and click on ‘Process efiling’.

You will be led to https://appl1igr.maharashtra.gov.in/NGDRS_MH/ where you have to click on the ‘Register Citizen’ tab.

You will reach https://appl1igr.maharashtra.gov.in/NGDRS_MH/Users/citizenregistration_mh where you have to fill in details including the authorised person name, contact person address, contact person ID details, username and password and hint question, in case you forget the password and submit.

Once you have registered, login by clicking on the Login tab on the homepage and enter your username, password, captcha and get the OTP and login.

Click on the new E-filing tab on the next page and fill in the details.

You can access this page in both, Marathi and English. According to the IGR Maharashtra website, because of technical delay from eKYC SMS services, there is a delay in eFiling services. Thus, citizens are advised to file NOI well in advance of the notice period.

IGR Maharashtra: Index 1, 2, 3 and 4

IGR Maharashtra prepares four types of indices, according to the types of documents being registered:

- For immovable property, Index 1 and Index 2 are prepared.

- Index 1 is prepared according to the initial of the parties’ names in the document.

- Index 2 is prepared according to the village name in the document.

- Index 3 is prepared for Wills.

- For movable property, Index 4 is prepared.

IGR Maharashtra: How to search property registration documents

Users can easily search property registration details on IGR Maharashtra platform, by following the procedure given below:

Step 1: Visit and click on the ‘e-Search’ option and select ‘Free Process’.

Step 2: You will be redirected to a new page. Here, choose the location where the property is located and enter the required data, such as the property registration year, district, village, property number or survey number, etc.

Step 3: Click ‘Search’. The results will be displayed on the screen.

IGR Maharashtra: What is Index II?

The Index II extract is issued by the Registration Department, as an official record of a document or transaction that is recorded in the records of the registering authority, confirming that the transaction has been completed.

Index II contains the following information:

- Consideration amount of property.

- Built-up area of the property in sq metres.

- Nature of the property, such as land, residential unit (flat/room/bungalow), commercial unit (office / shop) and industrial unit.

- Name of the parties: vendor(s) – vendee(s) / transferor(s) – transferee(s) / assignor(s) – assignee(s), etc.

- Execution date.

- Registration serial number.

- Stamp duty amount.

- Registration fee.

IGR Maharashtra: MoDT registration

Those who seek home loans, need to know that an undertaking, known as Memorandum of Deposit of Title Deed (MoDT), has to be given by the borrower stating that they have deposited the title deed and other property-related documents with the lender. The government levies 0.3% stamp duty on the loan amount. This undertaking is to recover debts, in case the borrower defaults or does not make payments on time. It is mandatory for the borrowers in Maharashtra to get the MoDT registered.

IGR Maharashtra: Latest update

Update on August 17,2021:

Around 27 SROs probed in Pune

The IGR Maharashtra has issued a ban on the registration of small pieces of land, as it violates the Maharashtra Prevention of Fragmentation and Consolidations of Holdings Act, 1947. According to the IGR Maharashtra, only 11,000 sq ft / 11 gunthas or more of land, can be registered. On the same lines, the IGR Maharashtra has also initiated a probe against around 27 sub-registrar offices (SROs) in Pune, after complaints against illegal registrations of small land parcels in Pune surfaced, as per reports. In addition to Pune, these frauds are prevalent in other parts of Maharashtra, including Nanded and Aurangabad.

Under this scam, SROs are alleged to have registered land of lesser area, by grouping a few people together, who did not realise that they would be cheated going forward. No one can sell a smaller piece of land and for selling the entire parcel, the owner would need a no-objection certificate (NOC) from the other shareholders in the group, making it an unviable, loss-making and complicated arrangement. While previously registered land deals have not been disturbed by the IGR Maharashtra, its well within the judiciary’s power to stall the registered land deals.

******

In the latest move to avoid crowding at the property registration office, the state government has made it mandatory for the property owners to book a slot through e-Step-in on the IGR Maharashtra portal at the sub-registrar’s office before proceeding for the documentation. Around 30 slots will be up for booking in each SRO for property registration.

Read more: Maharashtra makes slot booking mandatory for property registration

FAQs

What is index 2 in property agreement?

Index II is issued by the sub-registrar's office, which has all the information related to property transactions.

How can I check my government land value in Maharashtra?

You can check the government land value on IGR Maharashtra under the e-ASR option.

What is IGR process?

IGR or Inspector General of Registration is the state government authority where all immovable properties need to be registered.

Comments