- News

- City News

- ahmedabad News

- Gujarat loses Rs 171 crore to GST evasion in Q1

Gujarat loses Rs 171 crore to GST evasion in Q1

Picture used for representational purpose only

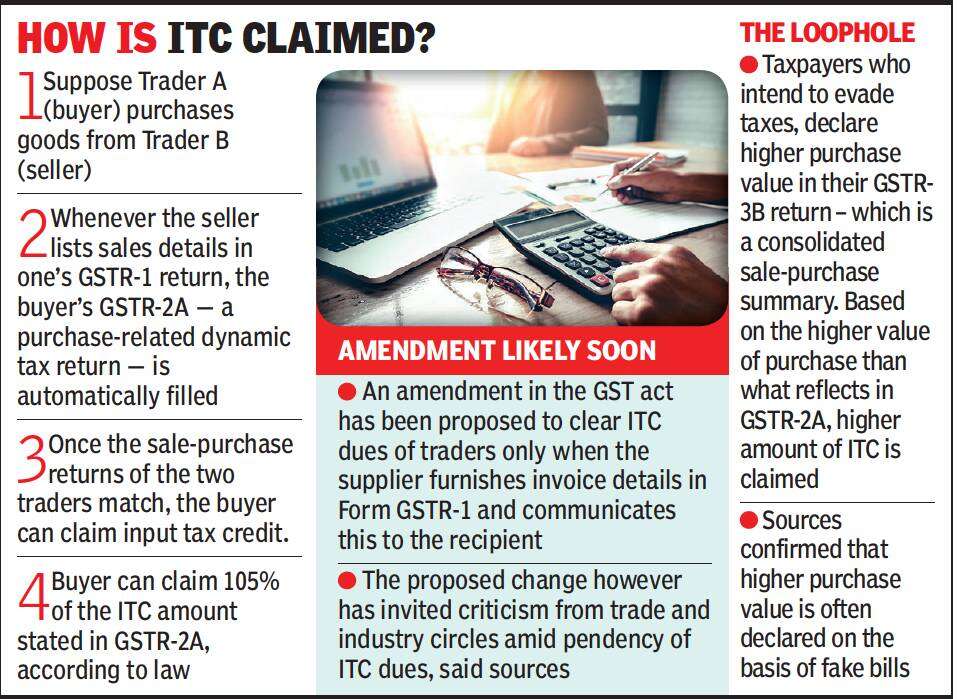

AHMEDABAD: Thanks to the evasion of Goods and Services Tax (GST) by wrongfully claiming input tax credit (ITC), the state exchequer in Gujarat lost Rs171 crore in the first quarter of 2021-22. The involvement of some 99 trading entities is suspected in this evasion. The details came to light after the state GST (SGST) department began probing traders who tend to claim excess ITC.

During the first quarter of 2021-22, the department identified some 99 big trading entities involved in such practice. Inquiry has been initiated against the culprits. Further investigation revealed that some 78 trading entities did not exist at all, indicating a fake billing scam.

SGST officials confirmed that their transactions are found to be suspicious and their involvement in bogus billing is being probed. At present, SGST officials are also probing past returns filed by these entities and their transactions for further clues on the amount of taxes evaded by them in the past.

In a bid to end the menace of availing input tax credit using fake bills, SGST officials are beginning to tighten their noose over all the taxpayers in Gujarat. The department has warned strict action against culprits who evade taxes this way.

The department was compelled to use technology to fish out such culprits as it came to their notice while examining sales and purchase returns that excess ITC is being claimed by traders to evade taxes.

During the first quarter of 2021-22, the department identified some 99 big trading entities involved in such practice. Inquiry has been initiated against the culprits. Further investigation revealed that some 78 trading entities did not exist at all, indicating a fake billing scam.

SGST officials confirmed that their transactions are found to be suspicious and their involvement in bogus billing is being probed. At present, SGST officials are also probing past returns filed by these entities and their transactions for further clues on the amount of taxes evaded by them in the past.

In a bid to end the menace of availing input tax credit using fake bills, SGST officials are beginning to tighten their noose over all the taxpayers in Gujarat. The department has warned strict action against culprits who evade taxes this way.

The department was compelled to use technology to fish out such culprits as it came to their notice while examining sales and purchase returns that excess ITC is being claimed by traders to evade taxes.

FacebookTwitterLinkedinEMail

Start a Conversation

end of article

Quick Links

Delhi Air PollutionDelhi TemperatureChennai WeatherBangalore TemperatureCovid vaccination centres in DelhiCoronavirus in DelhiRTPCR test in GurgaonHyderabad RainPollution level in BangaloreDelhi SmogDelhi TemperatureNoida AQIGurgaon AQI todayFire in MumbaiMumbai RainsCovid 19 RT PCR Test in NoidaDelhi AQI todaySrinagar encounter