Indian markets continued to rise for the second straight week which ended August 13. Strong inflow of funds from both domestic and foreign investors amid favourable global cues and supportive macroeconomic helped benchmark claim new highs. Benchmark indices, Sensex and Nifty, touched their fresh record high levels of 55,487.79 and 16,543.60, on August 13.

On a weekly basis, BSE Sensex rose 1,159.57 points (2.13 percent) to close at 55,437.29, while the Nifty50 added 290.9 points (1.79 percent) to end at 16529.10 levels.

In the broader market, the BSE Midcap and Smallcap indices fell 1 percent and 1.7 percent, respectively. However, the BSE Largecap index rose 1.5 percent last week.

Experts expect the trend to remain positive amid consolidation next week with a focus on global cues in the absence of major domestic cues, and the pace of vaccination.

"In absence of any major event, the news of further unlocking by the states and pace of vaccination drive would remain in focus. On the global front, the rising COVID cases due to the delta variant remain the key concern," said Ajit Mishra, VP Research at Religare Broking.

He further said, "Markets are taking comfort from the upbeat global markets and supportive domestic cues amid the fear of a third Covid wave. However, we are now seeing restricted participation and expect the same trend to continue, at least in the near future."

Thus he advised continuing with the 'buy on dips' approach but focus largely on index majors and select midcaps for long trades.

The market will remain shut on Thursday for Muharram.

Here are 10 key factors that will keep traders busy in the coming week:

The first day of the week will be busy for the market as four companies - Devyani International, Krsnaa Diagnostics, Exxaro Tiles, and Windlas Biotech - will make their market debut on Monday.

KFC and Pizza Hut operator Devyani International, and diagnostic services provider Krsnaa Diagnostics are expected to see double-digit gains on listing after seeing strong subscriptions to their IPOs.

According to experts, pharma company Windlas Biotech is likely to see lower double-digit gains and vitrified tiles maker Exxaro Tiles could start the day with moderate gains. Both issues saw subscriptions of more than 22 times each.

All 4 companies had launched their public issues during August 4-6, 2021.

Also, multi-channel auto platform CarTrade Tech and India's fifth-largest cement company Nuvoco Vistas Corporation are expected to list on Friday.

So far, the country has recorded over 3.21 crore confirmed COVID-19 cases, including 4,30,254 deaths. A total of 3,13,02,345 people have recuperated from COVID-19 so far. There are 3,85,227 active COVID-19 cases in the country, which comprises 1.20 percent of the total caseload, the data stated. India's recovery rate now stands at 97.46 percent.

Globally, more than 20.61 crore people have been infected by the coronavirus and 43.44 lakh have died so far. India has been running the third phase of the vaccination drive in which everyone above 18 years of age will be able to get the COVID-19 vaccine. The cumulative number of COVID-19 vaccine doses administered in India has crossed 52.95 crore, according to the Union Health Ministry.

After being absent for several weeks, overseas money once again flew to Indian markets as benchmark indices claimed new highs.

FIIs have net bought Rs 879.2 crore and DIIs bought Rs 636.38 crore worth of equity shares last week.

As a result, FIIs turned have now turned net buyers to the tune of Rs 3,495.24 crore in August, after net selling in the previous four consecutive months. DIIs continued their buying for the sixth consecutive month, purchasing Rs 1,533.22 crore worth of shares during August. Hence, the flow will be crucial for the sustenance of further upside in the market.

Indian Rupee

The Indian rupee has seen a consolidation throughout the week and ended largely on a flat note at 74.24 against the US dollar as positive trend in dollar index pressured the currency while there was support from rising equity markets.

The dollar index increased up to 93.17 during the week from 92.78 levels seen in previous week, but settled the week down at 92.52. The increase in US dollar index, which measures the value of US dollar against the world's leading six currencies, was on the back of possibility of tapering of bond purchases sooner than later. Experts feel, if there is tapering then there could be some pressure on the Indian currency, otherwise the sideways trade may continue.

"Several Fed officials last week came out in support of tapering bond buying in coming months, setting themselves apart from other, more dovish major central banks such as the European Central Bank and the Bank of Japan," said ICICI Direct.

Overall, the brokerage expects the rupee to consolidate in the range of 74.20-74.70 levels as stronger dollar as well as stronger domestic equities are likely to keep the pair in a sideways mode.

Technical View

Nifty50 after opening higher gradually extended gains to hit a record high and finally settled with 1 percent gains on Friday, forming a bullish candle on the daily charts. The index also saw a bullish candle formation on the weekly scale as it gained 1.8 percent.

Experts feel the breaking of a narrow range of the previous few sessions clearly indicates further fresh record high levels in the Nifty in the coming week amid some consolidation.

"A long bull candle was formed on Friday on the daily chart, which indicates an upside breakout of the small narrow range of the last 5-6 sessions. This is positive indication and one may expect upside momentum to continue in the next session. This pattern signal a formation of new sequence of higher tops and bottoms on the daily chart, where higher bottoms are part of a range movement and this is uptrend continuation pattern," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels having reached an initial upside target of 16,500 levels on Friday, the Nifty is now expected to head towards the next upside target of around 16,800-17,000 levels in few weeks. Immediate support is placed at 16,380 levels, he said.

Bank Nifty

The Bank Nifty gained a percent during the week and closed above the crucial & sizeable Call base of 36,000 mark, driven by major private banks Axis Bank, HDFC Bank, ICICI Bank and Kotak Mahindra Bank.

On option front, maximum Put open interest was seen at 36000 followed by 35500 & 35900 strikes while maximum Call open interest was seen at 36000 followed by 36500 & 36200 strikes. Call writing was seen at 36200, 36700 and 36600 strikes while Put writing was seen at 36000, 36100 & 36200 strikes. The weekly option data indicated that the Bank Nifty could see a trading range of 35,500 to 36,500 levels in coming days.

"Among leaders, HDFC Bank continued to witness closure in OTM Call strikes, which is likely to keep the momentum intact whereas supportive action is expected from others as well. During the week, Bank Nifty futures attracted fresh open interest additions of 3 percent along with positive price action. We feel this current leg of upsides is likely to continue," said ICICI Direct.

For the past two weeks, major Put writing was seen at 35500 strike, which remains the key support area, the brokerage said. However, as the index closed above 36,000, the brokerage feels Put open interest shifting activity would move higher, which should provide more upsides in coming days.

The current price ratio of Bank Nifty/Nifty again took support near 2.18 levels. ICICI Direct feels that on the back of outperformance in banking stocks, the price ratio should move towards 2.24 levels in coming days. A sharp up move is expected in the index once it manages to move above 36,500, according to the brokerage.

F&O Cues

Option data indicated that the Nifty50 could see a broader trading range of 16,300 to 17,000 levels while an immediate trading range may be 16,300 to 16,800 levels in coming sessions.

On option front, maximum Put open interest was seen at 16400 followed by 16300 & 16500 strikes while maximum Call open interest was seen at 16800 followed by 17000 & 16500 strikes. Call writing was seen at 16800 and 17000 strikes while Put writing was seen at 16400 & 16500 strikes.

"Continued writing was experienced among Put strikes throughout the August series when the Nifty breached its prevailing range of 15,600-15,900. In such a scenario, positive bias should continue till it holds its major Put base," said ICICI Direct.

The brokerage further said, "For the coming week, the highest Put base is placed at the 16400 strike, which should act as immediate support on any decline. An extended profit booking towards 16000 can be expected only below these levels."

"The current open interest in the Nifty is the highest seen since March 2020. In the current series itself, open interest has increased almost 50 percent since inception. Hence, the positive bias remained in the index till we do not see any closure of positions in the coming sessions. On the higher side, the Nifty may move towards 16,800 in coming sessions," he added.

India VIX moved up from 12.60 to 12.99 levels on week-on-week basis despite market at record high levels.

"The volatility index moved above 13 percent levels intraday on Friday despite continued upmove, which is an indicator of closure among Call writers. Hence, the momentum may continue in the short-term," said ICICI Direct.

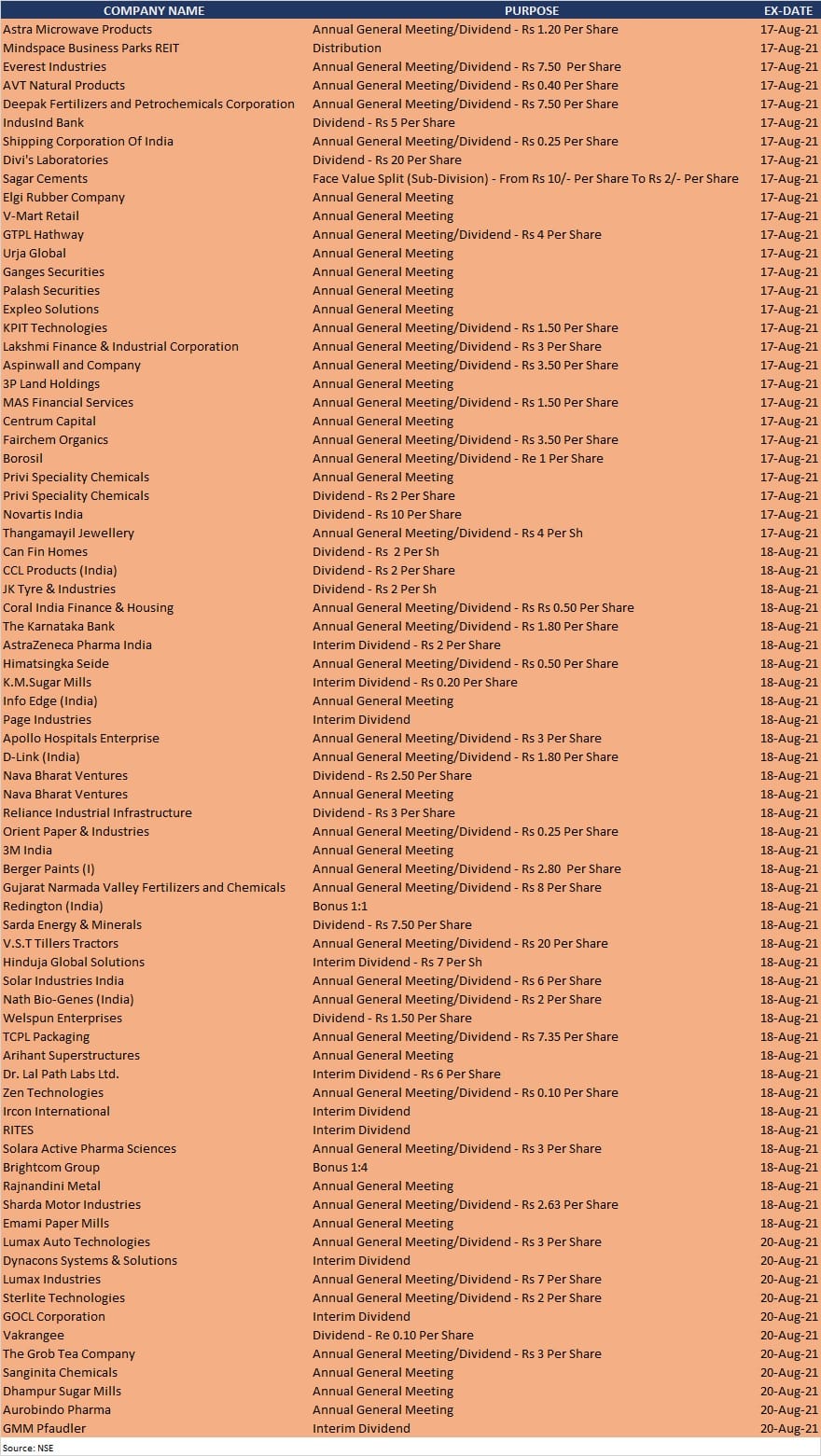

Corporate Action

Here are key corporate actions taking place in the coming week:

Economic Data

The market will watch WPI inflation data that is scheduled to be released on Monday, though generally it is a non-event for the market.

Foreign exchange reserves for the week ended August 13 will be released on Friday. In the week ended August 6, India's foreign exchange reserves jumped by $889 million to a record high of $621.46 billion, driven by increasing foreign currency assets.

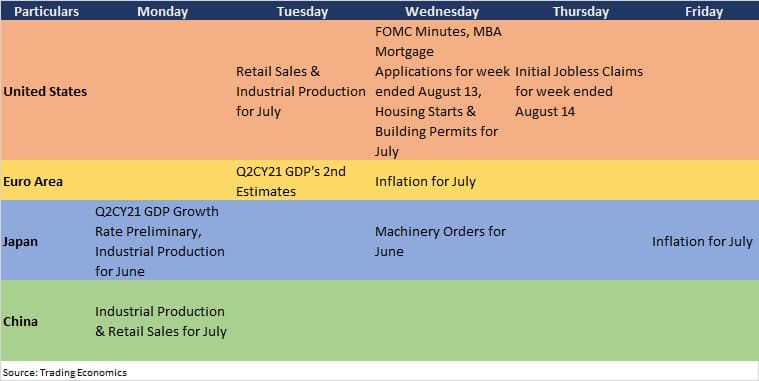

Global Cues

Here are key global data points to watch out for next week: