Indian equity markets staged strong show not only in the last one year but also year-to-date (2021), which is attributable to recovery in growth factors especially after easing Covid-led restrictions, healthy earnings, government and RBI measures, and ample of global liquidity.

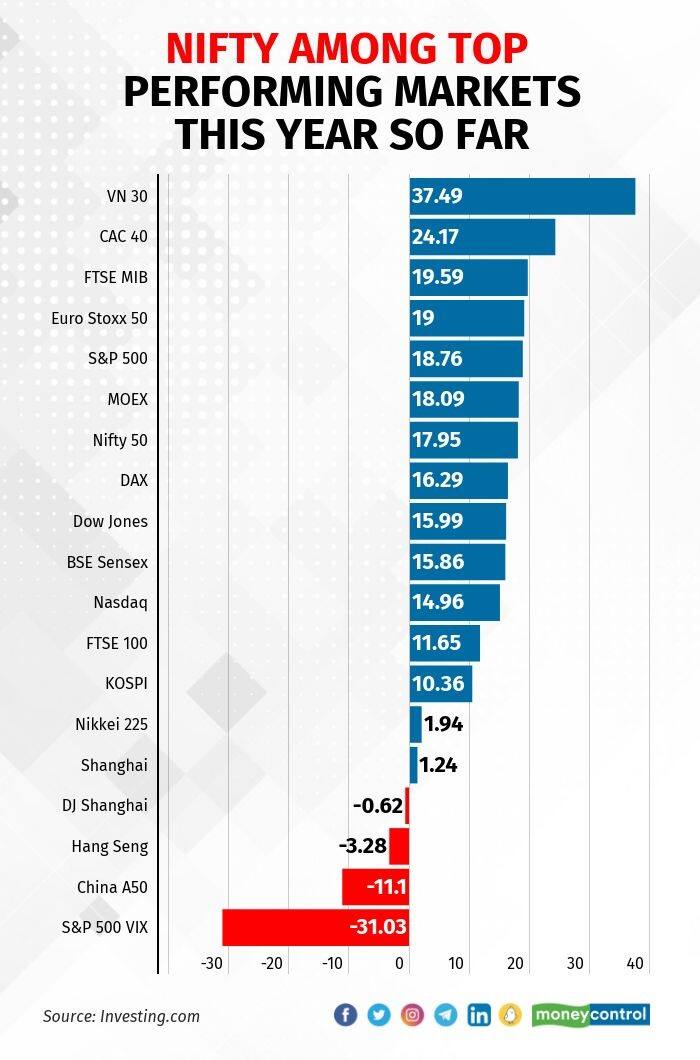

The Nifty50 shot up 17.95 percent from the January till August 13, 2021, driven largely by infrastructure, IT, Metals, Energy, Auto and Banking & Financial stocks.

The benchmark index surpassed 16,500 mark for the first time today, hitting a fresh record high of 16,543.60, indicating the month of August is very strong especially after the states in India further eased restrictions which is ultimately expected to boost the further recovery in the economy as well as earnings.

In the same period (YTD), global indices namely Dow Jones Industrial Average surged 15.99 percent, Nasdaq Composite gained 14.96 percent, DAX was up 16.29 percent, FTSE 100 gained 11.65 percent, Kospi was up 10.36 percent, Nikkei 225 up 1.94 percent and Shanghai Composite up 1.24 percent.

"The markets are a function of earnings in the long term and liquidity in the near term. Move away from physical assets and low fixed income rates is leading to significant flow into equities. There is no sign that this migration is going to change anytime soon. This is the short term perspective," Susmit Patodia, Director, Portfolio Manager at Motilal Oswal Asset Management Company told Moneycontrol.

"Longer term, earnings have been extremely strong as well. We have been in an upgrade cycle for nearly last 4 quarters which has not happened in the last 10 years," he said.

The Indian index Nifty50, however, underperformed only two major indices which are S&P500 that gained 18.76 percent and CAC 40 that rallied 24.17 percent.

All the central banks so far decided to keep the rates low and maintain the liquidity flow till the consistency in global economic growth, though they are keeping in mind the risk of Covid-19 waves.

"The recovery remains uneven across sectors and needs to be supported by all policy makers. The Reserve Bank remains in “whatever it takes” mode, with a readiness to deploy all its policy levers - monetary, prudential or regulatory. In parallel, our focus on preservation of financial stability continues. At this juncture, our overarching priority is that growth impulses are nurtured to ensure a durable recovery along a sustainable growth path with stability," said the RBI Governor, Shaktikanta Das in its monetary policy meeting.

Going ahead experts feel the momentum is expected to be supported by the strong earnings activity, flow of liquidity and expected nearly double digit economic growth in FY22.

"Equity valuations are ahead of their fundamentals owing to the signs of growth recovery, government spending and healthy demand outlook from rural economy. This combined with healthy liquidity conditions leads to exuberance in markets and hence, the current rally," said Rajesh Cheruvu, Chief Investment Officer at Validus Wealth.

Prasun Gajri - Chief Investment Officer at HDFC Life feels while the markets may continue their upward move, what matters, in the end, is the nature of the underlying portfolio as the fundamentals eventually catch up.

"It is always important to focus on individual stocks and not just on the aggregate market indices. In the current market where stocks across the spectrum are moving up, it becomes doubly important to focus on stocks where the fundamentals are strong and the business models are robust," he said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.